The 2016 election was a fait accompli, until it was not.

CNH EV and short USDCAD

USDCNH looks like positive EV but there are four caveats. Short USDCAD into BoC.

The 2016 election was a fait accompli, until it was not.

Marin Marsenne, masterful mathematician

A new largest prime number was discovered yesterday and it is also a Marsenne Prime

It has more than 41 million digits but can be neatly expressed as:

2136,279,841 – 1

Short USDCAD @ 1.3830

Stop loss 1.3911

First target 1.3750, hopefully more

Things are getting spicy as the Trump momentum continues, yields rise, precious metals accelerate, and the USD soars. While a Trump victory is starting to take on a feeling of inevitability, it’s worth thinking back to 2016, when the exact opposite felt true, but was not. Then, Trump’s odds of winning were around 12%, and I will never forget reading this story.

When that article came out, I was staring at a disappointing P&L for 2016, up $2.5 million, targeting $5 million minimum and really hoping for $10 million. The year had been all about Brexit, and I wasn’t the cable trader, and I had actually missed Brexit because when the date was announced, it conflicted with a fishing trip I already had planned with my son1. And I didn’t do well on the USDJPY move when the BOJ cut to negative rates and USDJPY collapsed.

The metagame was pretty clear: My compensation would be similarly bad whether I made $2.5 million on the year, or zero. Therefore, it made sense for me to make an outsized wager and pretty much go all in.

The most attractive play at the time was to buy USDJPY calls because the prevailing view was that there would be a massive relief rally in risky assets if Clinton won and the dangerous outcome for markets (a Trump victory) did not come to pass. USDJPY was trading around 104.00 and I bought a bunch of 107 and 110 strikes expiring at the end of November, risking 2 bucks to make 7.

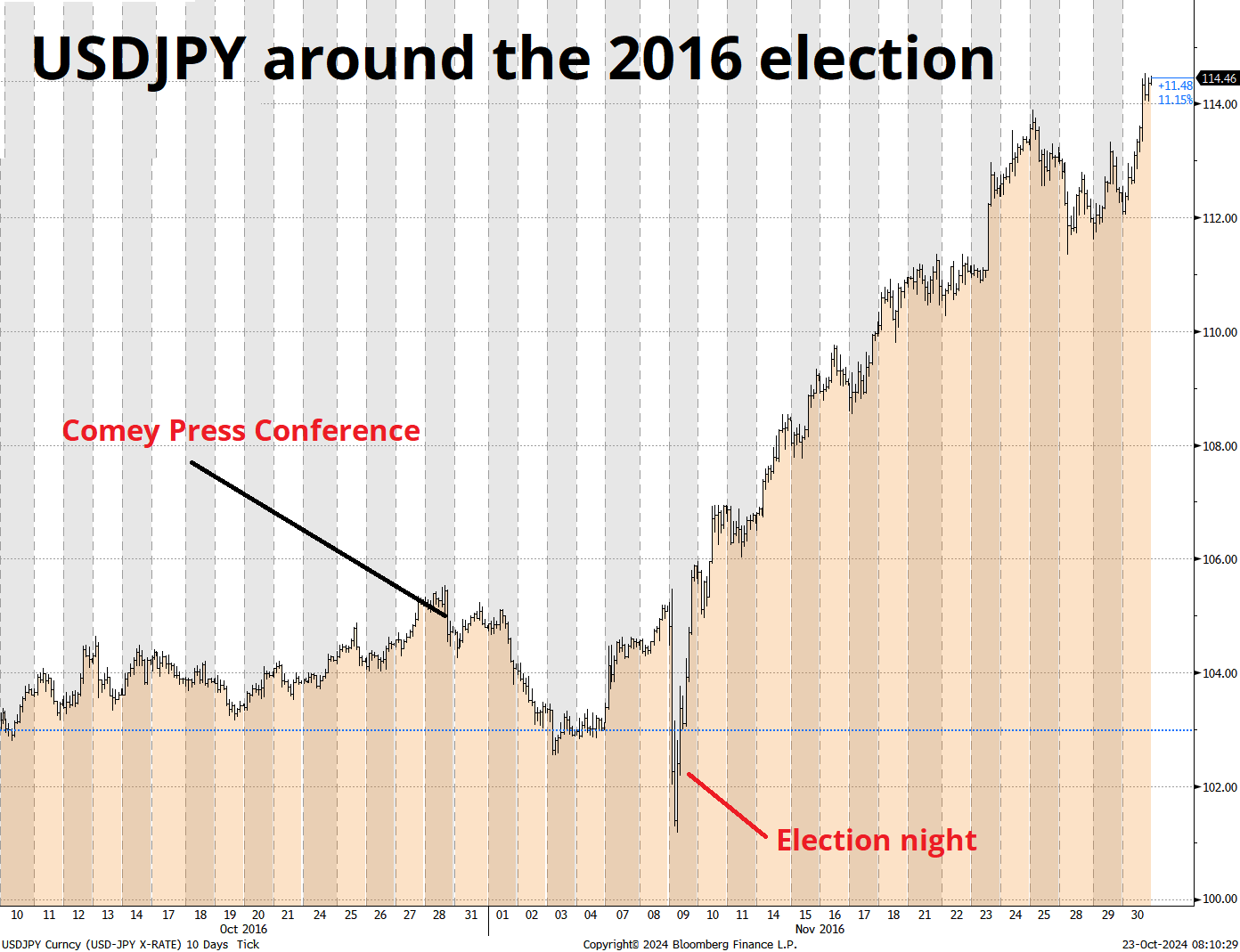

You know the rest. On October 28, James Comey (FBI) made the announcement of a further investigation into the Clinton emails. And on November 8, Trump won the election.

Here is the full story of that chaotic marathon market event (from the introduction to The Art of Currency Trading, by me).

—

1 The lesson I learned from missing Brexit was: No matter how crappy and FOMO it feels to tell your boss you have to miss a big work thing because of family, you will never regret that choice.

NEW YORK CITY

8:15PM

The cavernous trading floor is mostly empty, but the foreign exchange sales and trading rows are fully staffed. The trader sits in front of six monitors in the center of the G10 currency trading desk. His pupils flick from various Bloomberg and Reuters headlines to CNN, then to CNBC and foxnews.com. His eyes scan the EURUSD and USDJPY price feeds, and then flick back to CNN. Early presidential election results trickle in. Markets are in a holding pattern still, so he picks at the last few pieces of take-out sashimi.

He is rooting for Hillary Clinton, not for political reasons but because he is positioned for a stronger dollar and the market sees a Clinton win as dollar positive. In contrast, the consensus views a Trump win as bad news for the greenback. For the trader, the event is not about politics, it is about macroeconomic outcomes. He has a big long position in the dollar and he wants a rally.

Just a few weeks ago, a Washington Post headline declared: “Trump’s path to an electoral college victory isn’t narrow. It’s nonexistent.” And the trader agrees wholeheartedly. It just does not seem possible for Donald Trump to win the US presidential election. The math does not work.

The trader is relaxed and calm as a few Clinton-positive headlines roll by. His heart rate is steady around 85 bpm.

Sweet. Maybe I can get out of here by 10PM and get some sleep.

Live bloggers post compelling anecdotes that point to a possible Hillary Clinton landslide. Early returns look good for the Democrats. The dollar and the trader’s profits tick slowly higher. Tick, tick, tick. And then, boom. Everything changes in an instant.

There is a quick, unexplained drop in the dollar. The trader’s pulse quickens. His face becomes hot and flushed.

“What’s going on?” A sales guy yells over.

“Dude, I have no clue!” the trader hollers back.

A series of headlines scrolls in quick succession. Trump takes the lead in Florida. GOP has a chance in Pennsylvania. Toss up states lean red. Impossible. Unbelievable.

Over the next twenty minutes, more states lean Republican. Ohio. Wisconsin. Michigan!? The dollar gaps lower as the realization hits the market. Trump has a chance. A good chance. In an instant, gambling odds go from Clinton as a huge favorite to even odds. Nate Silver tweets a nervous mea culpa. Now Trump is the favorite.

Should the trader sell his dollars and get out? Or wait for a turnaround? Frenzied clients sell dollars. Salesmen yell. Markets careen lower. Someone spills water on a keyboard. There is no time to think. The dollar lurches lower. Then lower again. The trader feels like he is trapped in a falling elevator. Profits evaporate and losses build.

At 10:53PM, Trump takes Florida and it’s pretty much over. Everyone hangs out a few more hours but the result is inevitable. Finally, when Trump takes North Carolina at 1:30AM, election night is over. The dollar has collapsed and everyone on the trading floor is spent. Total exhaustion. Disbelief. The trader has lost more than 1.5 million dollars in less than four hours.

The stock market is halted, limit down. Currency markets are pricing in the worst. Fears of trade wars and the end of globalization and… The end of the world? The trader sits there numb, staring at flickering numbers on a screen.

Finally, he drags himself out of the chair. It has been a marathon 19-hour trading session and he needs sleep, badly. He walks outside into light rain and walks a few blocks, still shell-shocked. He checks into a nearby hotel and falls asleep for a few hours. A quick dream of falling in an elevator. Then, he’s awake again. It’s 6:00AM. He quickly dresses and heads back out into the dark New York City morning. Back to work.

By 6:30AM, the trader is at his desk, and everything has changed. The dollar is exploding off the lows. From a low of 101.19 in USDJPY, the market now trades 103.20. Before he can put down his Starbucks and log in, the phone board lights up. A flurry of customer calls. Something huge is going on. A 180 degree turn in sentiment.

The first phone call picked up by sales is one of the bank’s smartest clients and he buys a huge chunk of USDJPY around 103.50.

“It’s impossible to buy these!” the USDJPY trader yells.

A full reversal is underway and now the mood is euphoria. Stocks rip higher as the market comes to a brand-new conclusion: Donald Trump is great news for markets. He brings less regulation, lower taxes and a business-friendly change of pace after the long post Financial Crisis economic slog.

—

Election night 2016 is a microcosm of everything that is fantastic and terrible about currency trading. The hills and valleys. The emotional and financial highs and lows. Currency trading is mentally exhausting and (sometimes) incredibly satisfying. Tiring and exhilarating. Bad decisions can lead to good outcomes and good decisions can lead to bad outcomes. Luck rules on any given day while skill dominates in the long run.

FX trading is hard. But it can be incredibly rewarding.

Trading is a serious intellectual pursuit that is also incredibly fun. The joy of attempting to solve an unsolvable puzzle. A nearly impossible daily test of discipline and self-control. An endless emotional roller coaster of instant feedback, frequent disappointment, sudden euphoria and nearly unbearable periods of crushing self-doubt.

Enjoy the ride.

(End of excerpt)

Here’s a chart of the USDJPY price action into and after the election.

My last memory of 2016 is 5 p.m. on December 31, going straight from work to meet my wife and some friends at Beauty & Essex. I had an Excel printout of my P&L across 2016, and it finished right at the peak: $10,100,000. I plopped it on the table and ordered a mezcal and soda.

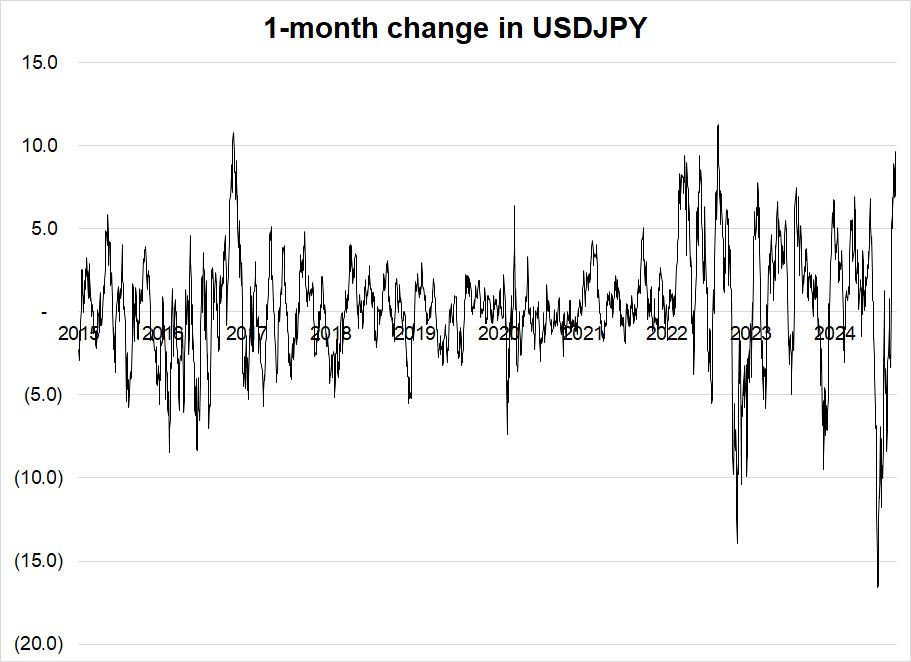

Kanda once said that 10 yen in one month is a concern for the Japanese government. We now have such a move, though it comes just after a 15 fig drop in one month (15JUL to 15AUG) and thus while the speed condition is met for intervention, the levels might not yet be a concern. We’re through the 200-day moving average now and USDJPY is rather unhinged. Watch for comments from authorities soon.

Ed Yardeni has been a strong counter to the persistent talk of economic doom out there. While you can argue he’s a permabull, he wears the hat proudly and I suppose there are worse things than being persistently more optimistic on the economy in a period where the consensus has been painfully pessimistic and wrong. Here’s his latest update. This one is more about the stock market, but his economic view “Roaring 20s for America” has been spot on over the last two years.

https://www.linkedin.com/pulse/lost-decade-ahead-stocks-only-3-annual-returns-edward-yardeni-92t0f/

Have a 41-million-digits out of 10 kinda day.

New largest prime number ever discovered dropped yesterday. That image is my folder window (with preview) after downloading the full 41-million-digit number in a .txt file. I tried to bring it into Word, but Word was not happy about it and repeatedly crashed.

The full story here: https://www.mersenne.org/primes/?press=M136279841

A Marsenne prime is where you take a prime number (p)… And put it in this equation:

2p – 1 = ?

… and another prime number pops out. It doesn’t always work. For example: 211 – 1 uses 11 (a prime number) for p but spits out 2047, which is not prime because 23 X 89 = 2047.

USDCNH looks like positive EV but there are four caveats. Short USDCAD into BoC.

I think it will be very hard for 2025 Bank of Canada pricing to come true.

Macro is a whirlpool right now with China stimmy, US elections, and stonking US data all competing for airtime.