Back from a blockbuster trip to Rio and São Paulo.

A high conviction trade idea in CNH and a metric tonne of other thoughts.

Back from a blockbuster trip to Rio and São Paulo.

A high conviction trade idea in CNH and a metric tonne of other thoughts.

Source: Phone of the Gitt

Flying into São Paulo

Buy 1-year 7.60 USDCNH

calls off 7.2250 spot for ~52bps

February 5, 2024

I am back from an epic week in Brazil as Matt, Yuval and I held ~20 meetings with about 100 individuals from various funds, banks, and real money firms in Brazil. The industry there continues to thrive despite a much higher Selic rate, though current vibes are not close to the rowdy feeling a year ago after the industry’s strong performance in 2022.

Unlike the USA, hedge funds in Brazil are paid on alpha in excess of the risk-free rate, so higher risk-free rates hurt Brazilian funds and make life easier for US funds. In theory, a US hedge fund could put all its money in T-bills and get paid 2 and 20 or something similar on the returns. Not that they do that, but it’s a massive structural difference in incentives and compensation.

Also, most money in Brazilian funds comes from retail and offers instant liquidity; a higher Selic rate offers a juicy alternative for fickle retail investors. This is in contrast to 2021, when Selic hit 2% (!) and money absolutely poured out of fixed rate products and into hedge fund alternatives. The industry has suffered two years of withdrawals, but these come after five years of inflows. The industry remains huge, sophisticated, active, humble, and hungry.

There are so many takeaways from the trip as the amount of information we accumulated was incredible. I am splitting this into the first ever two-part am/FX.

Over the past 18 months, carry has been the way to make money in FX. While there have been other short-term macro themes and events that were worth trading, the macro themes were short-lived and carry was king for most of 2023. The most popular choice for carry has been MXN because it has the double-barreled story of reshoring/US proxy/remittances/nice fiscal + high real rates. In contrast, BRL has been a popular trade but our client base saw it more as a pure carry story with some worrisome fiscal / political attributes and neutral fundamentals.

Onshore in Brazil, though, the talk was of booming trade balance, Lula acting pragamatic as the winds blowing to the right keep him in check, strong technology investments making agricutlure more efficient, and potential for stronger FDI and capex related to rising oil production and overall stability. Petrobras has raised its output foreacst to 2.8 barrels per day and the government expects 5.4 million bpd of oil output in Brazil by 2029. That’s about the same oil production as Canada.

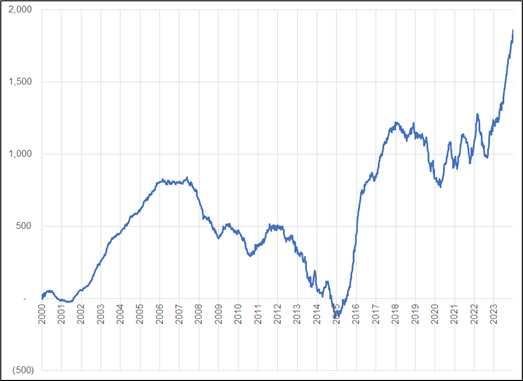

Brazil Trade Balance (weekly data, average of past 52 weeks)

BZTWBALW on Bloomberg

It’s interesting to see Brazilians so bullish on Brazil because that was not the case last year when I visited around election time, and I am told that is somewhat uncommon. Most Brazilians, like Canadians and Brits, tend to be bearish their home currency most of the time.

While the view was close to consensus (maybe 90% of everyone we met was bullish BRL), the position is not massive for a few reasons:

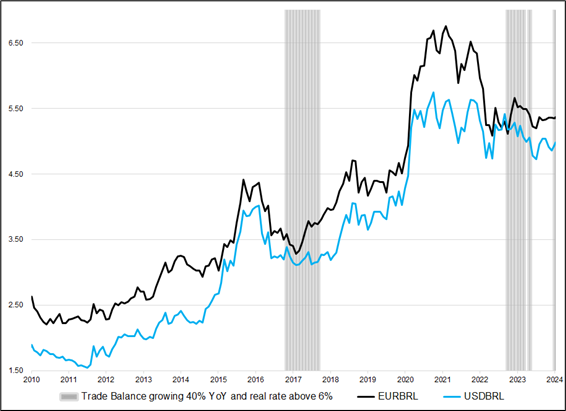

The biggest issue with the bullish BRL story is that it’s not really new. This chart shows EURBRL and USDBRL marked with times when both Brazil’s trade balance was growing 40% YoY and the real rate (Selic minus CPI) was above 6%.

EURBRL and USDBRL with times when trade balance >40% YoY and real rate above 6%

Also, most people in FX are familiar with the Australian terms of trade story and how that was a dud because the ToT explosion never filtered through to the economy or FX market. In the 2012 Commodity Supercycle, higher commodity prices led to capex, jobs growth, and tighter policy in Oz. The most recent ToT boom in Australia was accompanied by little capex and negative real rates. As such, I don’t think the current ToT boom in Brazil is similar to the one in Australia. Brazil has high real rates and investment is strong. That said, while the Brazilian fundamental story isn’t getting as much airtime in the US as it’s getting in Brazil, the story also isn’t news. You can see that the strong ToT + high real rates regime has been in force off and on for about a year.

It seems to me like the strong trade balance will lead to USD selling from exporters, but the general consensus is that these flows will come gradually and the exporters are in no huge rush. In the past, Petrobras was using USD inflows to pay down debt, but the view on the ground is that they are probably going to be net USD sellers at some point, as will agricultural exporters.

I have seen this before, working at Canadian and Japanese banks, where the exporters are underhedged and patient. They sit on the offer and wait to get paid. If they don’t get paid after a few months, they move their offers down. But the USD sellers are patient. In these scenarios, you tend to see a market that has trouble rallying but doesn’t necessarily go down. In other words, the topside in USDBRL is somewhat capped while the downside is reliant on global macro and Fed policy more than internal fundamentals.

I am not going to make a specific trade recommendation here because I don’t have high conviction on the setup. But this looks like a classic case I have seen before where Japanese exporters or Canadian exporters are underhedged and continue to see USD inflows and this supports the currency by capping the USD and crushing topside vol as those exporters also sell USD calls. If you are bullish world and like the carry/vol on BRL, I would structure it with this in mind. Buying low strikes is not the way. Better to do ATM EURBRL and earn the carry, etc.

We did not meet a single trader net paid rates. A few were paid US vs. received Europe and trades like that, but literally not one out of 100 people we talked to said they were positioned for higher global yields. Make of that what you will!

And due to the sluggish nature of FX of late, most clients have much more risk in rates than in FX. I would say instead of a normal 60/40 split for our clients, we are seeing people more like 70/30. Not just in Brazil but across our entire client base. Most popular receivers in the Brazil client base are (in order of popularity): Europe, Brazil, UK, other. People were leaning toward the idea of the US cutting first, but my sequencing is more like: ECB signals an April cut at their March meeting, SNB cuts in March, ECB cuts in April, Fed cuts in May. March SNB is only priced for 37% and that feels low to me.

Nobody is positioned for a US growth and inflation reacceleration and that looks like a major risk to me.

Trump is leading but our view is that each month that the soft landing continues, Biden’s odds will improve. The deep psychological wounds from COVID and from the drop in real earnings triggered by the COVID inflation hypercycle will slowly heal if wages stay strong, inflation falls, and the economy chugs along on cruise control. As Gittins put it: Biden is long carry. It’s extremely difficult to play the election right now because it’s a long way off. It’s impossible to play in MXN where the carry is prohibitive.

This section is the Spectra view that we presented on the trip, not the view of the Brazilian fund managers we met.

There are many paths to a higher USDCNH and very few ways USDCNH goes down this year. The economic setup is well-known and the export channel is one part of the China story that has held in OK. From a purely macro point of view, a weaker currency makes much, much more sense than a strong currency. Also, my view is that most paths and regimes still lead to a higher USD vs. G10 (that will be covered tomorrow). That said, the PBoC can toggle between stability and CNH weakness at will and they are currently targeting stability. Two natural times for them to release the currency would be after Chinese New Year (February 10) or after the election if Trump wins.

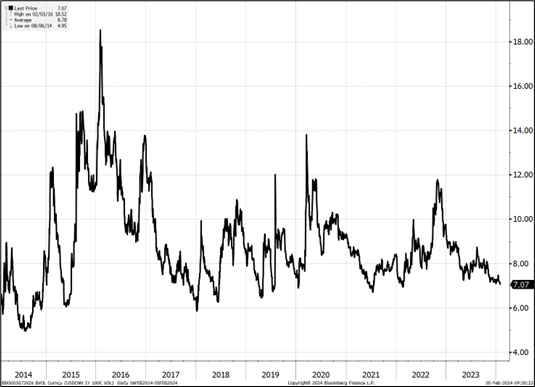

Normally, it would be crazy to position for a November event in early February, but USDCNH is positive carry, the vol is extremely low, positioning is negligible, and there are plenty of structures you can put on that cost you little or nothing to wait. And you want to be long vol here. Furthermore, because the PBoC defended 7.38 in both October 2022 and September 2023, you know exactly where the pair is likely go convex to the topside (through 7.40).

In USDCNH, the overnight premium for the election is around 1%, compared to 2.5% for other currencies like MXN and AUD. While obviously CNH trades on a much lower vol base, I believe it’s the only currency that matters for the election. It should be on the front burner while MXN should be a backburner idea given Trump already renegotiated NAFTA into USMCA and all the political points are to be earned bashing China at this point. Trump kept many of his economic campaign promises after the 2016 election and his platform now is to put a 10% global tariff and a tariff as high as 60% on Chinese goods. This is going to create massive USDCNH angst into the election if Trump maintains his lead and in the past China has devalued its currency mechanically in reaction to Trump tariffs.

Rarely do you get a trade that’s long carry, long geopolitical tail risk, long global macro, and massively long convexity. I think the simple play is to simply buy 1-year 7.60s for about 52bps. If you want it to be closer to zero cost, you can sell one 7.40 to buy three 7.60s (1X3). That has more leverage but it’s a bit more complicated.

Take a look at 1-year USDCNH 10-delta call volatility. It just looks totally wrong to me.

USDCNH 10-delta call volatility

So I am adding that to the sidebar. Buy 1-year 7.60 USDCNH calls for around 52bps off 7.2250 spot. Those will get you past the election and the inauguration. It’s a play on the Trump premium being too small, but I think there are many ways it can work, even if Biden wins. This trade is also an excellent hedge for a long equity book.

RBA tonight and CPI revisions Friday are two events to keep on your radar. Full calendar and updated positioning report tomorrow. Have a smart, sunny, friendly day.

View of Ipanema from the hotel rooftop

From left to right:

40-minute walk back from client meeting sans sunscreen requires dress shirt to be used as protection of bald cranium.

Mint car.

5-card PLO in Sao Paulo with 5% uncapped rake (!)

MSTR to infinity. Europe, not so much.