Macro is a whirlpool right now with China stimmy, US elections, and stonking US data all competing for airtime.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Macro is a whirlpool right now with China stimmy, US elections, and stonking US data all competing for airtime.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Here’s what you need to know about markets and macro this week

Don’t forget to listen to the podcast this week!

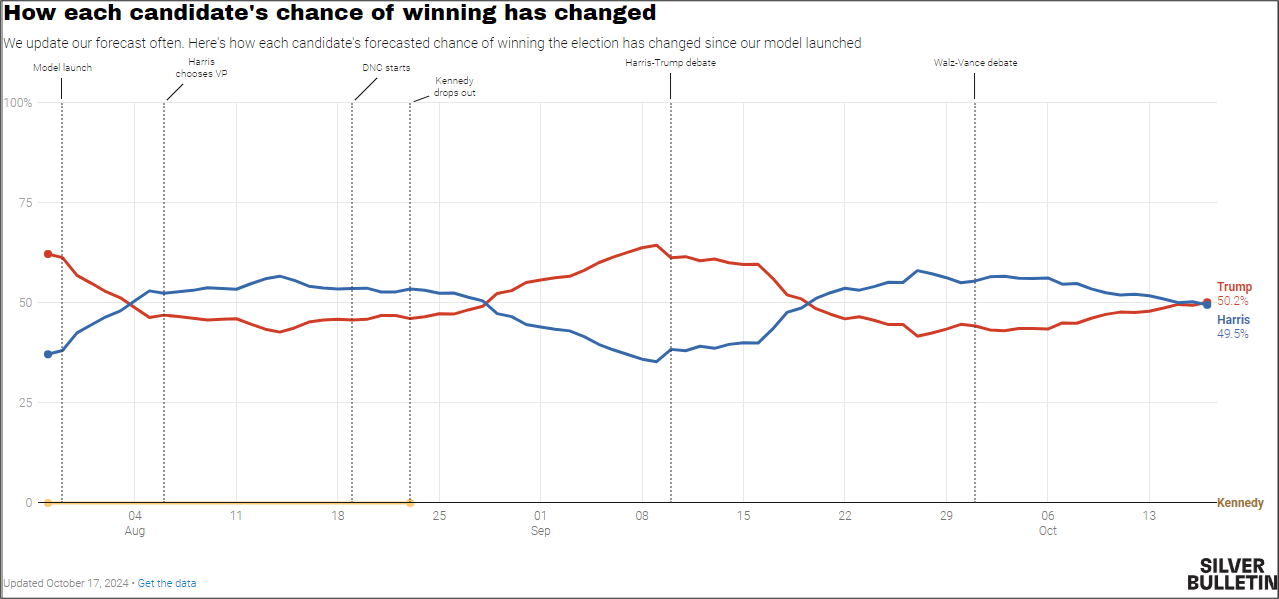

Macro is a whirlpool right now with China stimmy, US elections, and stonking US data all competing for airtime. Trump’s odds are rising during a period of strong economic data in the US, making it difficult to isolate the themes and figure out which is more important.

My feeling is that speculators spent a good chunk of cash this week on trades that will benefit from a Red Sweep. We saw that in our franchise (USDCNH calls, USDMXN calls, etc.) and that is definitely the vibe as the odds of a Red Wave continue to make new highs.

The tricky part of this is that sure the Red Sweep odds have gone up, but they’re still less than 50%. And none of the other outcomes work well for the Trump trades.

In other words, there are many scenarios in play here, and most of them are still not a Red Sweep. If you’re long the Trump trades via options, not only do you have to contend with various bad outcomes like a Blue Wave or split congress, but you also need to worry that your expiry is no good because the election result is contested and drags on for ages. While the market never took the 2020 challenges to the election result seriously, it might this time if there is a more credible challenge to the outcome.

All this to say it’s not exactly free money to sit there long the Trump trades at these levels. In fact, dabbling in some Harris trades might be higher EV.

With regard to the gambling odds… I am increasingly convinced that it makes sense for Trump-friendly billionaires to plunk down millions on Polymarket to achieve the following:

There has been some loose speculation that the whale moving Polymarket, Fredi9999, could be hedging some legitimate business interest, and I guess there’s a world where that might make sense. If you’re worried that Trump tariffs are going to hurt your business, Polymarket wouldn’t be a bad hedge because unlike rates or stocks, there’s no question of whether the hedge works. Then again, a legitimate business setting up a multi-million USD crypto account to buy Trump futures 5% above where they trade on every other platform seems a bit far-fetched?

Anyway. Even if you agree that Polymarket odds may be biased by non-economic actors, the unbiased forecasts of the election outcome are moving the same direction, to a lesser degree. Here is the evolution of Nate Silver’s forecast. Silver isn’t perfect, because nobody can forecast perfectly, but his odds have been credible through four election cycles. He’s pretty good!

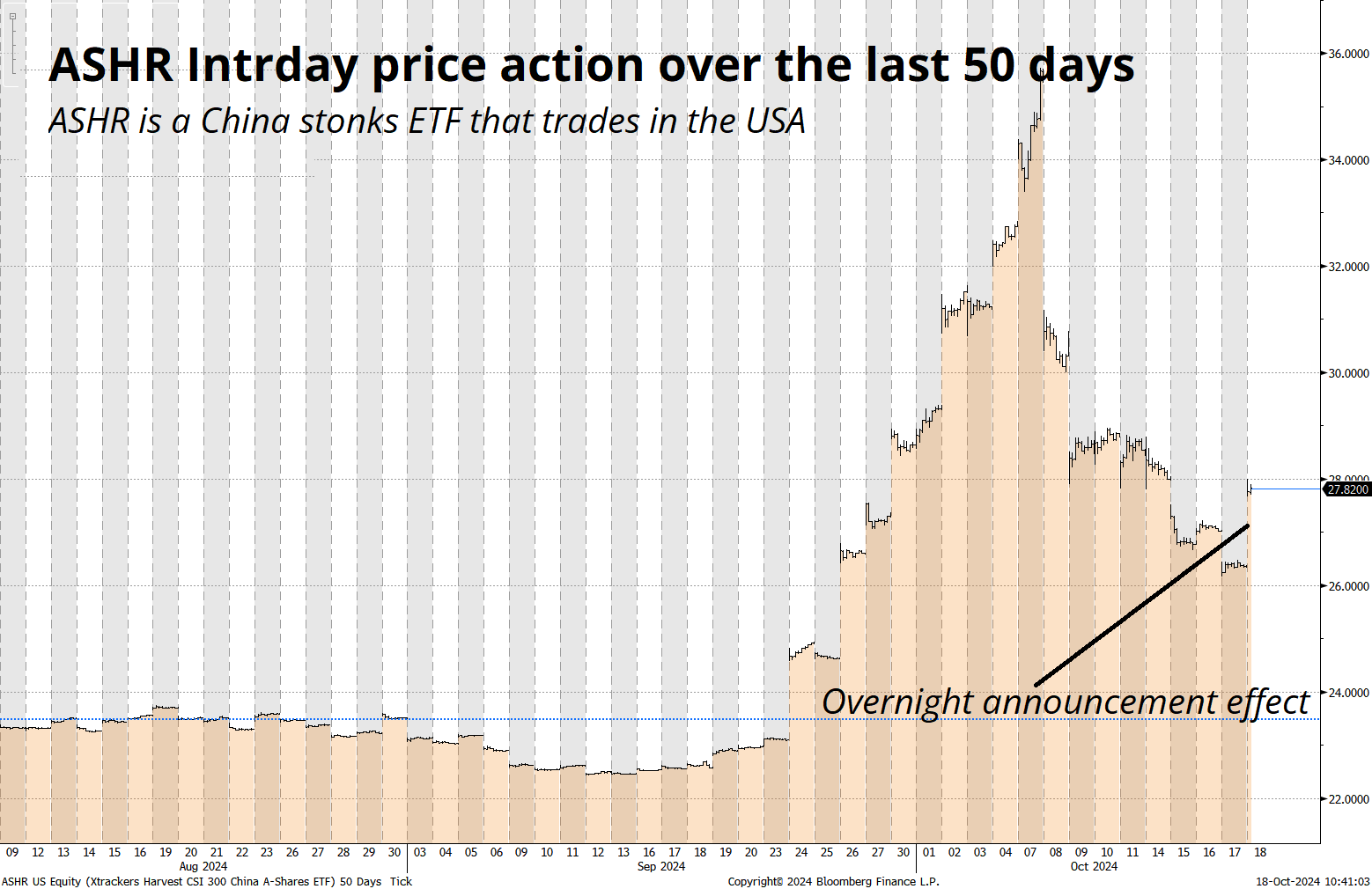

While the election increasingly becomes the main market focus as the date inches nearer, the shenanigans in China have moved to the backburner. China did another announcement last night in yet another attempt to rescue floundering A Shares, but diminishing returns are starting to kick in and the market has reached a verdict for now.

The big trade was to sell puts on China stocks, and the $23 and $26 puts expiring late December 2024 and January 2025 have the most interest. If I was short those puts, I would be scared.

Don’t forget to buy the 2025 Spectra Markets Trader Handbook and Almanac here.

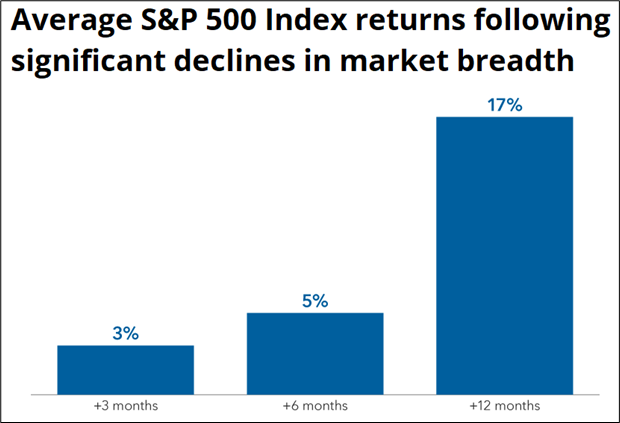

The S&P 500 has rallied to new all-time highs while the NASDAQ is close, but just below the July 2024 peak. That tells you there is some rotation going on and you might think back to when Mag7 was leading, and the bearish clarion call was that the lack of breadth portended imminent doom. Breadth comes and goes. It doesn’t help you forecast the stock market. Sectors rotate. Stuff rips then chills. Something to remember next time you see complaints about bad breadth.

Here are two stories by the same reporter. The S&P is up more than 20% since that first one.

In fact, while the headlines imply bad breadth is bearish… The opposite is true:

https://www.capitalgroup.com/institutional/insights/articles/risks-of-bad-breadth.html

Bears will point to anything to justify stale bearish calls. “Interest rates are going up!” is the big one, even though higher yields are sometimes bad for stocks and sometimes good. Recent weeks have shown how higher yields and higher stocks can happen at the same time. If someone is bearish stocks, it’s always worth investigating:

As counterintuitive as it might seem: Market halitosis is bullish.

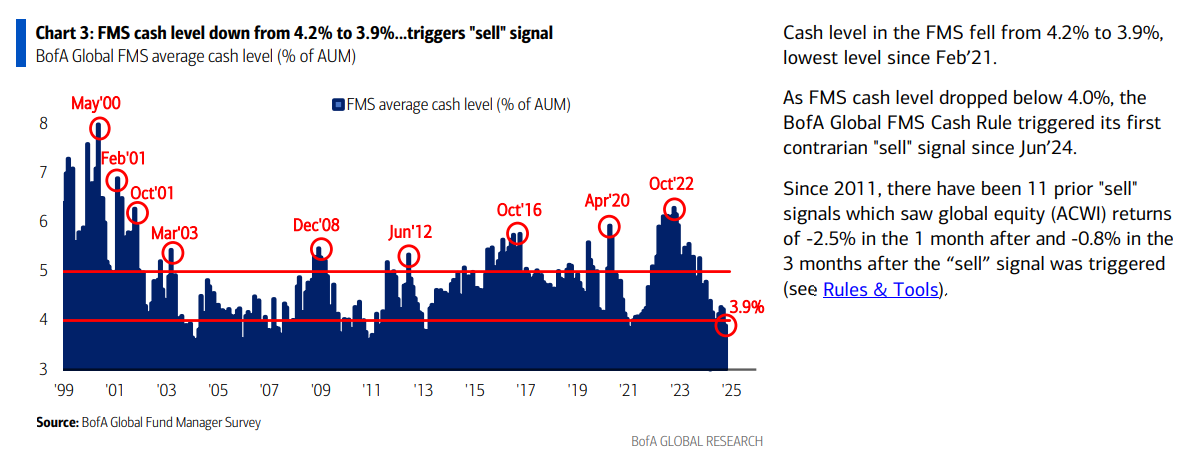

Right now, it’s an interesting story in stocks because the market is wildly bullish into the election, which is rare. This BofA chart highlights times when the market raised cash (red circles).

The put/call ratio and AAII surveys show similar ebullience. I offer no call to action here, but you would not be mad to take some chips off the table and raise cash when everyone else is doing the opposite. You can see in the BofA chart that people generally tend to become risk averse into elections, but this election is the exact opposite—the fear of missing out on a Trump tax cut and MMT fiscal deficit induced stock market rally is stronger than any concern about tariffs or Middle East uncertainty, or China softness or deflationary vibes from oil and commodities.

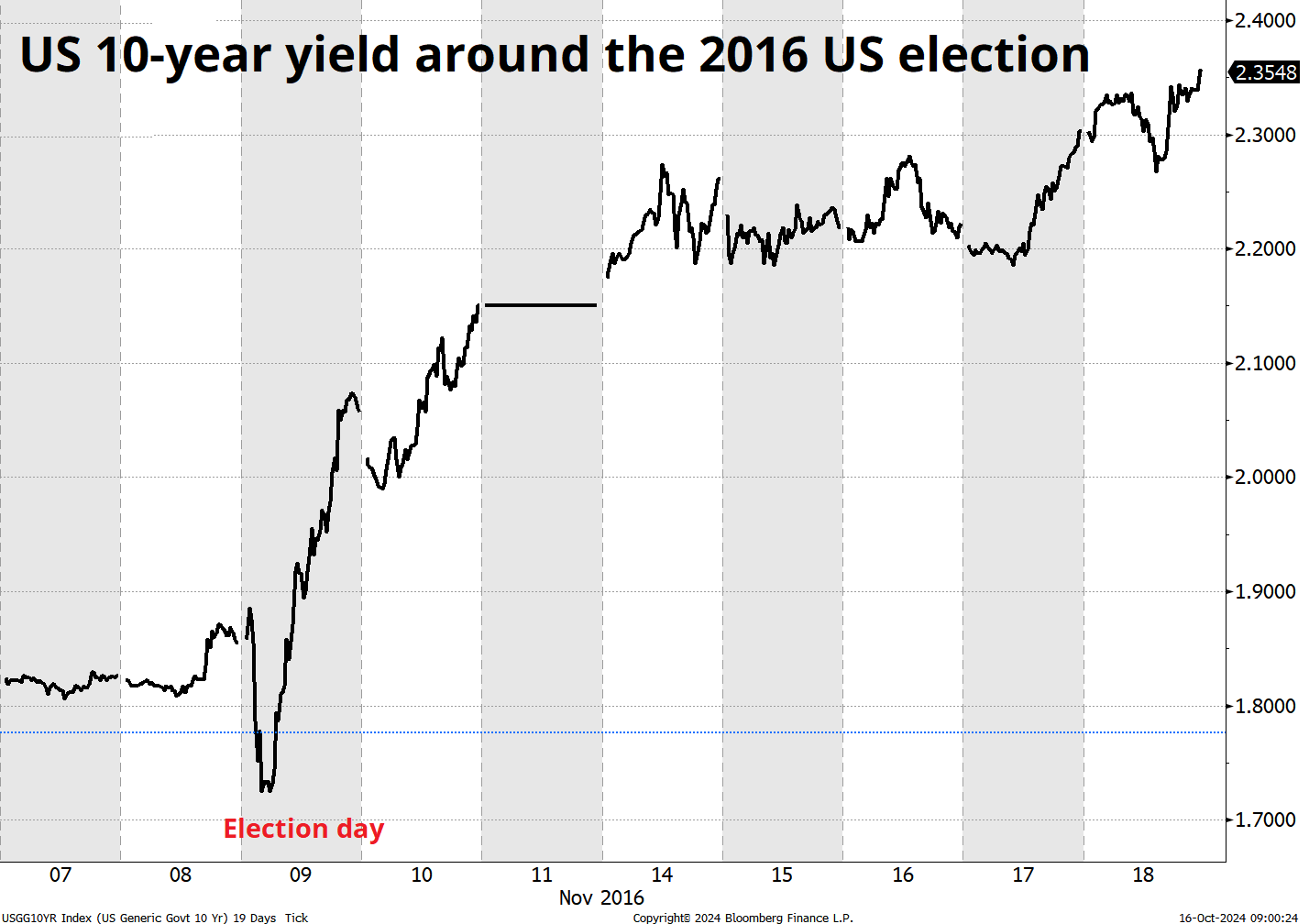

The common knowledge in 2016 was that Trump is bad for stocks. They went limit down and then you remember the rest. This time the common knowledge is that Trump is good for stocks. OK.

It’s a funny and potentially risky mirror image view to hold.

Here is this week’s 14-word stock market summary:

Everybody is mega bullish into the 2024 presidential election. What could possibly go wrong?

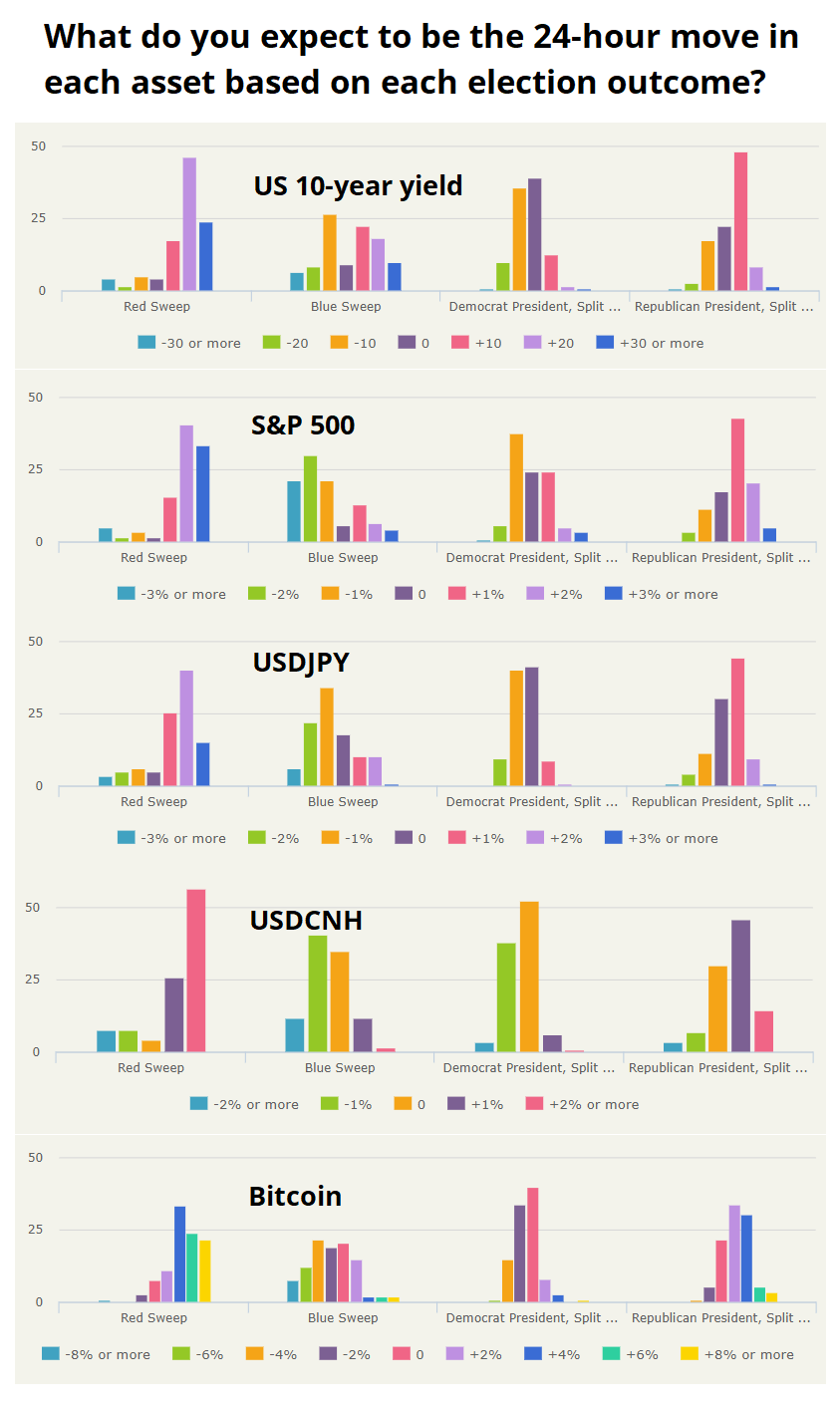

I ran a survey this week on expected 24-hour post-election market moves. Here are the results.

Takeaways:

My view in last week’s Speedrun was that 10-year yields would consolidate 3.90% / 4.18% approx. That view was decent as the range was 3.98% / 4.12% and things were generally calm despite a zippy Retail Sales figure.

Betting against the US consumer is hard.

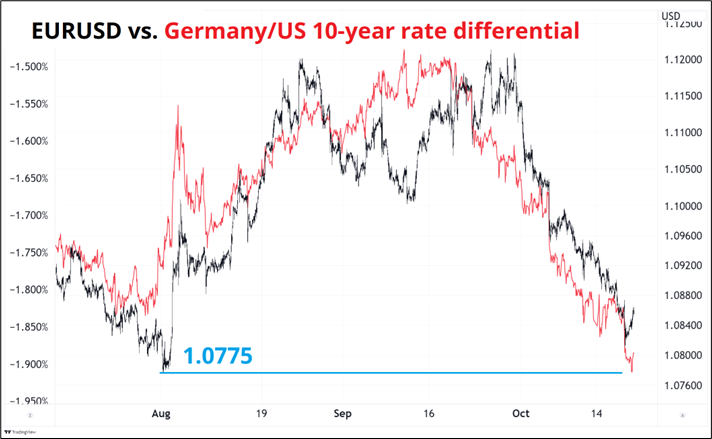

EURUSD continues to catch down to rate differentials, but the week-long buying of USD on strong data and rising Trump odds burnt itself out Thursday and we’re getting a bit of a tiny turn today.

My view is that the Trump trades have reached full participation in the short term and now we will chop for a bit as the market waits through a boring data calendar week with very little new information on the election.

Note that 1.0775 level is where EURUSD was when the weak NFP came out in early August, and we have now just about completed a perfect symmetrical M formation. These symmetrical formations are more common than one might expect because volatility can be relatively constant over time when you’re in the same regime. I don’t think it will be easy to take out 1.0775 over the next week so I’m calling 1.0780/1.0915 as next week’s range. Boring.

Kinda niche, but GBPJPY is very high relative to interest rate differentials. I published a short trade idea on the topic and you can read it here (free).

https://www.spectramarkets.com/amfx/pm-fx-short-gbpjpy/

I publish trade ideas all the time and the idea is not for people to just copy them. If you like the logic, sure, go for it! I copy people’s ideas sometimes if I think they’re good! But ideally the trade ideas are food for thought and also a glimpse into various ways to think about and structure trade ideas. People always ask: “Where do trade ideas come from?” so this is one answer. A bunch of stuff all coming together at once, usually, into a short GBPJPY trade.

The MSTR weirdness continued this week as we saw one particular day when bitcoin was up 5% and MSTR was down 4%. That’s odd! Inverse moves of 4% or more in those two highly-correlated things have only happened four times in the past four years, looking back to the beginning of the cyber hornet trade in 2020.

What does it mean? Not much, other than you can probably assume that RV players are having either a very good or very bad time as the infinitely wise and disastrously unprofitable short MSTR / long BTC trade continues to bring back memories of past madness-of-the-crowd style disconnects.

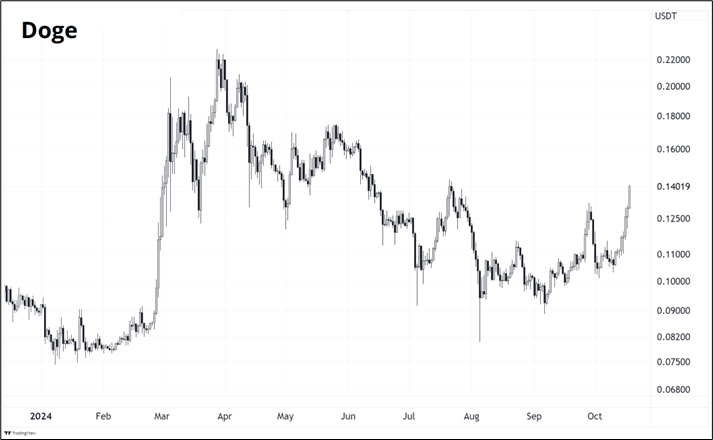

Meanwhile, there are pockets of speculation all over the cryptoverse, including future monetary standard dogecoin, which finally rose out of its 6-month coma to retest the middle of the 2024 range.

Happily gone are the days of crypto babytalk like WAGMI, NGMI, and frens and all that—but I do miss the doge memes.

I was wrong about crude oil last week as we swiftly dumped sub-$70 on the back of something something China something Iran something.

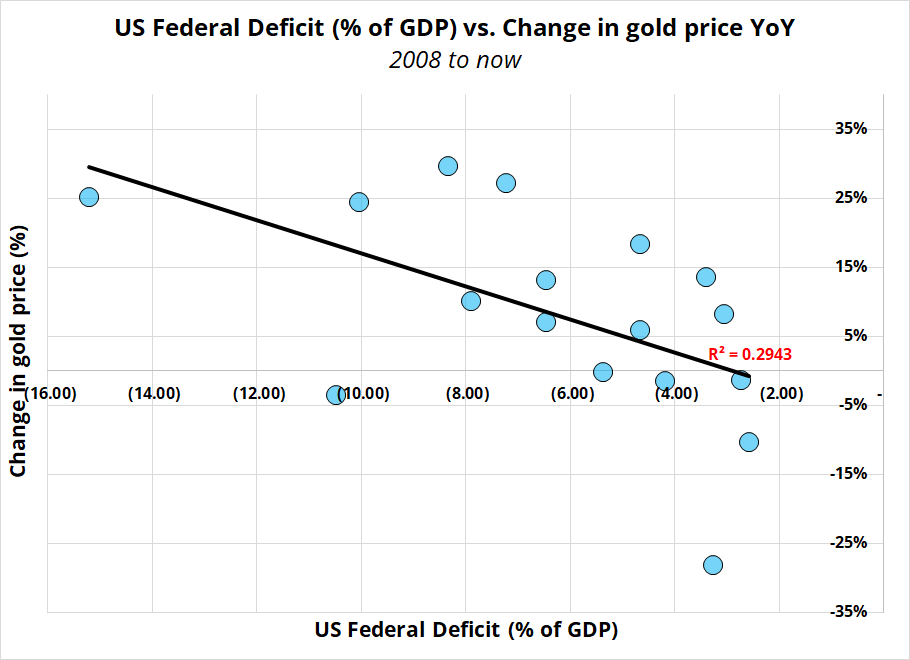

Gold, meanwhile, continues to TWAP higher every day and it’s hard to put a topside target on it other than round numbers. It has proven to be pretty OK hedge for larger US deficits in the post-GFC period.

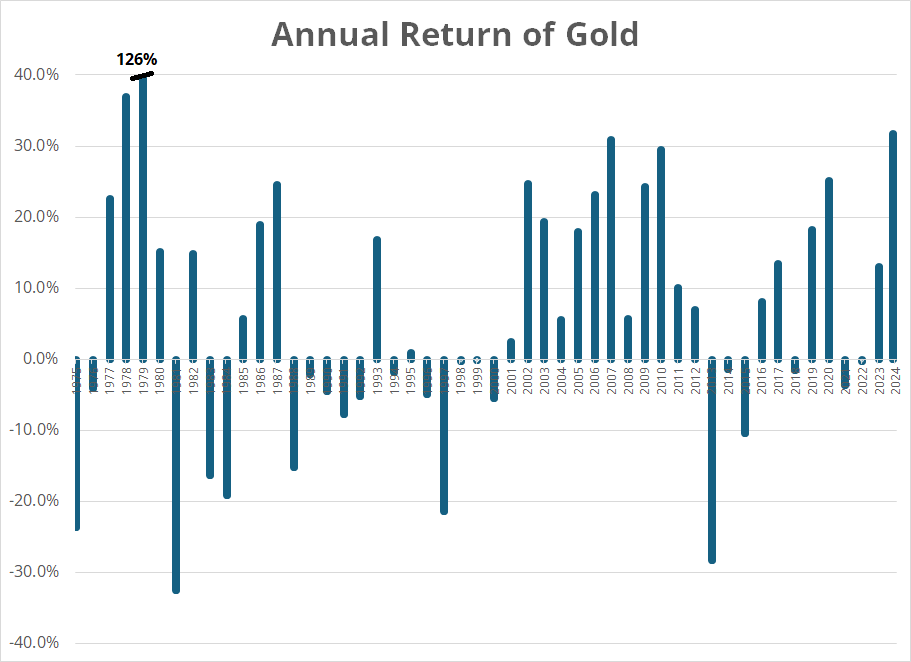

This has been one of the best years ever for gold.

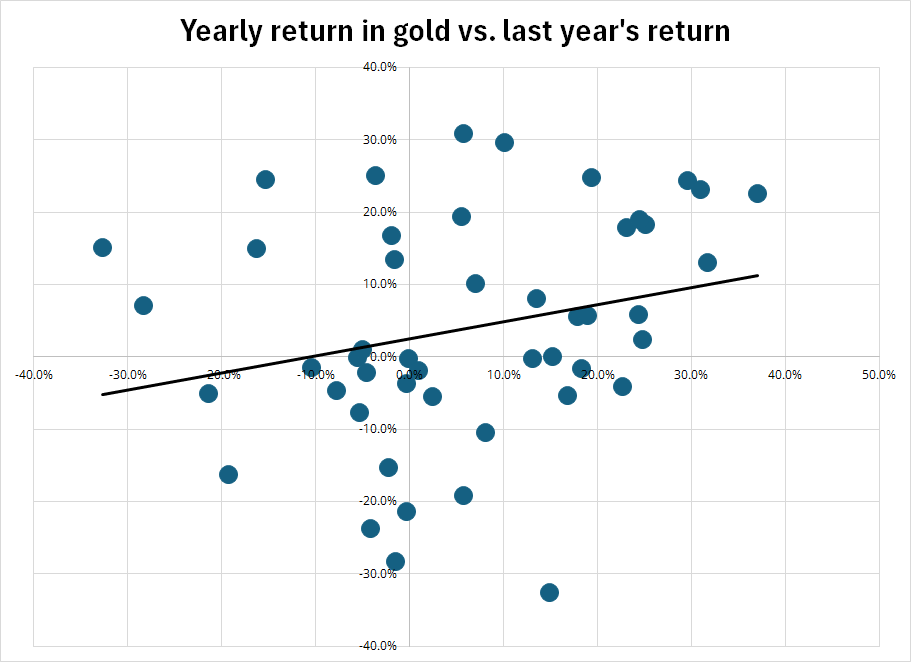

Lucky for goldbugs, year-to-year returns are not correlated. A shiny year in 2024 doesn’t necessarily tarnish expectations for 2025.

Whew! OK! That was 12.8 minutes. Thanks for reading Friday Speedrun.

Get rich or have fun trying.

Excellent article on prediction markets and central limit order books via Sam Rines

https://quantian.substack.com/p/market-prices-are-not-probabilities

Baseball games and announcer calls don’t get much better than this…

https://www.mlb.com/guardians/video/noel-fry-power-guardians-to-epic-win

When the government might send you jail for being bearish, you get research reports like this one…

Biggest wealth-destroying US ETFs of all time

It’s easier to score when you’re born on third base

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

Investment bank outlooks may suffer from extrapolation bias. Tails are the base case.