It’s impossible to ignore the WaPo article, but get ready for a reversal, too.

Cloudflare uses 100 lava lamps in its HQ lobby to generate the true randomness needed for properly secure encryption.

It’s impossible to ignore the WaPo article, but get ready for a reversal, too.

Cloudflare uses 100 lava lamps in its HQ lobby to generate the true randomness needed for properly secure encryption.

Flat

We’ve seen a worst-case scenario overnight for USD bulls as Trudeau looks set to resign, the Washington Post reports only targeted Day One tariffs, and German CPI comes in way above expectations. EURUSD continues to track the turn of 2016/2017 in eerie fashion.

One thing to remember about unsourced articles from WaPo (and WSJ!). They were very often wrong in 2017/18. They are great clickbait, and there isn’t necessarily any truth behind the story when it comes out. Nobody ever goes back and audits the veracity of these things.

It’s hard to completely dismiss the article, of course, but a subsequent denial or flip flop is a huge risk here. In 2017/18, the WSJ and WaPo produced a steady stream of unsourced clickbait-style China/US Trade War articles just like the one we got today, and many of them were just blatantly wrong.

Furthermore, the WaPo article actually does not exclude the Canada and Mexico tariffs. Here’s the relevant excerpt:

“It’s also unclear how these plans intersect with Trump’s stated intent to impose 25 percent tariffs on Mexico and Canada and an additional 10 percent tariff on China unless they take measures on migration and drug trafficking. Many business leaders view those measures as unlikely to ever take effect, but some people familiar with the matter said they could be imposed along with universal tariffs on key sectors.”

For now, offside positioning meets triple USD-negative newsflow to yield a fairly explosive USD down move.

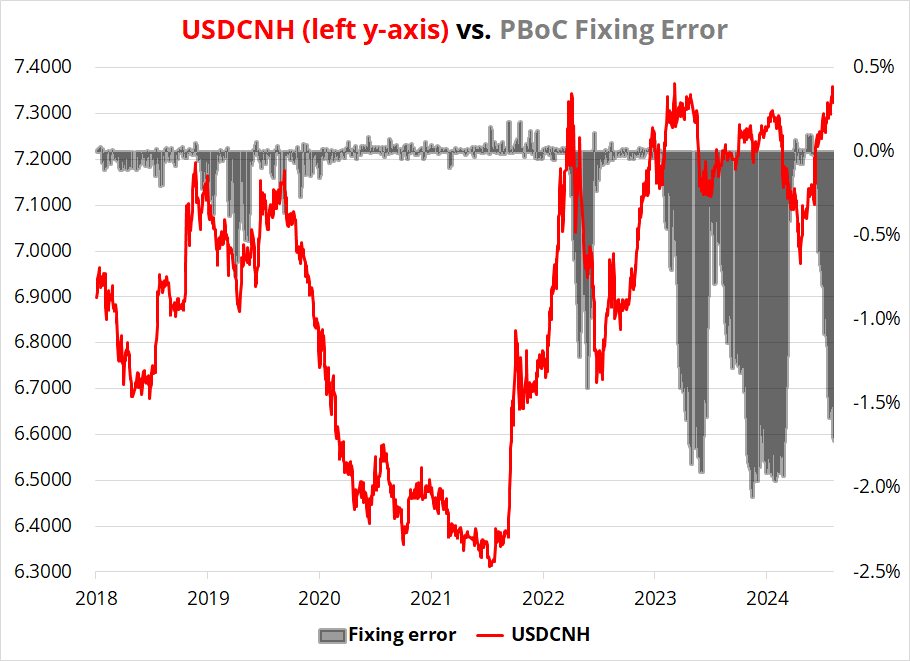

The PBoC are cheering the Washington Post right now as the critical 7.3750 level is off the table for a bit. They continue to fix USDCNY at super, super low levels despite the buoyancy in spot. In the next chart you can see the huge CNY fixing error in gray along with the current level of USDCNH spot in red.

The PBoC won in 2022 and they won twice in 2023, but whether or not they win this time will come down to the question of big tariffs or targeted/scaled tariffs. For now, the momentum is on the side of those that believe that Elon Musk and Scott Bessent are driving the bus (they prefer scaled and/or targeted tariffs). But a denial or reversal of the story could drop at any moment.

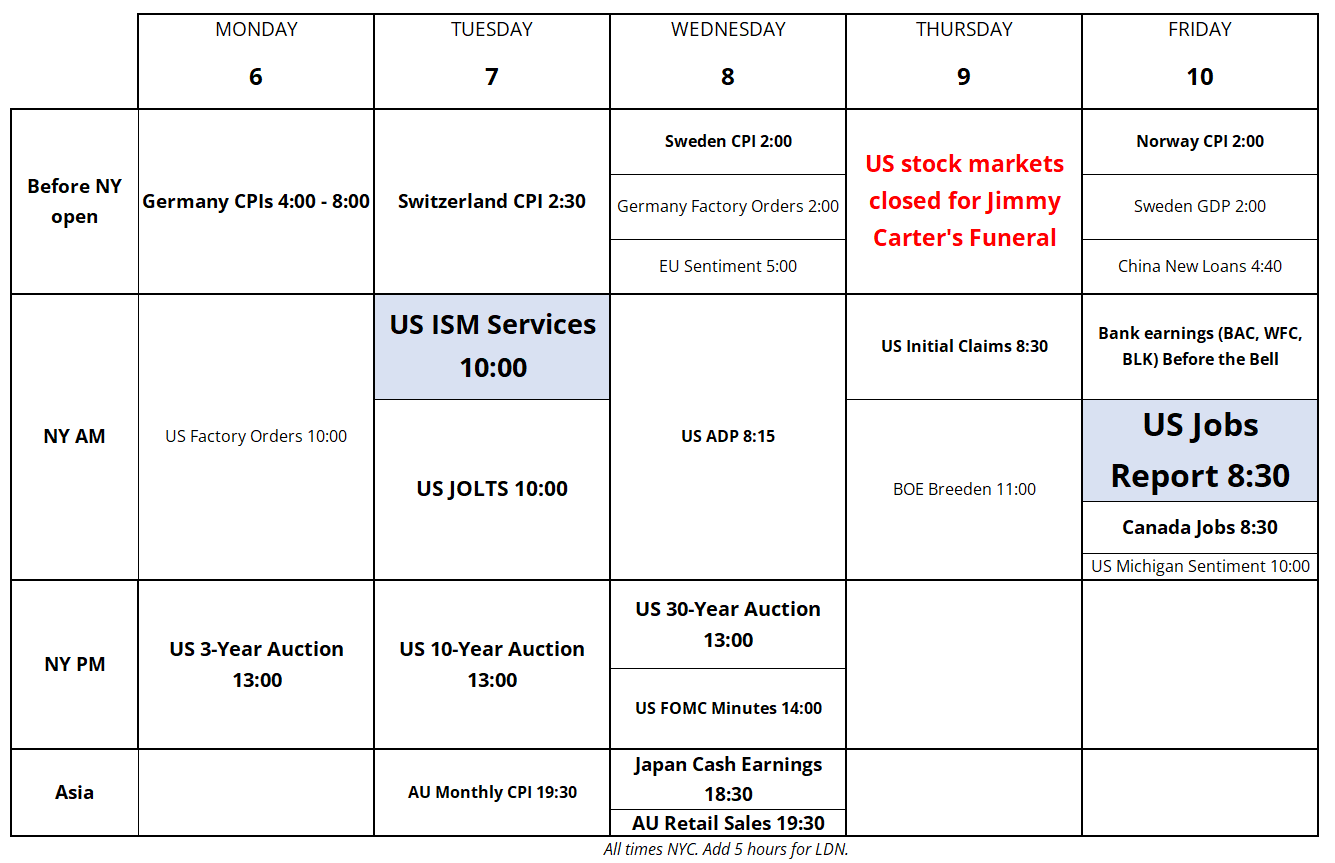

German CPI came in hot this morning and starting tomorrow we get Swiss CPI, ISM Services, JOLTS, ADP, NFP, three auctions, and the start of earnings season. Note that stock markets are closed for President Carter’s funeral on Thursday.

The issue with trading the US data is that none of it really matters compared to tariffs yes or tariffs no and therefore I would be careful getting overly excited taking directional views in FX based on US data. Mean reversion is more likely than continuation, regardless of the data. If data matters at all… Weak US data is likely to matter much more than strong data because of positioning and psychology.

Note the bond auctions moved one day to the left because of James Earl Carter Jr.’s funeral.

It feels to me like both hyperoptimization and the embrace of one’s own victimhood are moving from high-status conduct to lower-status. Here’s a good article on the perils of overoptimization:

https://www.forkingpaths.co/p/against-optimization

Have a dynamic and fluid week.

The fluid movements of lava lamps are a good source of true randomness. Here is an interesting explanation of why Cloudflare uses them to help with encryption:

https://www.cloudflare.com/learning/ssl/lava-lamp-encryption/

HT AdamD

The title kind of explains it and thus a subtitle is not really necessary.