The reopening tonight could be spicy.

Gold and Envy

Gold as a release valve for US deficits and an update on the Magazine Cover Indicator

The reopening tonight could be spicy.

This is a riddle. I typed a punny phrase into the AI, and it drew this.

What is the phrase? First correct answer via email gets a signed copy of Alpha Trader

Bigger pic at bottom of page.

Answer tomorrow.

Flat

Tonight, we get the China reopening along with some kind of hard-to-explain press conference at 10 p.m. NY time (10 a.m. Beijing, October 8). That presser could either be a recap of measures announced so far, or it could involve an announcement / hint of new measures.

That event could prove to be painful for China proxy longs in copper and AUD if no new fiscal stimulus is signaled. The rise in US yields and US equities post-NFP makes the idea that we are going to the middle of the USD smile less realistic again. A pause in the China bull story would be another brick in that wall. Volatility for this event looks underpriced to me.

That is a chart of overnight vol for all the Mondays over the past few years. (I’m showing just Mondays so that we are looking at apples to apples. If you show all the data, the Friday drop makes the chart unreadable.)

I can’t imagine overnight or one-week AUD gamma being a huge loser, but it could be a great asset to own. Given the overbought equity story, borderline bullish hysteria, and long positioning in proxies, I think one-day or Friday AUD puts are more likely to make money than the equivalent calls.

Watch copper for direction and I would also keep an eye on FXI and ASHR intraday today for clues as to whether or not US traders are getting nervous or doubling down in the US afternoon.

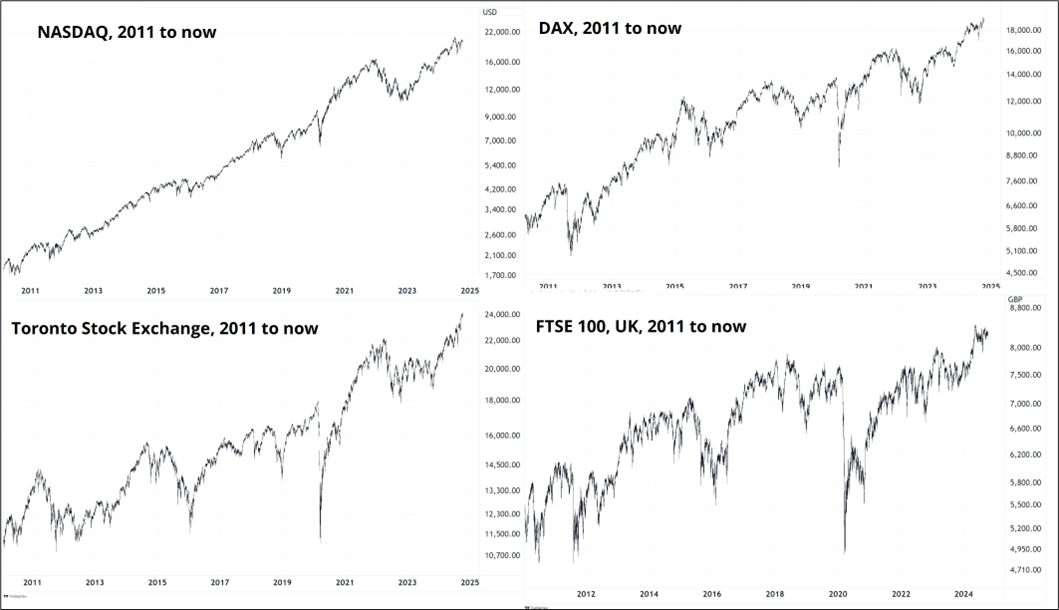

If you look at a chart of the Shanghai Composite going back 10 years or so, you will see that it trades less like a normal stock index and more like a meme stock or altcoin. Normal stock market indexes in mixed capitalist G10 economies look like this:

Note that the DAX is a total-return index, while the other indices are price return indexes, but either way, you see what a “normal” stock market looks like. In contrast, here are the Shanghai 50 and the Shanghai Composite Index. Note there has been no positive drift. The stocks languish, then spike, then revert toward an unchanged baseline. They trade at the same level as they did in 2014.

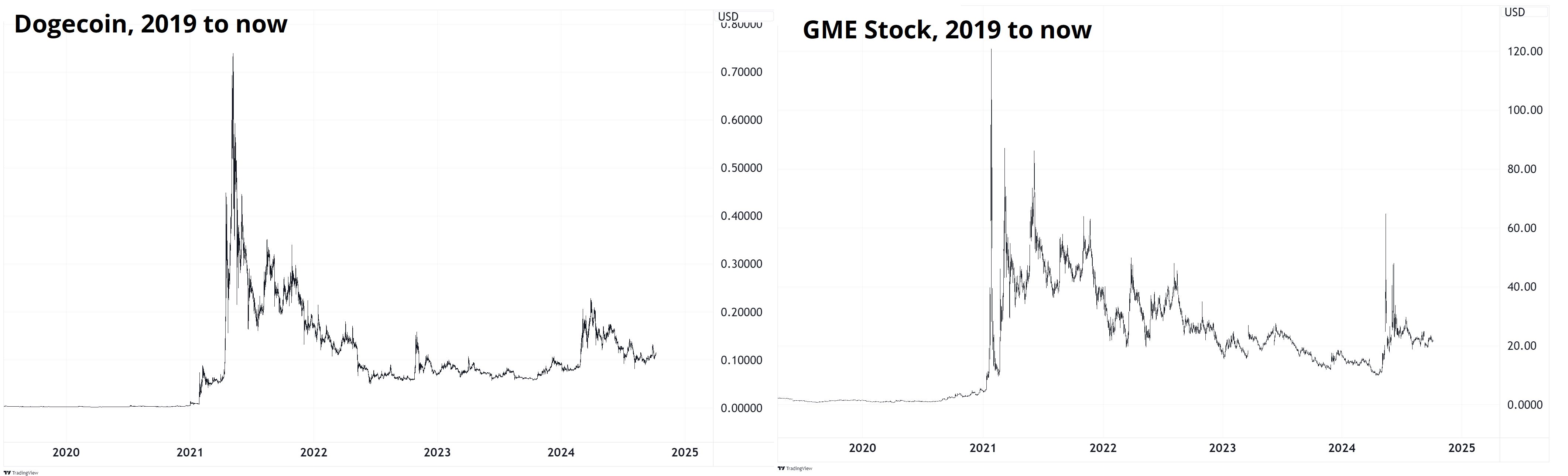

This is reminiscent of how things like dogecoin and GME trade.

I am not saying it’s time to short the China indexes, I am just saying that they are not normal stock markets. While the cliché is that the US stock market is not the economy, that is true times fifty in China. The stock markets there are more a speculative barometer, with a bit of “we-like-or-don’t-like-capitalist-characteristics -billionaires-gonna-go-to-jail-etc” risk premium going up and down. The idea that a share of stock in the US gives you title to some future stream of earnings is already rather abstract. It’s full-on Daliesque in China.

On October 26, I am hosting a virtual conference with Alfonso Peccatiello. It is called Macro Roadmap 2025. Below is the agenda. The cost is $499 per person, but as an am/FX subscriber, if you sign up before Friday, you will get $200 off by using the coupon code: BRENT. See details, and sign up here. If you would like multiple tickets for your team, and would prefer an invoice to credit card, just email me.

Macro Roadmap 2025 Agenda

8:00 A Primer on Prediction Markets

Brent Donnelly, Alf Peccatiello

The rising importance of prediction markets. Why they matter. How to incorporate prediction markets into your global macro framework.

8:30 Election Gameplan

Bruce Mehlman, former US Assistant Secretary of Commerce, Washington politics expert

Understand, interpret, and trade the election results in real-time.

Latest on the election and keys to the outcome.

9:30 Building a macro framework from the ground up

Alfonso Peccatiello with Brent Donnelly

How to create a robust macro process from the ground up. Macro is not only about being right, but about consensus, probabilities and risk/reward.

10:30 The trading and investing metagame

Brent Donnelly with Alfonso Peccatiello

Psychology, risk management, and position sizing.

Dodging kryptonite: Don’t make the same mistakes everyone else makes.

11:30 The 2025 Macro Roadmap

Alfonso Peccatiello and Brent Donnelly

Macro, trading, and investing implications of the main election outcomes.

Top 5 macro trades for 2025 (and why they might or might not work).

12:30 Closing Remarks and 30-minute AMA and post-conference discussion

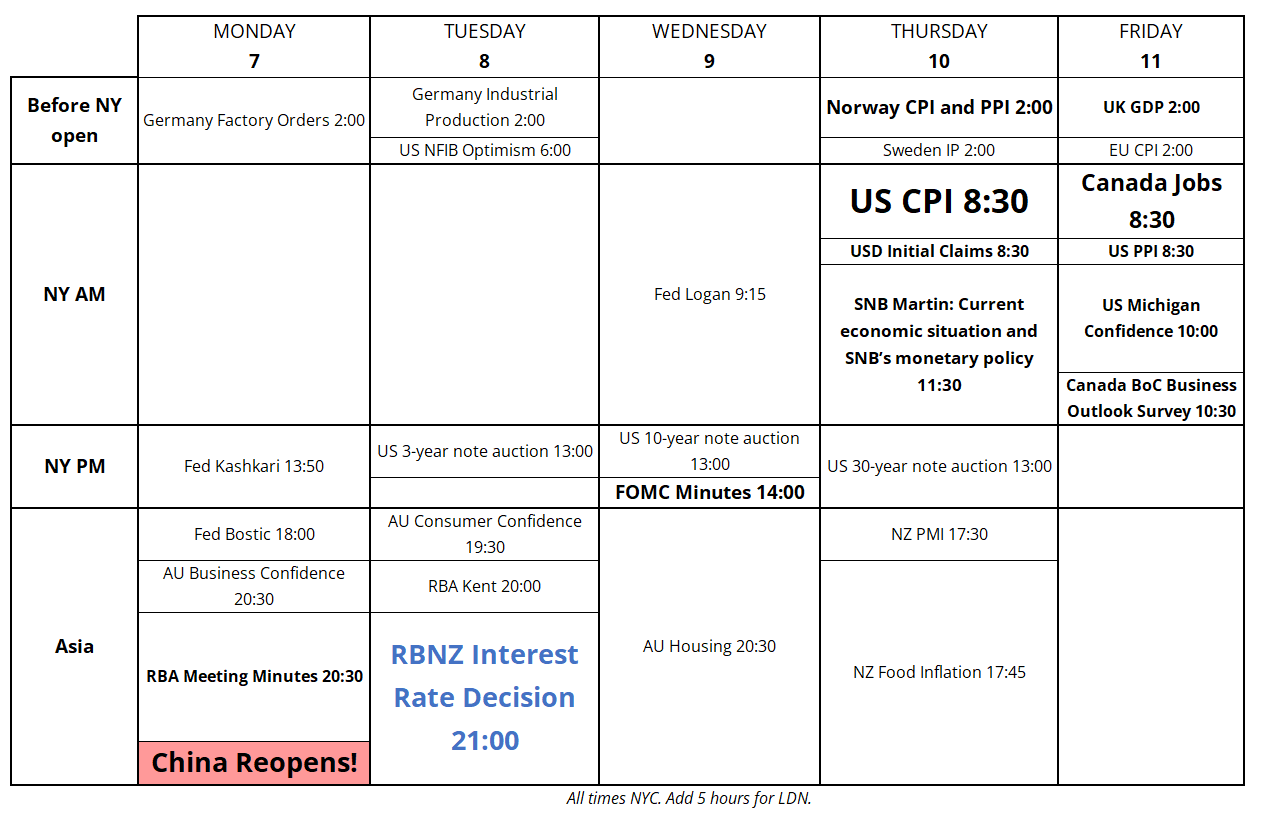

The China reopening is obviously the main event this week, but US CPI, RBNZ, and FOMC minutes will also attract attention. Only about one in ten FOMC Minutes releases are relevant to markets, but I would highlight this one as potentially in that 10% because of the confusing gap between the 50bp cut and the dots and subsequent signaling by Powell. It feels like there are many branches of the multiverse where the Fed only went 25bps in September—it was a close call. Maybe the Minutes will help us understand what happened and give us a lens into what will happen going forward now that the most recent economic data has failed to help locate the Bigfoot recession.

With the confusion around Fed policy and the upcoming CPI release, I was thinking about Powell’s focus on Supercore inflation during the tightening cycle (and particularly in his November 2022 speech). It’s another example of how policymakers with a buffet of 100s or even 1000s of data points can pick and choose based on their prior taste for the direction of monetary policy. In November 2022, they were hiking, so they cared about Supercore. Now, they’re cutting, so they don’t talk about it anymore.

We hang on every new indicator they claim is important. Then they just pick some new ones. It’s funny.

The Economist on why Canada is falling behind the USA.

And finally, for your event risk calendar France’s sovereign credit ratings assessments: Fitch : Oct 11th, Moody’s : Oct 25th, S&P : Oct 29th. With the move in yield spreads, and the agencies’ pattern of backward-looking rating assessments that follow market spreads, you might want to be on guard for downgrades, I guess? S&P downgraded France in June. Here’s a good writeup on how to understand the different sovereign rating scales. See second page (page 46).

Have an exciting week!

Gold as a release valve for US deficits and an update on the Magazine Cover Indicator

A Red Sweep has much clearer implications for markets than any other outcome.