It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

Rollah Coastah

NASDAQ sharply unchanged in quiet trading this month.

It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

“Friday” comes from the Old English “Frīgedæg”, which means “day of Frigg”. Here’s how it breaks down:

Frigg: A Norse goddess associated with love, marriage, and destiny. Similar in some aspects to the Roman goddess Venus.

Dæg: Old English for “day”.

This matches the pattern seen in many European languages, where Friday is also named after the goddess of love.

Latin: dies Veneris (“day of Venus”)

French: vendredi

Italian: venerdì

Spanish: viernes

Long 12MAY 168/163 put spread in CHFJPY

~31bps off 175.25

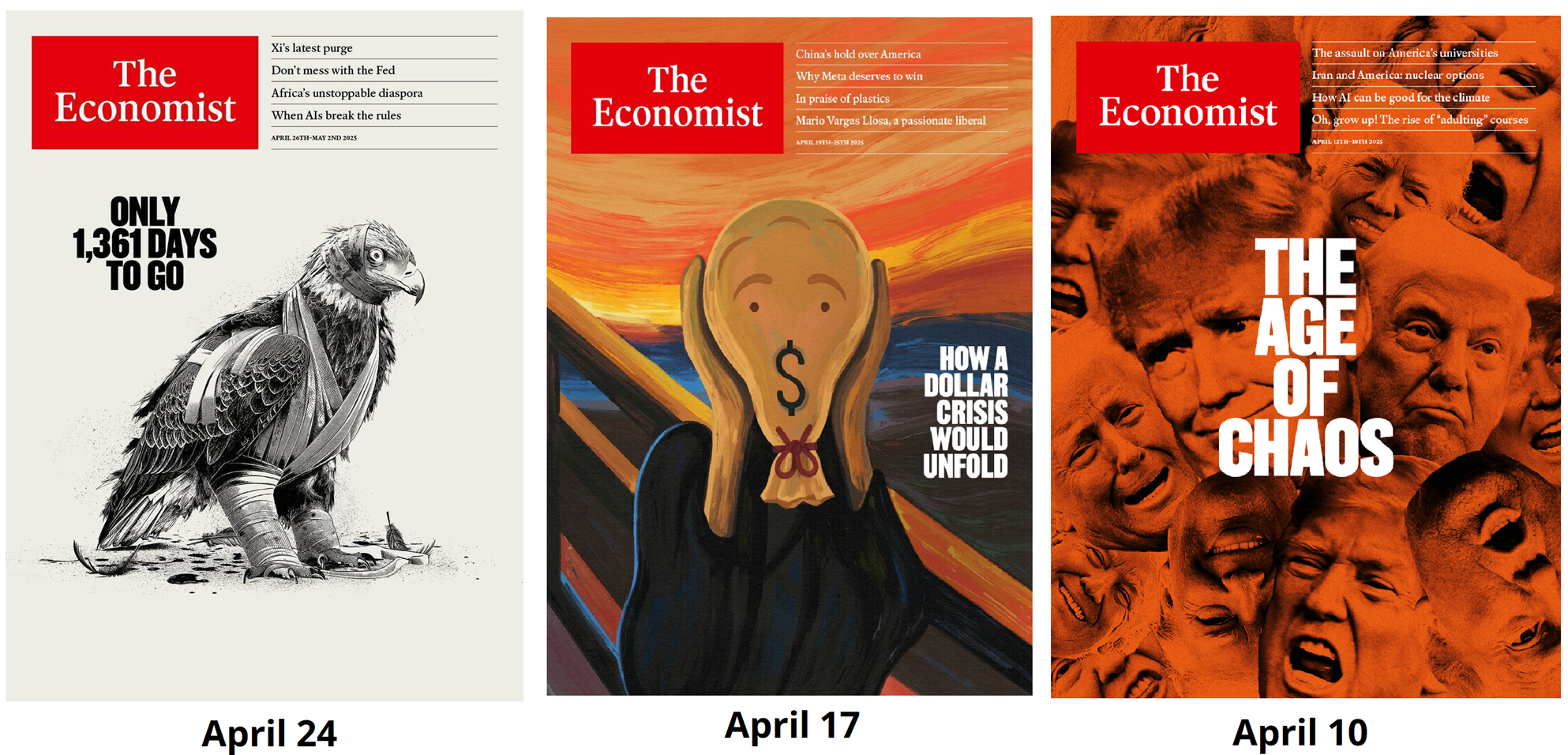

While my bigger picture view remains that we are at the front edge of a regime change towards a weaker USD, I would be remiss if I didn’t mention that The Economist has been piling onto the theme. Last week’s cover questioned how a dollar crisis might unfold. The one before that was titled “Age of Chaos”. This week’s cover shows a battered eagle.

If you are not familiar with the Magazine Cover Indicator, please read this explanatory article first. The gist is that studying all the The Economist covers back to 1997, they have a remarkable track record of picking the narrative and market extremes. Over a 1-year time horizon, investment returns from doing the opposite of the magazine covers has been stellar. This is not cherry picking and it has worked out of sample, in real time, since 2021.

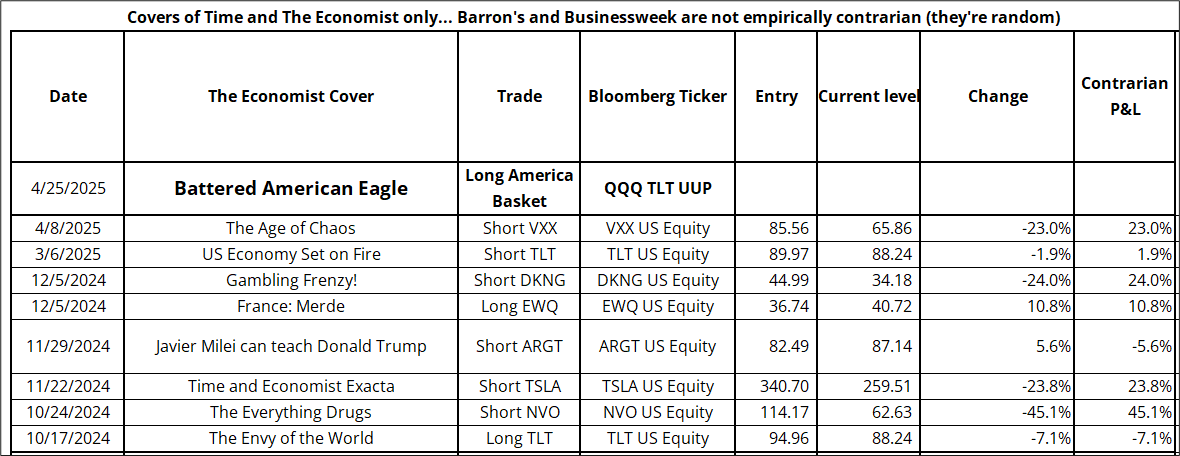

To keep things honest, I publish the trades in real time on Twitter, and the most recent was to sell VXX on April 6th when the Age of Chaos cover came out. Over the past six months, the signals are 6-for-8 with some massive wins and only tiny losses. Here are the trades:

While I said there is no cherry picking, I do have to make somewhat of a subjective call each time The Economist comes out. The criteria for choosing a cover were established when I first ran this study with Greg Marks in 2016:

Cover selection criteria

My ruling was that last week’s cover “How would a USD crisis unfold?” was not unequivocally making a statement on direction because it was posed as a question, and did not affirmatively suggest a dollar crisis is upon us. This week’s cover, showing a down and out, battered eagle, along with last week’s cover, which was close to a signal, but not quite, have me thinking that Magazine Cover Capital[1] should be long America.

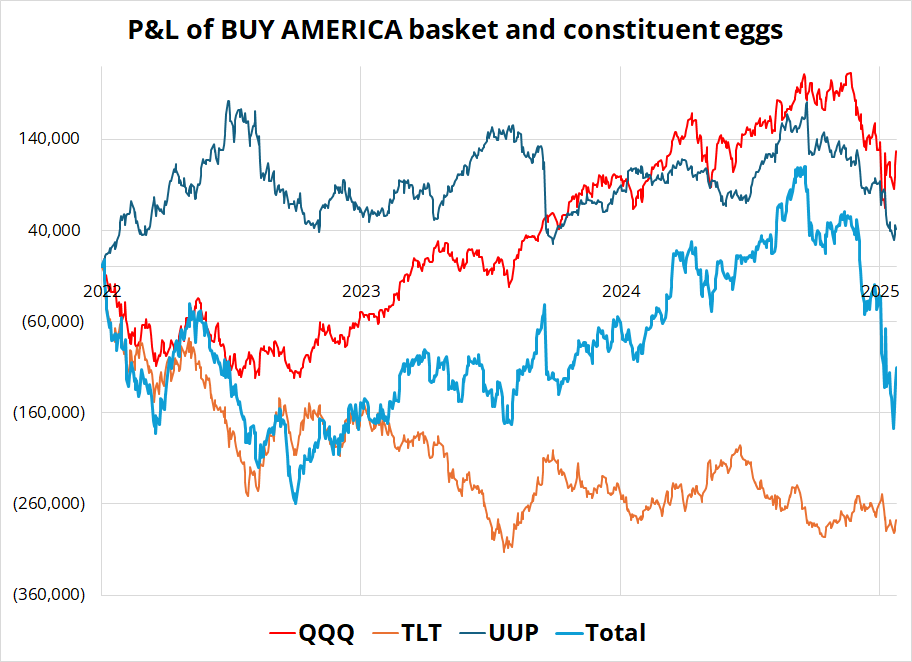

I suppose the simple trade would be long NASDAQ, but the real implication of the battered eagle cover and the lingering stench from last week’s dollar crisis cover is probably that we should create a BUY AMERICA basket of long NQ, TY, and USD. I will use QQQ, TLT, and UUP (three ETFs) because then I don’t have to worry about futures rolls or any other complications. There are sophisticated ways to vol-weight this structure using implied volatility, but I am going to use the simple way, which is to use a 3-year lookback that creates equal P&L for the three eggs in the basket. I normalized it so that the standard deviation of the daily P&L of the three trades = $10,000 and the STDEV of the daily P&L of the three legs is the same ($7,000). This means 1200 QQQ, 6300 TLT, and 42000 UUP. That sounds like a crazy ratio of UUP, but it trades at a low vol and a low notional price. That is UUP is a $28 ETF trading at 11 vols, while TLT is an $88 ETF trading at 15 vols and QQQ is a $467 ETF trading at 34 vols.

Here is the P&L of the basket and its constituents at those weights, back to the start of 2023.

That’s a lot of work for a trade that I don’t even agree with, but anyway—there it is! So Magazine Cover Capital goes long that basket. A huge flaw in the Magazine Cover Capital approach is that there is no stop loss or vol-weighting in the main spreadsheet, but the point is just to track the direction, not create a viable trading strategy. I looked into launching this as an ETF and then I could use proper trade structuring to profit from the direction, but there are a few issues:

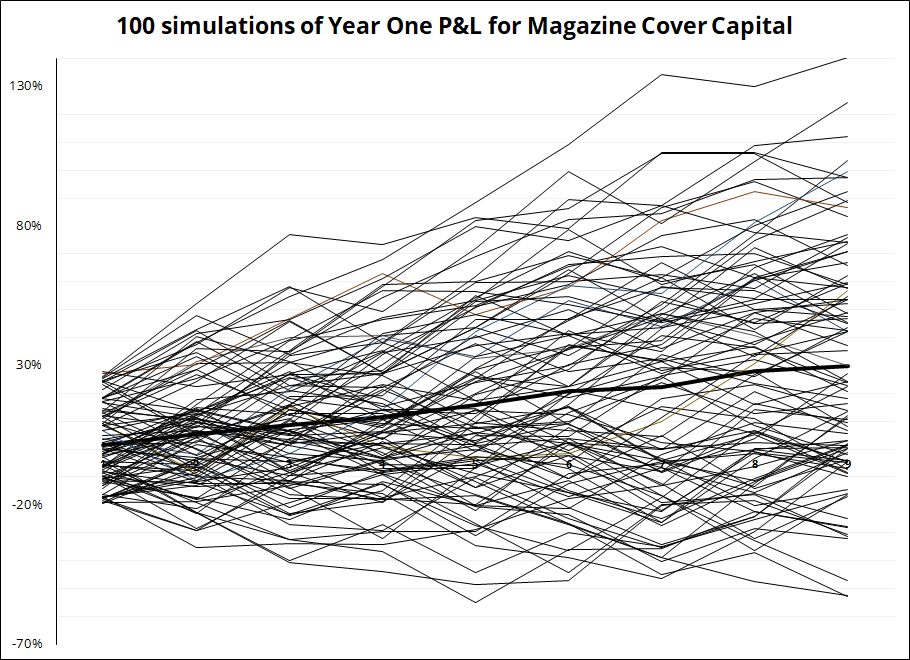

If you are curious about point 2 and variance, let me show you a simulation. If you assume a 61% win rate and average winning trade +15% and average loser of -9% (these are the real stats from the 2021 to 2025 period), and nine trades per year on average (again, that’s the real data). Then run 50 simulations of Year One. Here’s the distribution of outcomes.

So you can see that if you size it to target a 25% return for Year One on average, you still end up with sub-8% returns 25% of the time and sub-zero returns about 15% of the time. So that’s a 40% chance your ETF is going to suck wind, just simply due to variance. I am exaggerating a bit here because of course you don’t only have one year to prove yourself, but you don’t have much more. AUM is super path-dependent and Year One is the biggie.

![]()

Go Crystal Palace!

Have a lovely day.

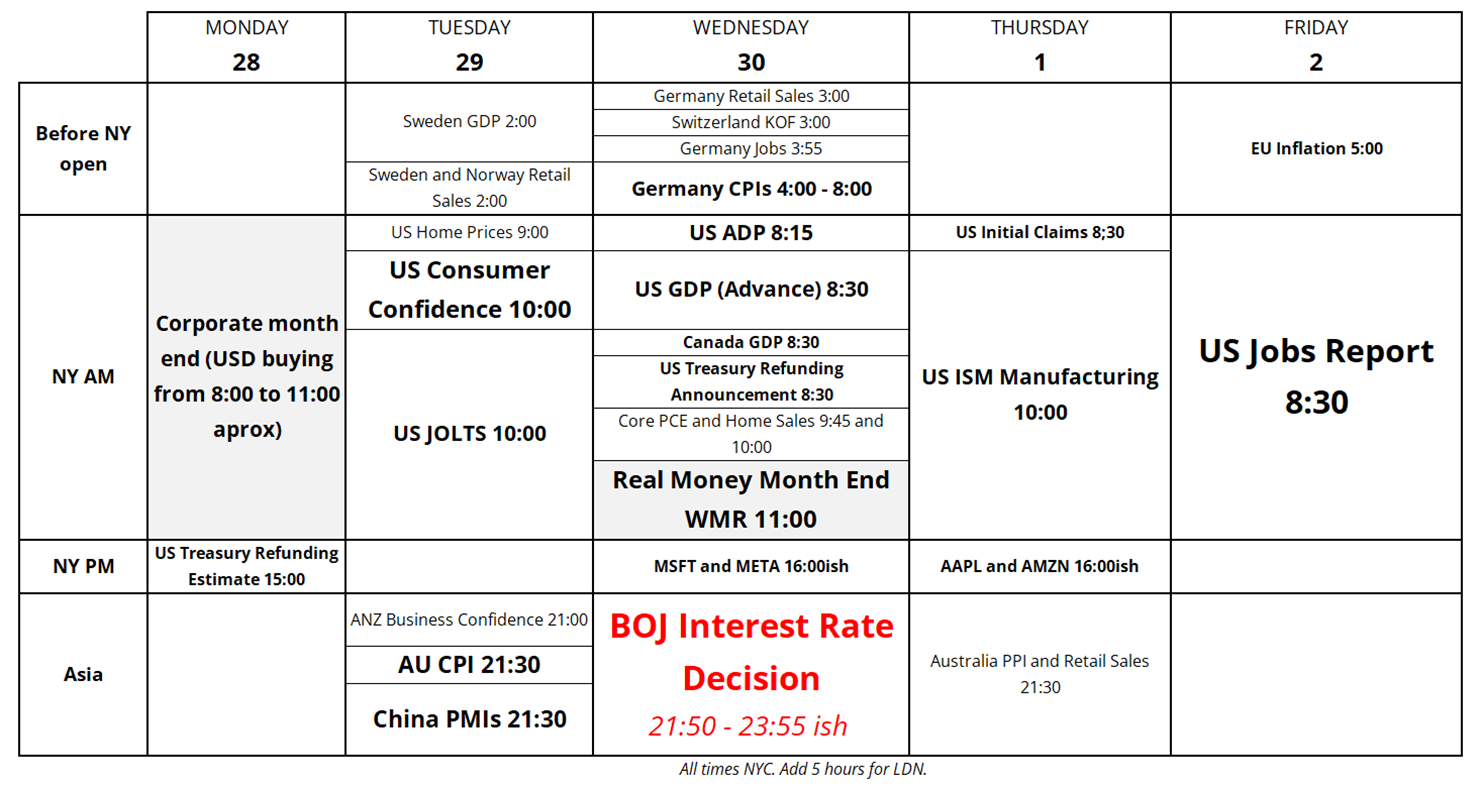

Next week’s calendar

A juicy week is in store. Get your red hot gamma deals from the vol experts down at Spectra FX Solutions!

Megacap Earnings Next Week

“Friday” comes from Old English “Frīgedæg”, which means “day of Frigg”. Here’s how it breaks down:

Frigg: A Norse goddess associated with love, marriage, and destiny. She was the wife of Odin and similar in some aspects to the Roman goddess Venus.

Dæg: Old English for “day”.

This matches the pattern seen in many European languages, where days of the week are named after planetary bodies or gods from mythology and Friday is named after the goddess of love.

Latin: dies Veneris (“day of Venus”)

French: vendredi / Italian: venerdì / Spanish: viernes

—

[1] Not a real hedge fund.

NASDAQ sharply unchanged in quiet trading this month.

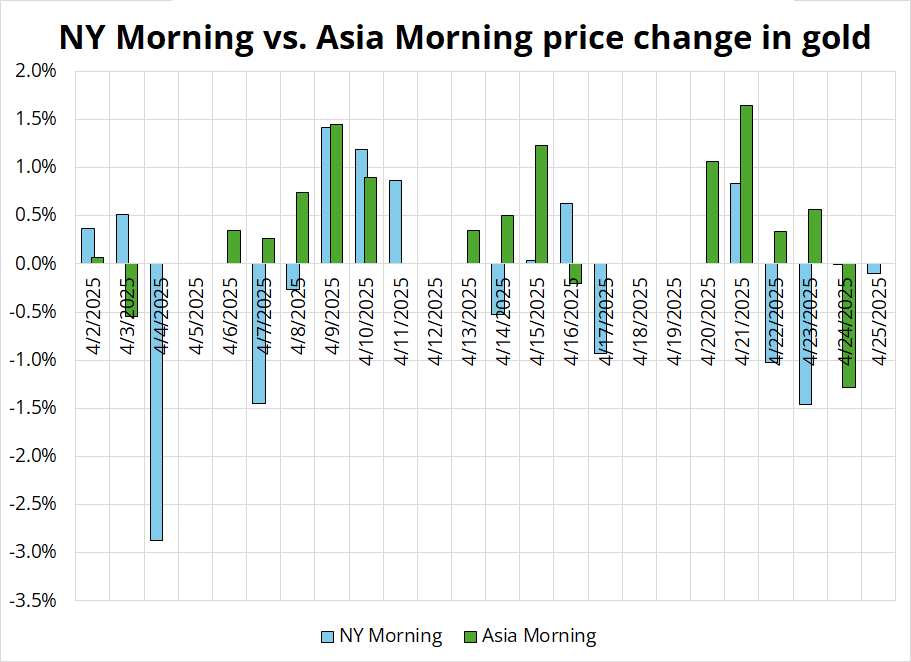

Time of day patterns in foreign exchange are surprisingly persistent and have never been more relevant.

The base case is obvious so it’s time to think about the alternative hypothesis