CPI will probably be 0.3, but if it’s 0.4: Buckle up.

Rollah Coastah

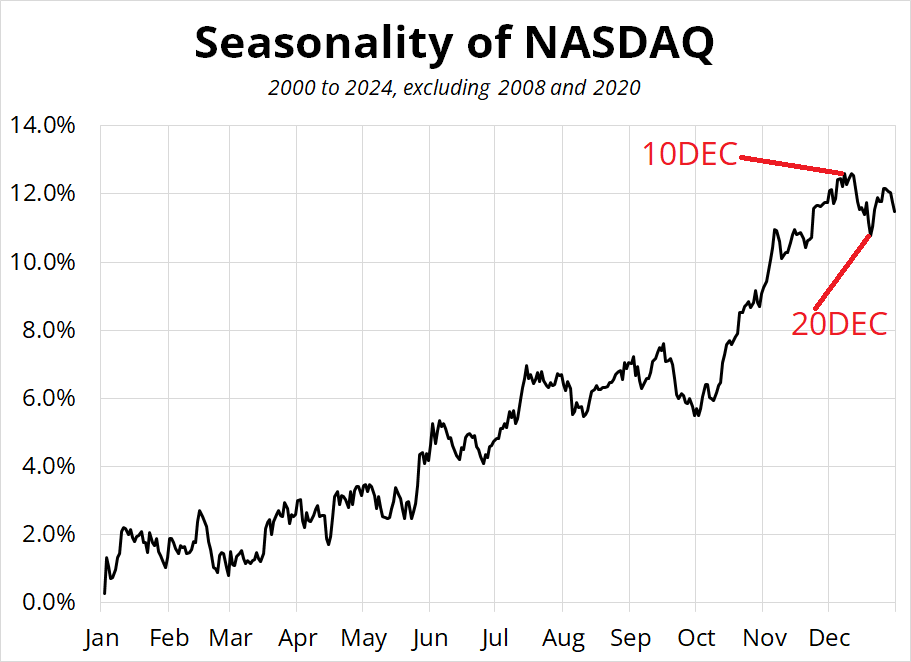

NASDAQ sharply unchanged in quiet trading this month.

CPI will probably be 0.3, but if it’s 0.4: Buckle up.

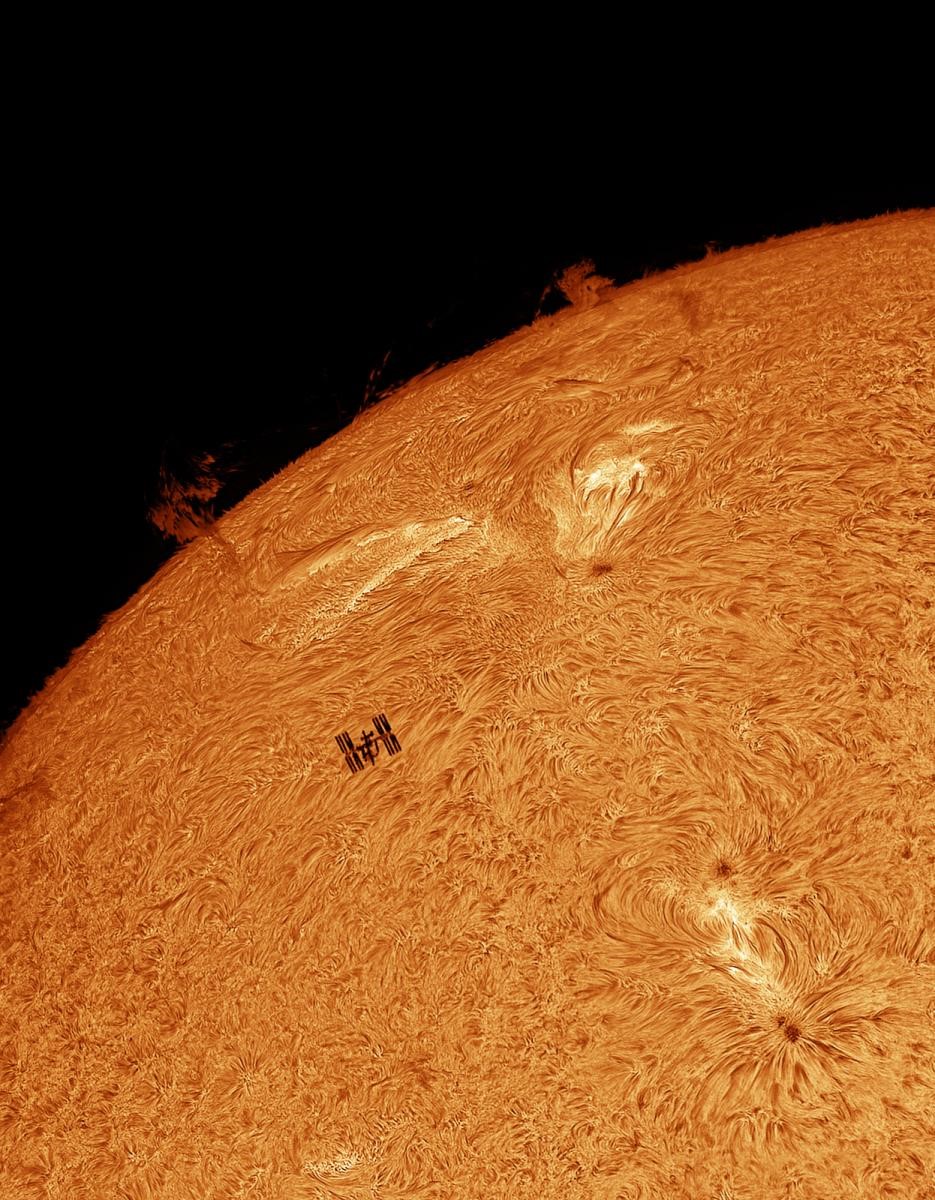

The International Space Station silhouetted against the backdrop of the Sun’s eastern solar limb.

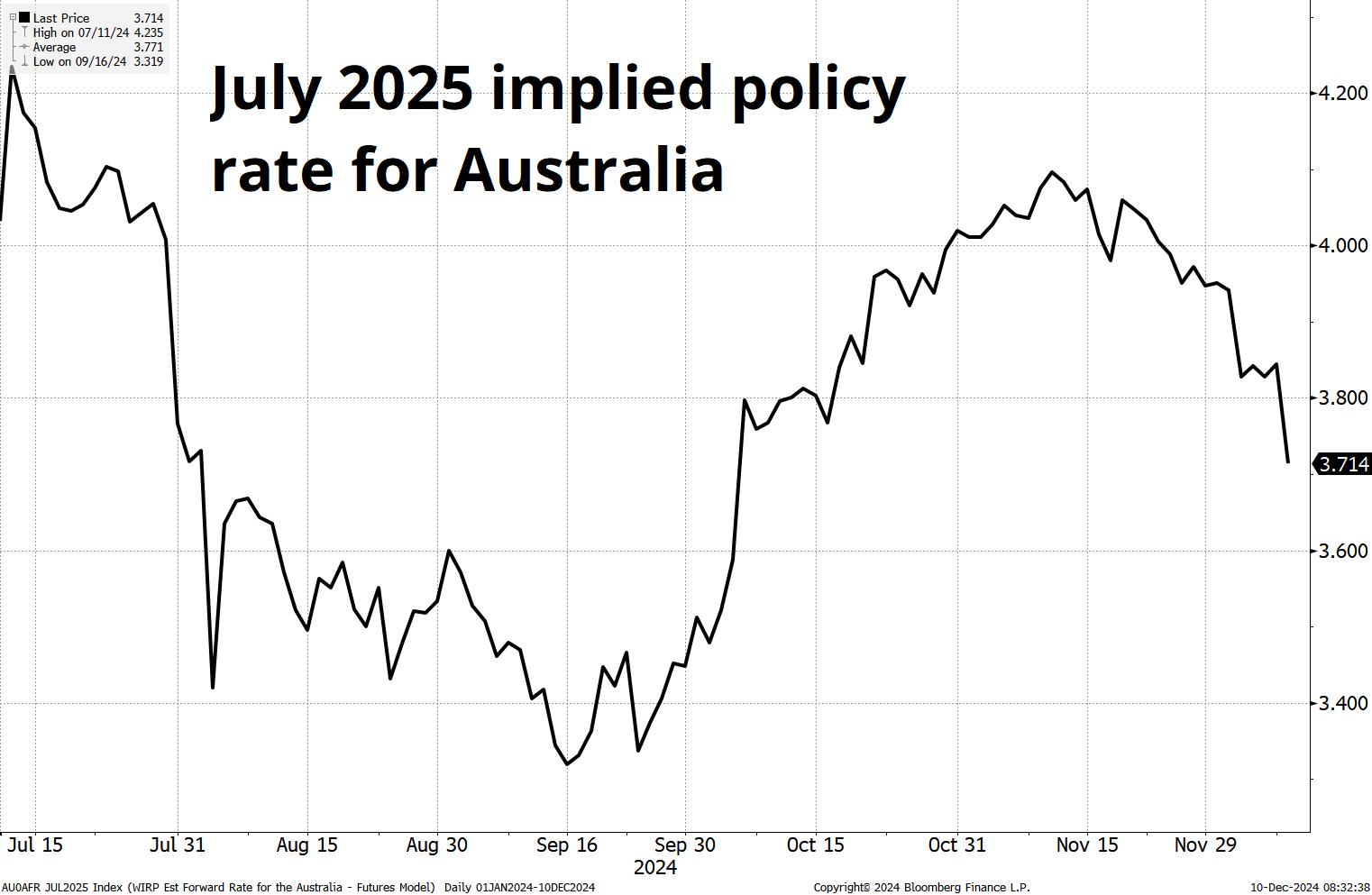

Sell AUDUSD on 0.4 CPI

Risk 60 pips to make 120

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Long EURSEK @ 11.54

Stop loss 11.3390

Flip short Friday at 11 a.m.

Tomorrow’s CPI data is huge, but only if we get 0.4s on the release. I wrote about this yesterday, and after the NY Fed Inflation Expectations Survey offers another data point suggesting inflation is getting sticky around 3%… I don’t think the Fed will cut if we get 0.4 on both Headline and Core tomorrow. Unfortunately, I don’t have any reason to think we will necessarily see such a high print, and I think the current Kalshi odds (25% or so) sound about right. So the base case is “as expected” and boring, but the 0.4 case is a barnburner. There are more than 100 estimates for Headline and Core MoM and exactly zero estimates of 0.4 for either. There are many 0.2s and zero 0.4s.

Given I don’t see any edge on the number itself, and given I think it’s of major importance… The trade is to buy USD and sell stocks on 0.4 and do nothing otherwise. We are entering a bad (brief) seasonal period for the NASDAQ.

You’ve got stocks priced for perfection and entering a risky seasonal period, crypto in a new bubblette, fixed income volatility in the gutter, and the Fed priced 86% for a cut that they have clearly said is conditional on jobs data that came in strong and a CPI that comes out tomorrow.

There is a lot of room for an epic move tomorrow. Nobody wants to sell any stocks or crypto until January 1st because of tax timing, but they might not have a choice. Buy USD and sell stocks on 0.4 tomorrow, trade idea in sidebar, acknowledging execution will be a challenge.

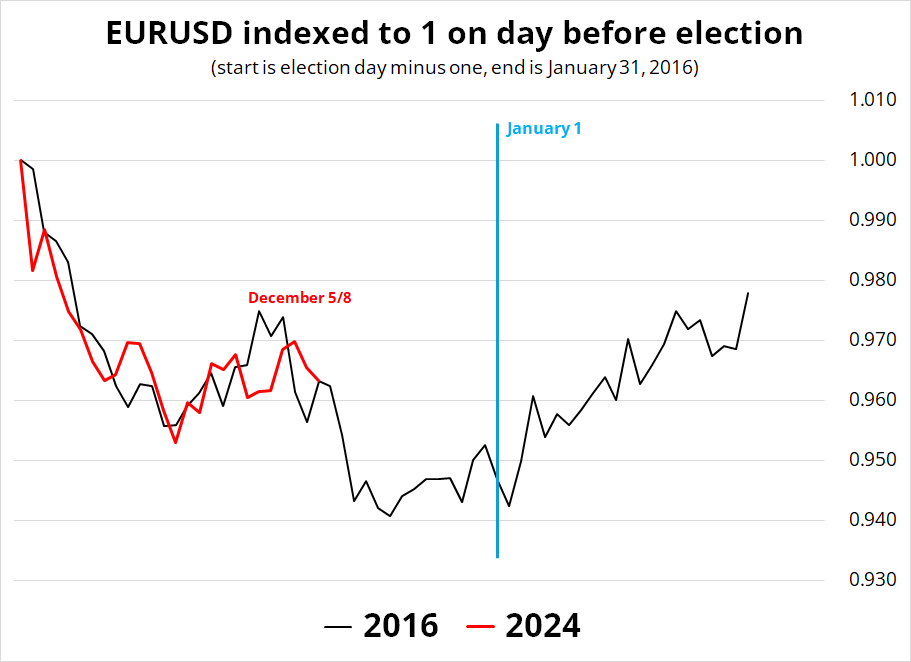

Note that while EURUSD has not exactly followed the 2016 playbook, it hasn’t really not followed it, either.

I am choosing AUDUSD over EURUSD simply because I think there is more open air below in AUD as the break of the August 0.6350 low should quickly open up an extension to the 2023 low of 0.6272 now that the RBA sounds dovish and the China story is too equity-centric to matter for Oz.

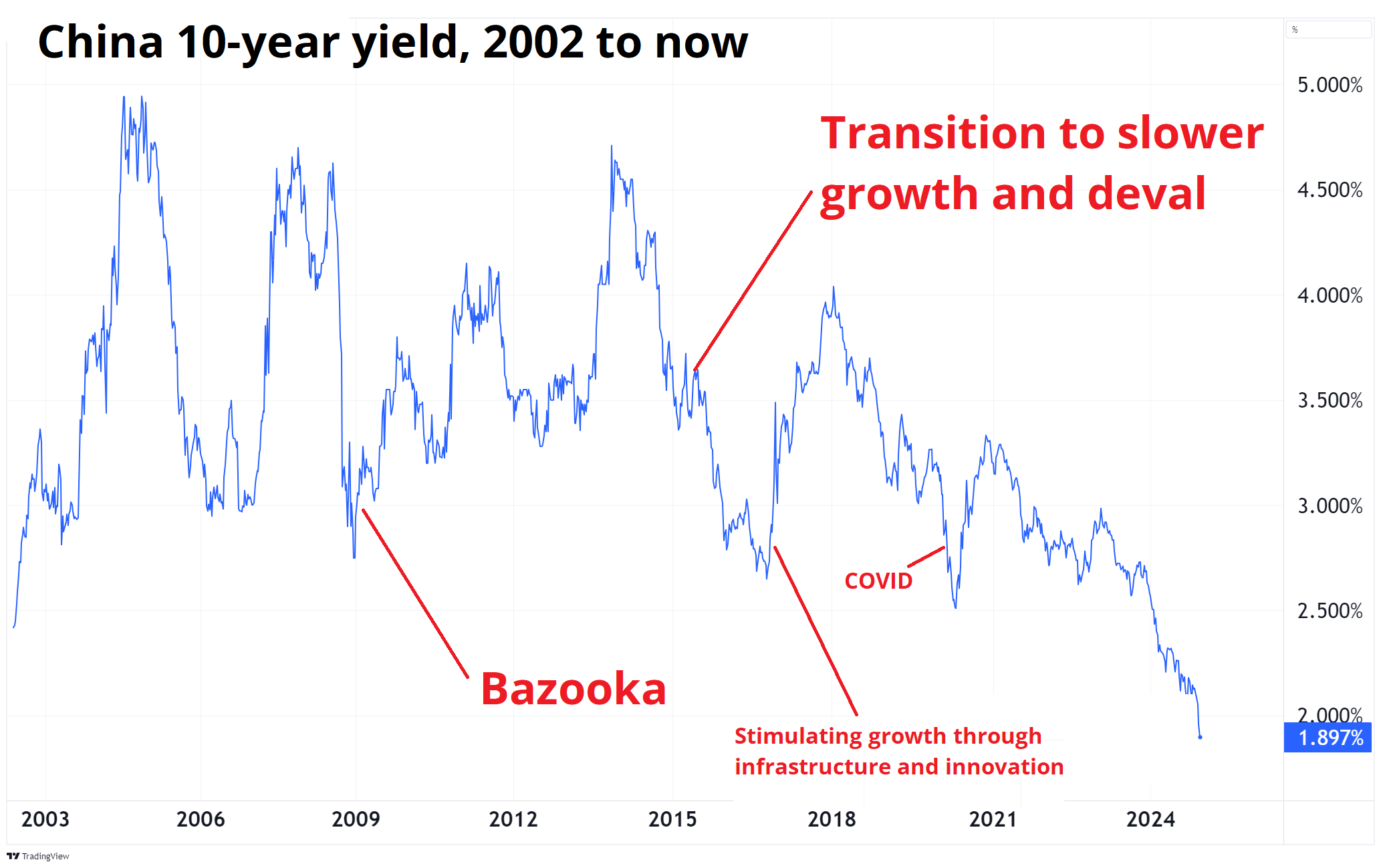

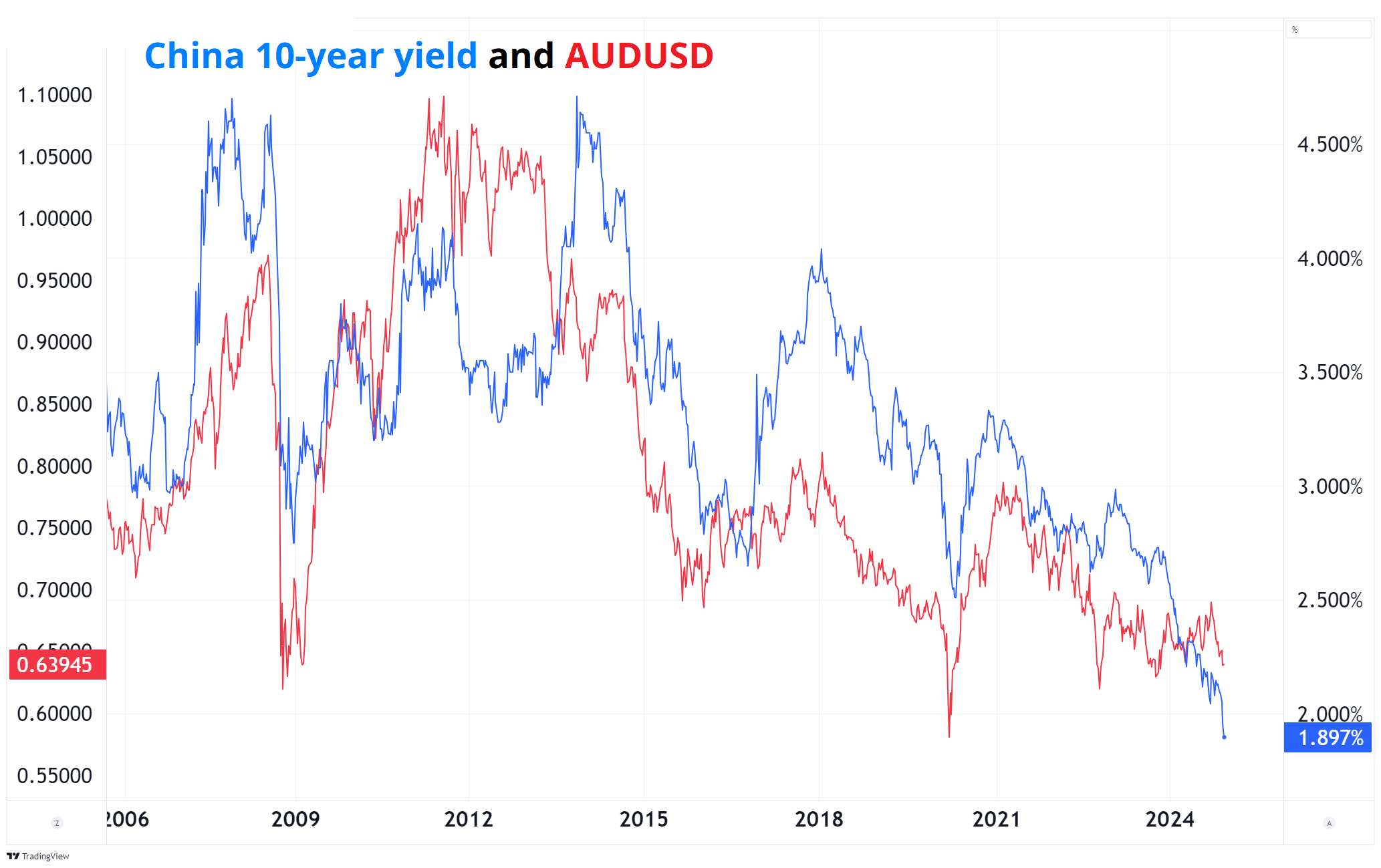

Chinese stocks are trying to recapture the September highs after the latest stimulus pronouncements, but if the real economy in China is actually expected to pick up, that should mean Chinese bond yields are going up, not down. In other words, if the Chinese authorities are embarking on a truly reflationary policy mix, not just looser monetary policy, the market will sell Chinese bonds. Right now, the market is still not selling Chinese bonds.

I would keep an eye on Chinese bonds more than stocks, because bonds are a better signal of reflation in China. This is because stocks are a central bank policy target and thus Goodhart’s Law applies. You can buy stocks because China is targeting stocks, but you can’t really buy AUDUSD unless China is actually reflating. While I would not recommend trading this correlation, it is worth observing that usually AUD goes up when Chinese yields are rising, and vice versa. Chinese deflation is not good for Australia.

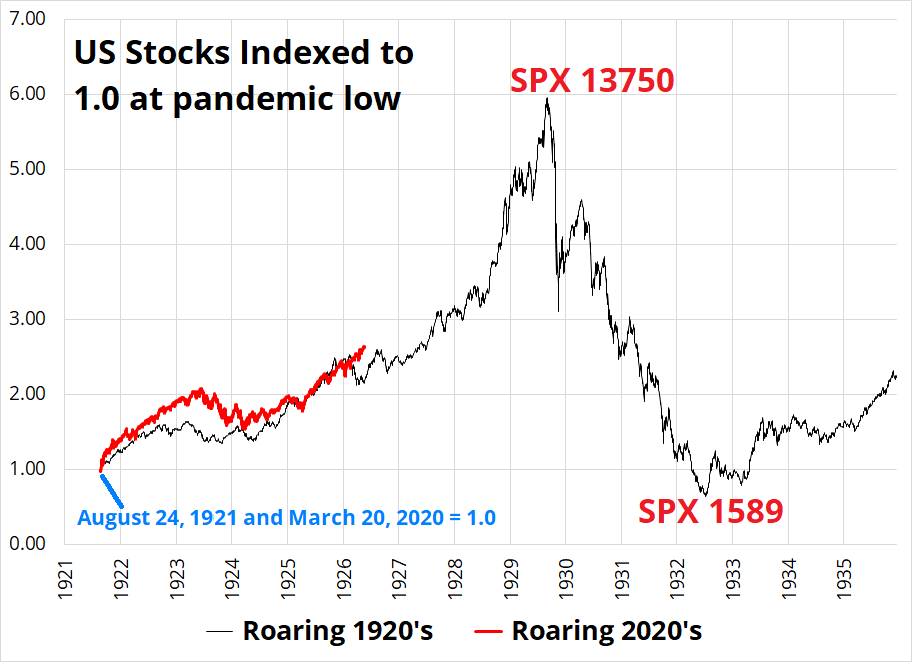

This last chart is dumb, but I could not resist.

Ed Yardeni has been pumping the Roaring 20’s thesis for ages, and his thesis has been pretty good! I think he’s the best elucidator of the bull case over the past couple of years and given there are always 100’s of bearish takes readily available everywhere and anywhere, I try to balance my information diet with a few bulls.

His thesis got me wondering what things would look like if we overlay the pandemic lows in 1921 with the pandemic lows in 2020. To see what a true repeat of the roaring 1920’s would be like this decade.

Not investment advice!

And if you want to read a good thought piece about the Great Depression and why univariate analysis is usually simple, easy-to-explain, and wrong, check out Scott Sumner’s piece here. The Spectra FX positioning report appears on the pages that follow. Have a sunny day.

Stasis

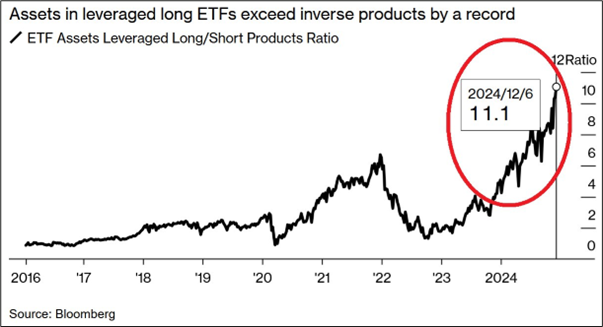

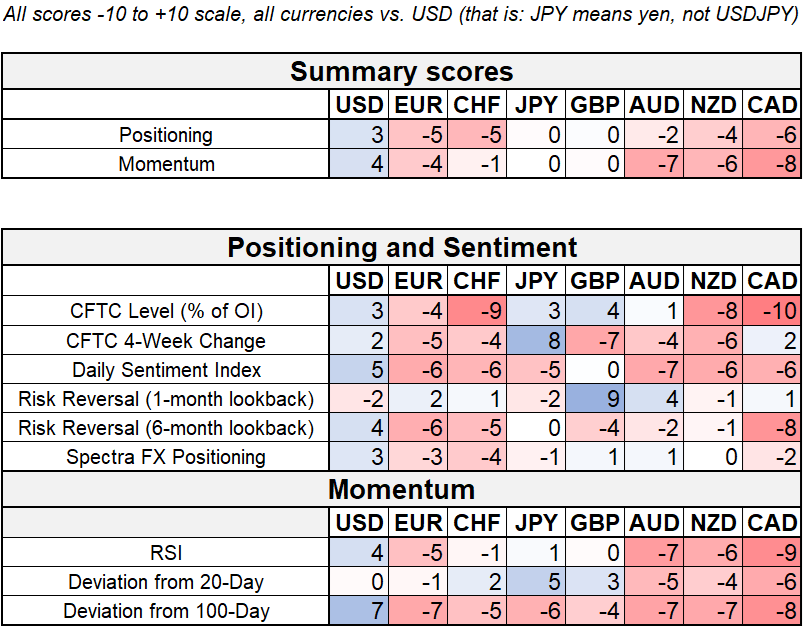

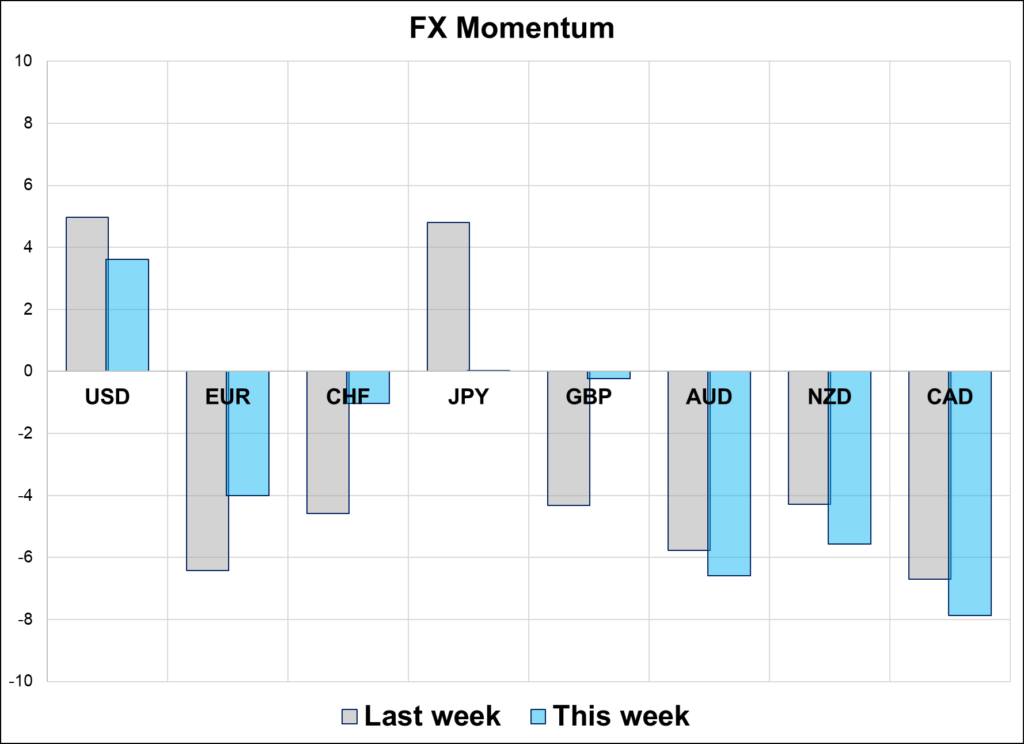

Hi. Welcome to this week’s report. Equity and fixed income vol have collapsed, but FX vol remains more elevated as the market views the tariff story as a clear and binary USD play. The market remains long USD, but not worrisomely so, as short EUR, CHF, and CAD are popular while JPY and GBP positions are more balanced. Every equity positioning metric in the world shows extreme bullishness, while measures of crypto length and leverage also look extended.

NASDAQ sharply unchanged in quiet trading this month.

It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

Time of day patterns in foreign exchange are surprisingly persistent and have never been more relevant.