Time to take a shot at tactical NQ shorts.

America, Heck Yea

I am not one to call every bull market a bubble, but this moment feels a tad Bubblicious™. Stocks only go up. TINA is alive.

Time to take a shot at tactical NQ shorts.

A thought-provoking paper from Jay Zagorsky that makes me wonder about confounding factors:

28JUN expiry

455 QQQ puts $2.90

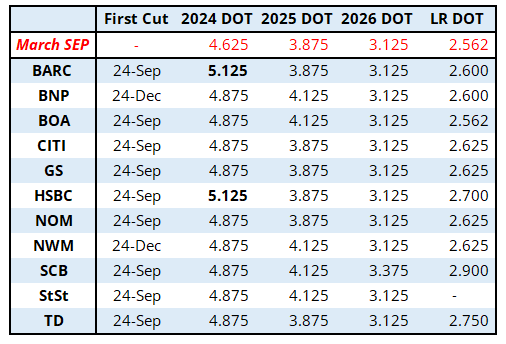

Interesting couple of days coming up with CPI presumed to be weak and then FOMC seeing some potential variance with 2 banks out of 11 we track calling for the median dot to go to just 1 cut with the other 9 banks expecting dots to show 2 cuts for 2024.

While the bar for me to be bearish equities is very high, the warning signs for equities are stacking up. I’m bearish now.

Tactics are tricky with CPI and FOMC coming out, so my view is either buy some wingy 2-week puts in NASDAQ or scale in to shorts before and after CPI with the idea that the market will sell the rally on a weak figure and sell hard on a strong figure. Or both. Not investment advice; please trade your own view.

This is a tactical correction view, looking for a quick move to 18,200 in NQ over the next week or two.

Here’s a quick FOMC Preview, courtesy of Adam Maltz.

The most interesting part of the FOMC could be the dots. You can see in that table that most banks are calling for 2 cuts in the dots, but Barclays and HSBC are calling for one. It’s going to be close with the median likely to be determined by a single (or maybe 2) votes.

The first move in Europe was to take France wider vs. Germany. It’s now at 67bps vs. 58bps yesterday and 48bps before the weekend. As long as Europe is selling French and peripheral debt, EUR will be capped.

Have a smarter-than-expected day.

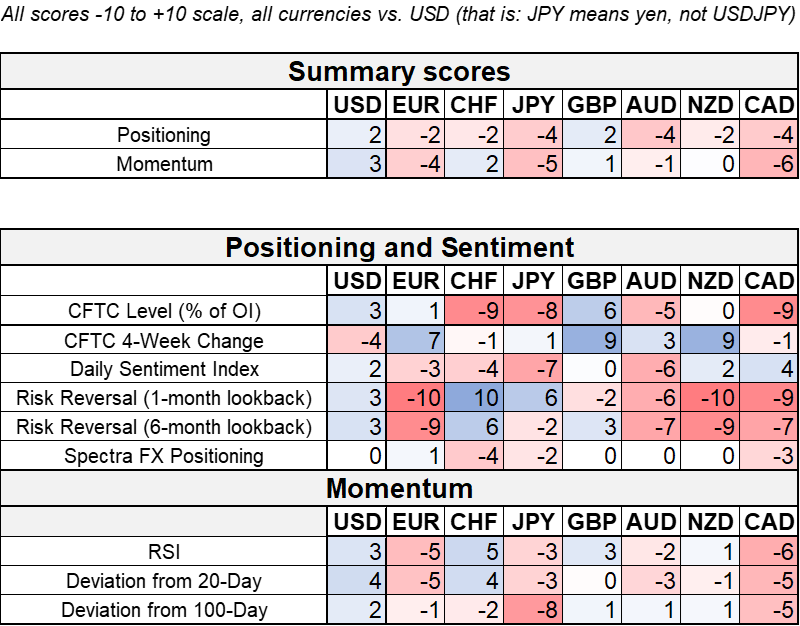

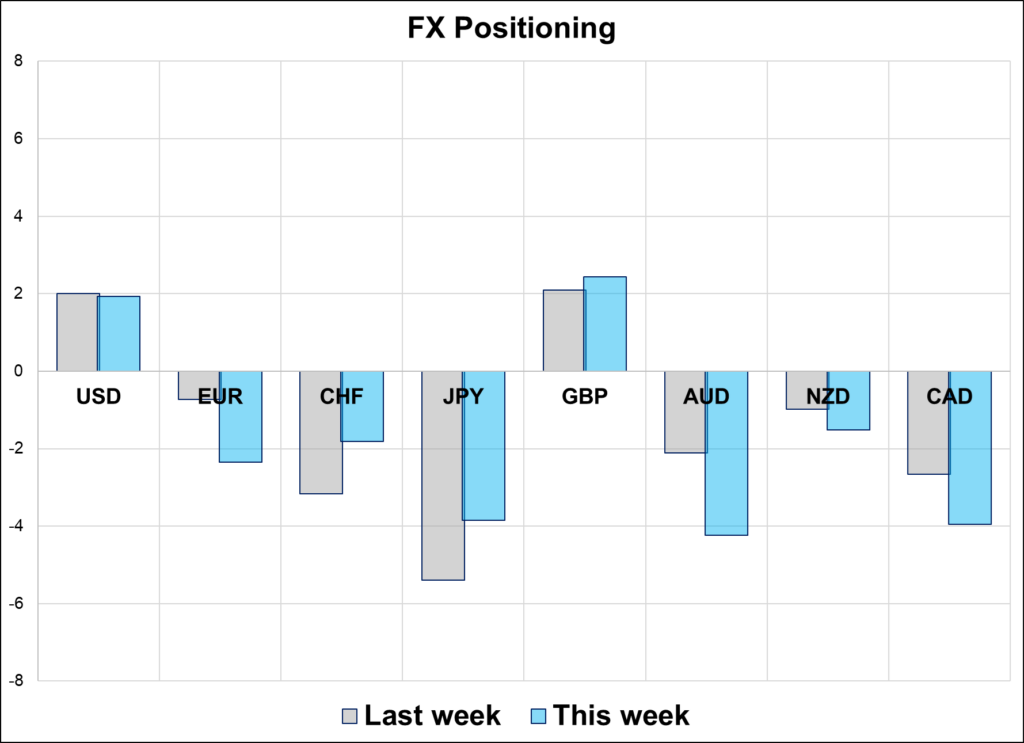

GBP Zags Again

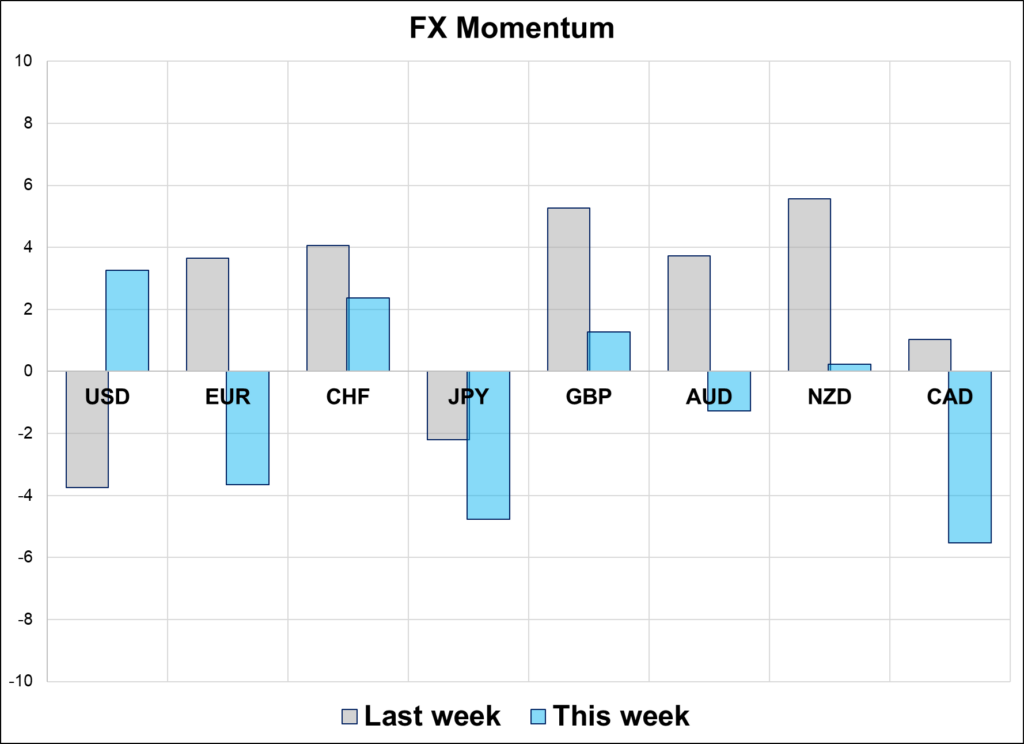

Hi. Welcome to this week’s report. The story in FX has been in EM carry as unwinds triggered by Mexican elections continue to ripple through various corners of the market. G10 Positioning has stabilized with the market sitting on medium-small shorts in the funding currencies, AUD, and CAD and longs in the USD and GBP. The CFTC has re-engaged long cable yet again.

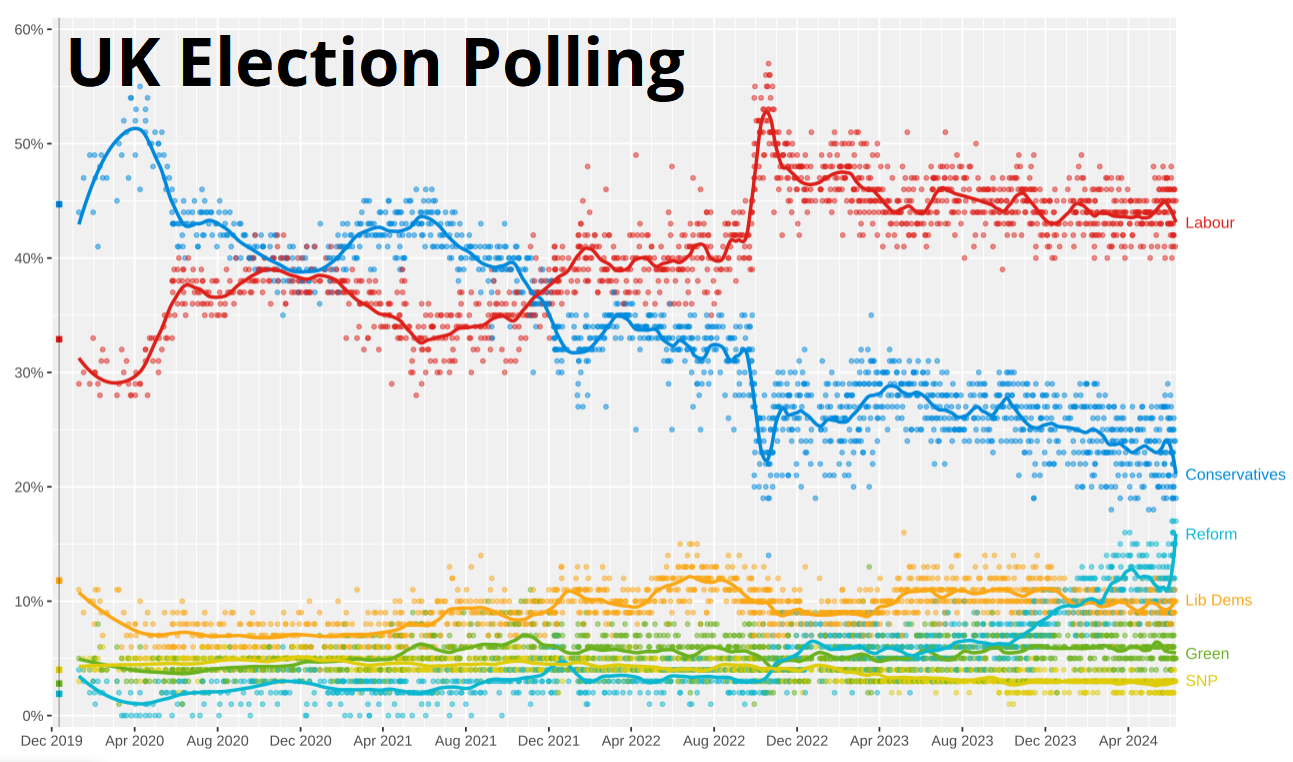

The CFTC has been chasing its tail in GBPUSD for two years, as the non-commercials were short at the lows in 2022 and then twice long at the highs in 2023/2024. After zigzagging from +55k to -20k to +55k and back to -29k… The CFTC has now zagged again, up from -29k short to +43k long in six weeks. That’s chunky: 5.7 billion pounds. This makes GBP an interesting short if the USD accelerates on a strong CPI.

The UK election has so far been classified as a nothingburger by markets. This presents a risk to the pound even as polls show a growing and insurmountable lead for Labour. Policy trial balloons and wonky headlines are a risk as the July 4 election nears, because there is very little premium in the options market, and nobody is on high alert for anything. Still, the 2022 Truss debacle is fresh enough in people’s minds that a few loose lips on fiscal could sink GBP.

Nothing to do in the pound right here, right now, but the conditions for a zippy move lower are in place if a positive US or bearish UK story were to take hold.

Finally, if US CPI were to come in super soft this week, there is a ton of ammunition on the sidelines waiting to get back into MXN and BRL. Our clients mostly believe those blowups are more about unwinding large carry positions after a VAR shock, and less about structurally-worse fundamentals in LATAM.

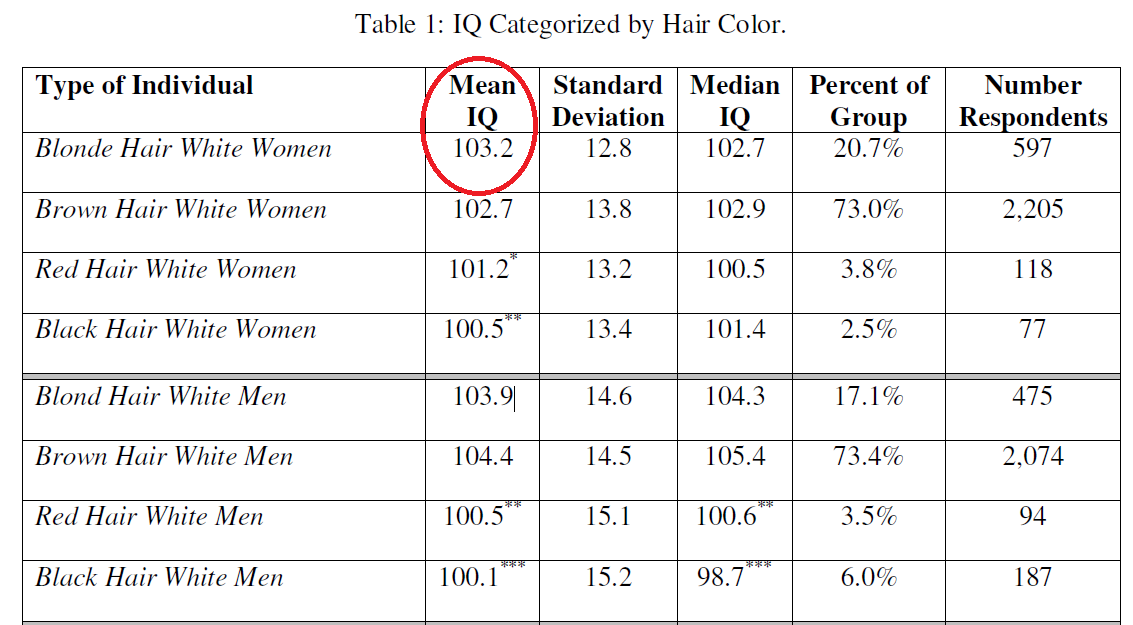

From: Are Blondes Really Dumb? By Jay L Zagorsky, Ohio State University.

This study is provocative. I would guess confounding variables here. Study’s author says:

Potential Explanation: Both heredity (nature) and environment (nurture) impact intelligence. Factors such as early childhood nutrition, alcohol usage during pregnancy, levels of lead in the environment as well as genes matter in determining a person’s IQ. Stanovich (1993) asked a provocative research question “Does reading make you smarter?” His affirmative answer suggests one possibility is that blondes grew up in home environments that provided more intellectual stimulation.

This particular hypothesis can be tested using three survey questions from the NLSY79’s first survey which determined if the respondent had access to reading materials. The interviewer first asked “When you were about 14 years old, do/did you or anyone else living with you get any magazines regularly?” The question was then repeated for access to newspapers and library cards.3 The results show that white, blonde women grew up in homes with more reading material than those with other hair color. It is important to note that this does not rule out other factors as the driving reason behind the IQ differences.

I am not one to call every bull market a bubble, but this moment feels a tad Bubblicious™. Stocks only go up. TINA is alive.

An announcement, CPI, and the GOAT on equity concentration.

Peripheral debt and EUR in the spotlight as memories of the Eurozone crisis bubble up.