Even a whiff of stagflation risk should make you concerned.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Even a whiff of stagflation risk should make you concerned.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Today’s global macro section is mostly excerpted from today’s am/FX, so if you are a subscriber you can skip to the next section. Thanks.

Things look a bit stagflationary. Commodity prices are going up (ex-oil), there are no eggs on the shelves, agricultural prices are at 10-year highs, and Prices Paid indexes in the regional Fed surveys all point to trouble. Meanwhile, government, the largest provider of employment in the post-COVID period, is being axed by DOGE and the surrounding ecosystems (defense, lobbying, and consulting) tremble in fear as they cling to a wobbling Leviathan.

In case you’re not familiar with it, Thomas Hobbes’ Leviathan (1651) uses the metaphor of the “Leviathan”—a powerful sea monster from the Bible—to represent the state. His claim is that society needs a strong, centralized authority to maintain order and prevent chaos. Hobbes argues that without government, humans exist in a “state of nature,” where life is “solitary, poor, nasty, brutish, and short” due to constant fear and conflict. To escape this, people form a social contract, surrendering some freedoms to a sovereign (the Leviathan) in exchange for security and order.

The Leviathan metaphor underscores Hobbes’ belief in strong, centralized authority as necessary for societal stability. This is the original cover of the book.

Anyhoo, as the Leviathan is torn down by billionaires, the collateral damage is that many $100k / year jobs in Washington, DC will be lost. In the long run, transferring energy away from government and into the private sector increases productivity, but in the short run (i.e., the next year or two, at least) it’s bad for growth. The handoff to more productive work takes time as the fired workers are not immediately re-employed into the workforce. In the meantime, confidence and spending fall.

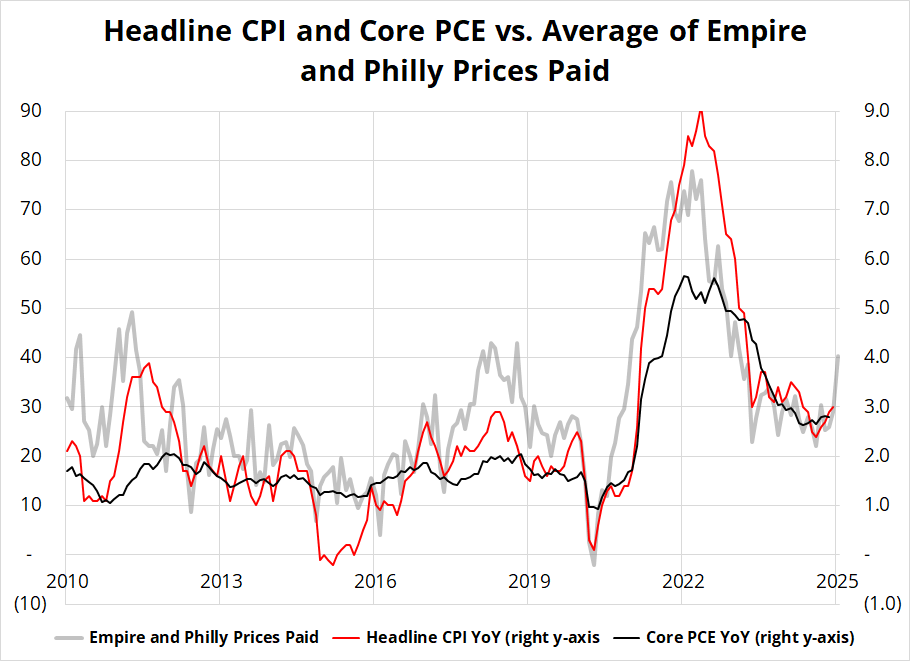

Rising inflation and rising unemployment are a rare pair. Take a look at the regional Fed surveys and Prices Paid vs. Core CPI and PCE. Here are a couple of charts. We’ve got limited February economic data so far, but the Prices Paid components of the regional Fed surveys are moderately alarming:

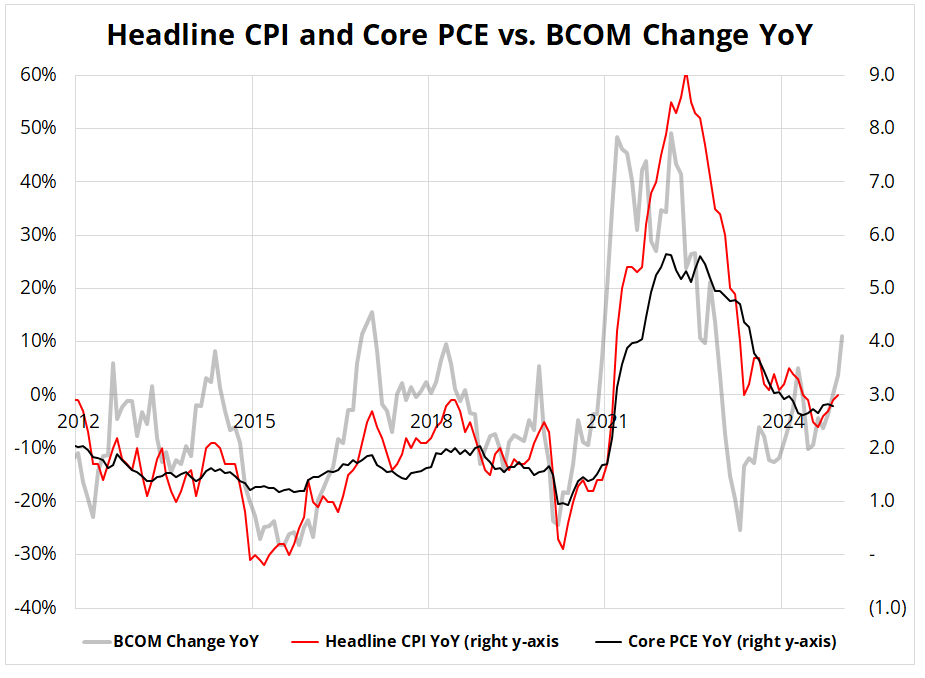

And here’s the same chart, subbing in BCOM instead of the Prices Paid measures. Obviously, this is mostly the same chart as the purchasing managers will be noticing the skyrocketing price of inputs and responding to the surveys with higher Prices Paid. That is, the Prices Paid indexes listen to BCOM.

But comparing the two charts does help confirm that inflation, which tends to be strong in February, generally, isn’t heading towards the Fed’s 2% target anytime soon. It’s probably going to move away from it.

And then this morning we got bad surveys (US S&P Services cratering, presumably as government policy uncertainty has spiked and investment is impossible with Trade Wars looming) and inflation expectations rise again in the Michigan Survey.

It all paints an ugly picture of slowing growth and rising inflation.

There are four years when the Unemployment Rate and CPI both rose. 1974, 1990, 2002, and 2009. You can ignore 2009 because that was a bullish year, the Unemployment Rate only rose due to the lags in the figure after Global Financial Crisis. The other three years saw SPX returns of -29.7%, -6.6%, and -23.4%.

If we get stagflation, it’s very bad for stocks. It’s still a big if, but it’s one worth considering. You have bad news on growth and bad news on jobs and bad news on inflation right now and I don’t see that newsflow improving anytime soon.

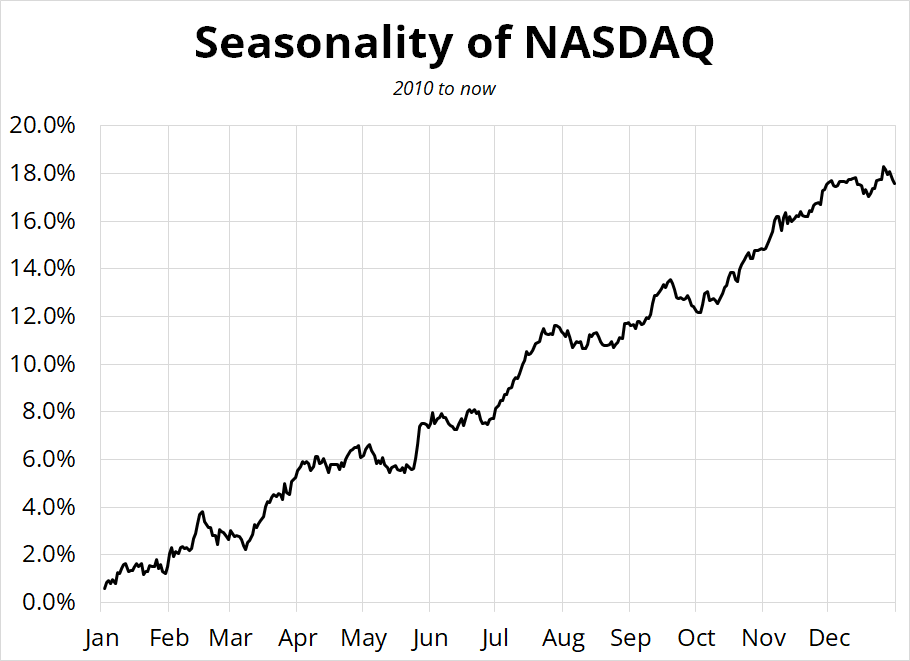

The main news in the stock market this week was the break in trend of many major stock market favorites. PLTR, WMT, and German equities, for example, all cracked after rallying for a billion weeks in a row. We are in a seasonally bad period for stocks and precious metals and these cracks in the popular stocks do not bode well for the broader market.

I very often write about the perils of being bearish the stock market, but hey, I’m bearish right now. Sometimes it makes sense to be bearish!

Look how far that bad boy is from the moving averages!

In global action, Chinese stocks got a boost from a meeting between Jack Ma, Xi Jinping, and some other tech execs. Much as TSLA and ORCL rose when Trump picked their bosses as winners, Chinese tech stocks do best when they have government support. The ensuing rally in BABA has been kind of mind boggling. Tepper wins again!

Next week, we get NVDA earnings. This week’s 14-word stock market summary:

Stagflation is incredibly bad for stocks. Trade wars ain’t great either. Seasonals also bad.

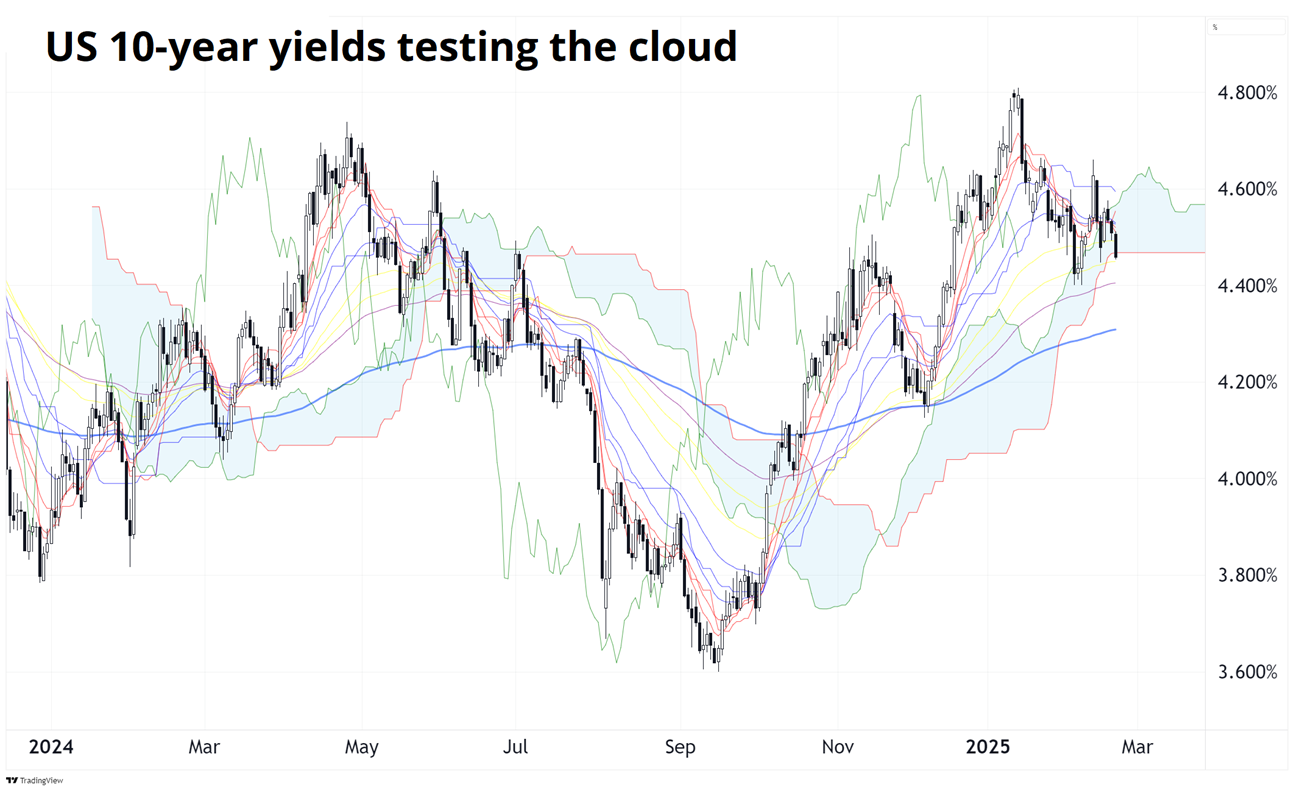

Yields are flying around and going nowhere as the upward pressure from inflationary worries is offset by downward pressure from worries about the economy. This will probably resolve to lower yields at some point, but it’s going to be messy as long as commodity prices stay up here. If commodity prices release to the downside, then yields should buckle massively.

10-year yields are testing the cloud and look ready to dump back towards 4.15%/4.20%.

Meanwhile, Japanese yields also broke their relentless up trend this week. Momentum in popular trades very often fades around week 6 of the year as the new year money has finally been fully-deployed and trends wilt. This is something I have back tested and it’s a real thing. Here’s a daily chart of Japanese 10-year yields for perspective on the might accelerating trend higher.

And here’s the hourly chart:

The market keeps trying to sell dollars, but the dollar doesn’t really want to go down. Even as positioning has cooled all the way off (from record long USD at the start of the year), EURUSD is barely changed in 2025. This is bullish for the dollar as the market has burned off the big USD long and continues to bandy about the Mar-A-Lago Accord silliness made popular by the same intellectuals calling for a Shanghai Accord and dedollarization in 2015, 2016, 2017, 2018, 2019, 2021, 2022, 2023, and 2024. If a Mar-A-Lago accord happens, there will be plenty of time to sell dollars. You don’t need to front-run the appearance of a unicorn.

FX trader reading Mar-A-Lago Accord headlines

The rebirth of European equities and the possible end of the war in Ukraine have created ebullient positioning in European turbo proxy currencies like PLN and SEK, so if you are long those, I’d be careful.

The company formerly known as MicroStrategy is struggling to raise money for the newer converts so it has sweetened the offerings and stopped buying bitcoin for a bit. You can read this as bullish (BTC didn’t go down) or bearish (the MSTR bitcoin buying flywheel is starting to clatter and throw off sparks).

The real story in crypto (other than the memecoin debacle) is the lack of movement. BTC has been 98k for three months. ETH has been either side of 3k for a year.

It is a near-truism that when assets become popular, mainstream, and large, their volatility drops. Bitcoin is extremely popular, totally mainstream, and huge.

I have been accused of being a gold permabear and the accusation isn’t far off the mark but my real bias is more that I like to sell high and buy low. Many people make money by buying high and selling higher, and that’s a valid strategy, I’m just not as good at that. One of my best calls ever was a three-year view to buy silver at $14 in 2020. Fun fact, silver is barely higher than where it peaked in August 2020, though. Silver is not goooooold.

Anyway, I’m not being defensive—you’re being defensive!

I don’t sit here short gold all the time. I identify times when I think it’s vulnerable to a reversal and I take my shot. I am doing that right now. Short gold with a stop at 3011.

As mentioned, there is a phenomenon I have seen year after year and back tested multiple times where the most popular new year momentum trades tend to run out of gas around week 6. This happens because new money floods into the market on January 1 and that money is logically deployed in the trades that look most attractive. And huge passive flows at the start of the year boost liquidity and all asset prices. Then, around mid-February, the liquidity surge dries up, stocks and gold underperform for a few weeks, and the most popular momo trades reverse.

We are starting to see that with PLTR, HIMS, and WMT and I suspect you can go down the list of what’s hot and wonder if those trades are next. Gold, European equities, and long rest of world / underweight USA come to mind. Gold is particularly interesting as Bessent quashed the Gillian Tett gold revaluation meme with a clear statement this week:

*BESSENT: REVALUING GOLD RESERVES ‘NOT WHAT I HAD IN MIND’

A big part of the bullish gold thesis was out of control government spending and it’s hard to argue that thesis is as valid today as it was two months ago. Even if the G and the E in DOGE probably stand for “Gross Exaggeration,” Hegseth’s comments on defense show that even the sacred cows like Defense, Medicare, and Social Security could be on the table for cuts. Short gold with a stop at 3011 and take profit at 2805 makes sense to me as momentum trades reverse, the reval story looks midwit, and US deficits are less obviously going to balloon going forward.

Another way to trade short gold is via the 3X short gold producers ETF (GDXD). The gold producers underperform on the way up and they underperform on the way down. That’s just the rules!

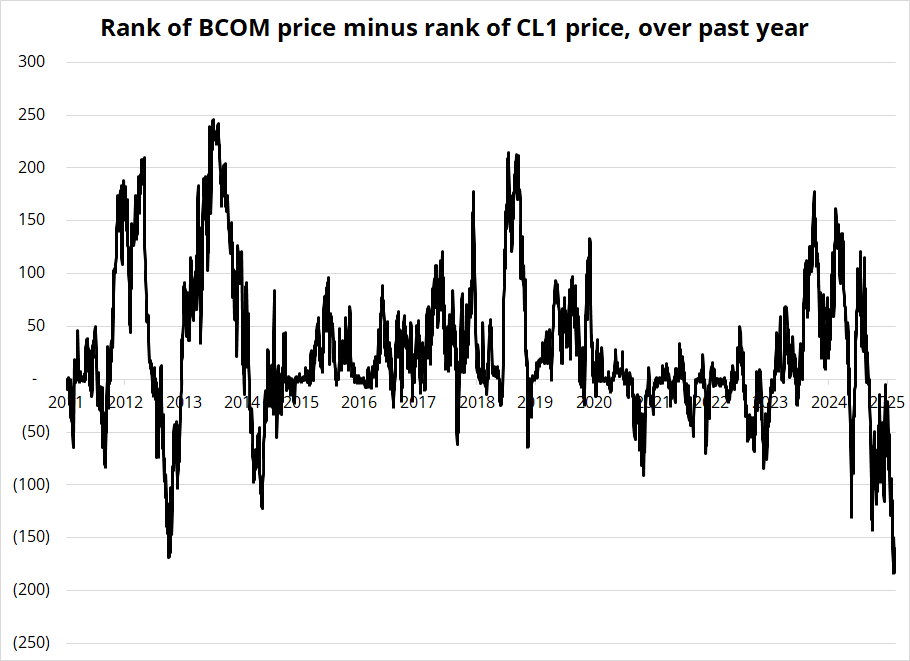

Brad Wishak pointed out to me that commodities are experiencing strange divergence as oil trades horrible and BCOM is at the highs. That’s unusual as you can see here.

The chart takes the rank of where BCOM has been over the past year and subtracts the rank of where the price of oil is. Right now, BCOM is 1 (highest price in the past year) while oil is 161. That is unusual!

In today’s am/FX, which you can read for free right here because it’s a free day today, I expound further on the possible implications of a commodity rally that leaves oil behind.

That’s it for this week.

Get rich or have fun trying.

Conway’s Game of Life (press play on the black grid video)

*************

*************

Claude AI doing God’s work here.

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

New Year momentum trades often lose their mojo around mid-February.