Trump has returned but the actual vs. presumed policy mix is yet to be seen.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Trump has returned but the actual vs. presumed policy mix is yet to be seen.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

Here’s what you need to know about markets and macro this week

Don’t forget to listen to the podcast this week!

Oh boy. Quite a week. Unfortunately, my view that polling errors are not autocorrelated was one of the worst calls I have made in the past 20 years.

Fortunately, my memory is like:

As a trader and speculator, it’s important to have a short memory. Once a trade is done, you draw any possible lessons from it right away, then move on. Don’t think about it too much or you will drive yourself crazy. Traders that buy at 8, take profit at 10 then spend two weeks cursing themselves as it goes to 20 are doing it wrong. Do your thing, stick to your process, follow your rules, and don’t obsess over missed opportunities. Every trade is a drop of water in an infinite ocean.

So yeah, Trump won. You probably heard.

Now the question is what it means for global markets, and perhaps more importantly: When does it mean what it means? Calling the tariffs and fiscal juice right in 2016 only made money for about a month, and then everything reversed for two years before the trade actually worked again.

There is a big difference between the announcement effect and the policy effect when a central bank or government takes an action. Generally, you can split the two out pretty cleanly. For example, I would say about 85% of the impact of QE comes from the announcement effect. The actual QE or QT flows are barely relevant. Bonds usually go down during QE and stocks have gone up during QT. The important aspect of QE is the signal, not the flow.

With economic policy, it can be the same thing. The problem speculators face right now is that we aren’t even at the announcement effect phase yet. We are at the “guessing what the announcement is going to be” effect. For example, with tariffs, you have the market guessing that tariffs are coming, but in Trump 1, the tariffs didn’t come until Spring of 2018. So how can you position for tariffs now and hold on until Spring 2026? You can’t. So, if you’re on that trade, you’re hoping for some tweets, or for Kyle Bass to be appointed as Treasury Secretary or something.

Now, the question is: What will policy actually look like, and when will we have some visibility? The nominations of Steve Mnuchin (2016) and Janet Yellen (2020) to treasury both came on the 30th of November, immediately after the election. Geithner was nominated November 24, 2008. Secretary of State and Treasury Secretary are generally the first two announcements. The hearings take place in January and confirmation is shortly after, depending on how that goes.

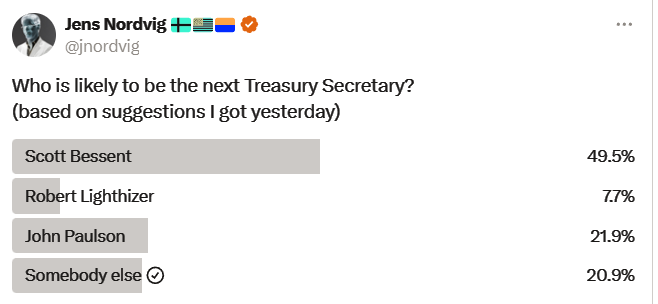

The front runners for Treasury Secretary are:

Scott Bessent, Key Square founder, current adviser to the Trump Campaign. He advocates targeting 3% growth, 3% deficit/GDP, and a domestic energy production increase of 3 million barrels per day (currently 21 mio).

John Paulson, another hedge fund manager. Advocates tax cuts, deregulation, lower government spending, and targeted tariffs.

Robert Lighthizer, USTR for Trump’s first term. Strong advocate of tariffs and skeptic on trade. Helped renegotiate NAFTA and spearhead China tariffs.

Some dark horse candidates are Jamie Dimon, Howard Lutnick, Jay Clayton, Bill Hagert, and Larry Kudlow.

A possible important disconnect between the pre-election forecasts and the rhetoric is that Trump was viewed as the gigantic deficits guy (7T vs. 3.5T for Harris), but the rhetoric and policy lean has some theoretical elements of debt reduction. Sure, these are pie in the sky, contradictory concepts (cut taxes, and reduce deficits) but one of the first things Trump said in his victory speech was:

We’re gonna be paying down debt. We’re gonna be reducing taxes. We have, we can do things that nobody else can do. Nobody else is gonna be able to do it. China doesn’t have what we have. Nobody has what we have.

Installing Elon Musk as some sort of “Department of Government Efficiency” czar has also been floated, and both Musk and Trump have strong admiration for Javier Milei’s approach in Argentina. If you look at what’s happening in Argentina, or what Musk did with Twitter (immediately cut the workforce by 80%)… There is a hallucinatory scenario where taxes are cut, government efficiency is dramatically increased via job cuts and restructuring, and deficits stabilize. Given how I view gold as the release valve for deficits in the post-2008 world, maybe this is why gold cratered yesterday? Maybe the view that Trump will massively expand the deficit is wrong?

Don’t get mad at me for saying this. I’m just saying maybe. I realize that history does not support the idea, but then again, a lot has changed since 2017. Politicians have been shown how inflation is the death knell for whatever party is in power when it happens. Maybe this administration will be more careful and methodical than people think, and we are past peak MMT? Something to think about.

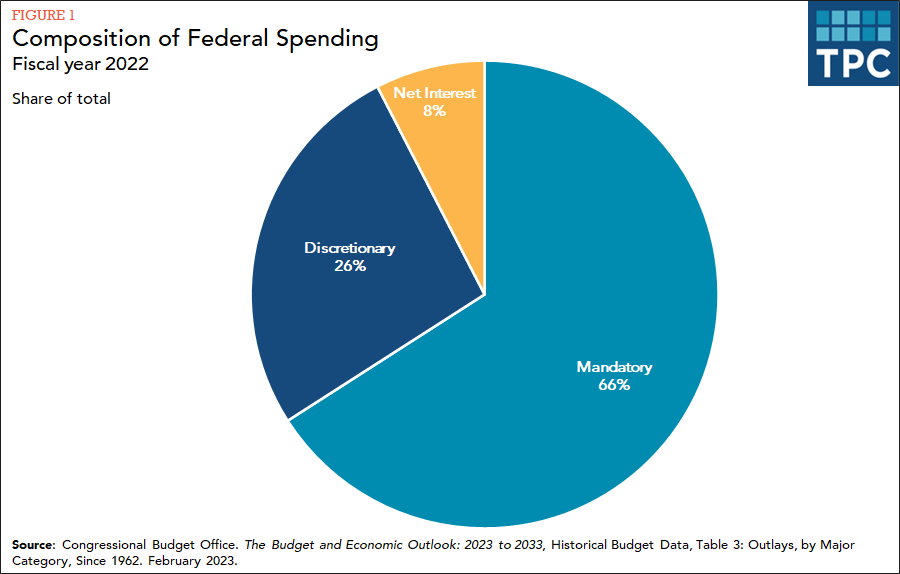

The biggest problem with this view is that most government spending is not discretionary. But some of it is.

Anyway, if the market decides that maybe deficits are not going to increase as much as initially expected, that would take the upward pressure off yields and keep gold heavy.

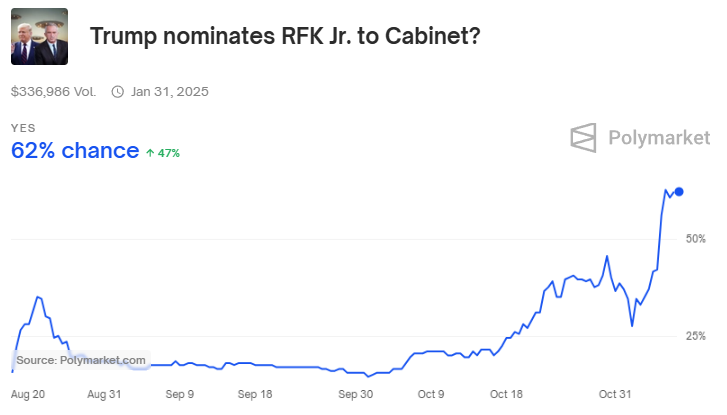

And finally, note that RFK Jr. got a long shout out in the Trump victory speech and his odds of taking over US Health care services are rising.

Don’t forget to buy the 2025 Spectra Markets Trader Handbook and Almanac here.

S&P 6000. Amazing. The NASDAQ, which traded down to 6,500 during the COVID panic, is now 21,000. America, heck yeah. The ratio of US equities to non-US equities has gone from 4.0 in 2010 to 16.7.

Retail is all in, but the post-election response has been for CTAs, which were underweight due to high volatility expectations through the election, to pile back in like mad. My persistently sarcastic questioning of “what could possibly go wrong?” has been answered with an empathic: NOTHING!

Soft landing, still near full employment, tax cuts, deregulation, and more. Stock market Nirvana has been attained. Funny enough, the reactions to this election have been the exact opposite to the 2016 reactions. The bears are dead and life is good. The selloffs in 2008 and 2020 now look like blips on a linear chart of any index. The NASDAQ traded to 1,045 in 2008 and is now 21,000.

Next week, we get CPI, which should not be a major event.

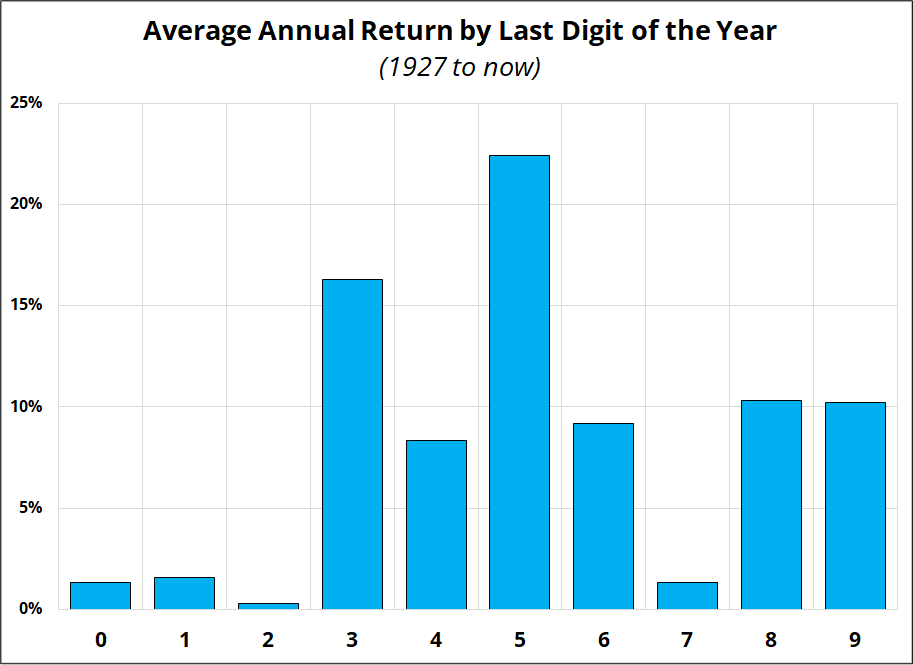

Numerology Corner

You know how towards the end of the year, you start to feel more optimistic because a new year is coming? Even though you know it’s arbitrary, you feel some sort of optimism that maybe next year will be better than the last. Then, once the new year gets going, you return to baseline because you see that the arbitrary turn of the calendar did not actually change much, and things are kind of like they were before?

This is the theory behind the decennial cycle in stocks. People are optimistic as the decade ends (1989 Berlin Wall fell, 1999 dotcom bubble, 2009 end of GFC, etc.) but then are disappointed in the new decade (2000 dot bomb, 2010 Eurozone Crisis, 2020 COVID, etc.) Once the dust settles after the start of the decade disappointment, stocks can rally again.

This is not the kind of theory I would present in an institutional finance writeup, but we’re all friends here so we can talk about this stuff without judgment. Anyway, years ending 5 are particularly good over the past 100 years.

I chopped up the chart to show the progression in the order of how it happens …

This is dumb. But it’s kind of neat. But it’s dumb. I think. I am having a lot of trouble being bullish here as I just feel like everything in everywhereland is priced for perfection. But I can’t really see any reason to be short. “It’s gone up a lot and it’s priced for perfection” is a really bad thesis for equity shorts. Then again, it’s not a bad reason to go from 60/40 to 40/60 in your retirement account. Be fearful when others are greedy and all that.

This week’s 14-word stock market summary:

The NASDAQ is above twenty-one thousand. Wow.

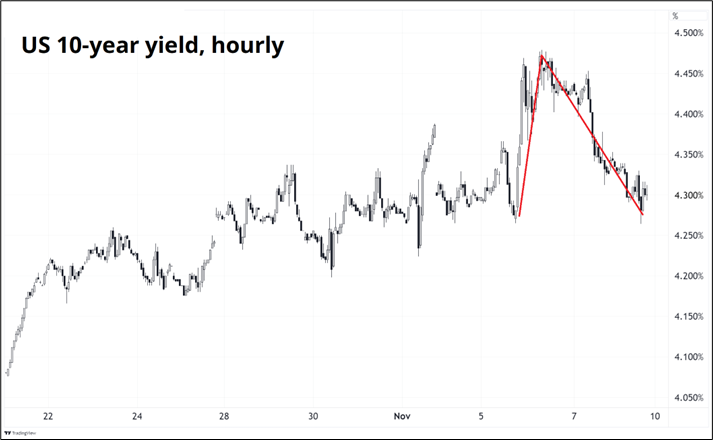

Everyone thought yields would go mad on a Red Sweep, and they did, but only for a few hours. While the move up was faster than the reversal, you ended up with a nicely symmetrical move (up 20bps, down 20bps). From here, the mix of policy breadcrumbs and economic data will determine where we go. Down through 4.17% would take out the bottom of that whole month of trading and will trigger a capitulation event for bond shorts.

Looking at Fed pricing, things have come way off the boil as Powell’s cutting strategy looked like this before:

And now looks more like this:

Here’s a more intelligent (less dumb?) visual:

The soft landing continues and the great employment collapse and carry trade unwind of August 2024 were fleeting hallucinations.

Nobody knows what to do with the USD any more than anyone knows what to do with bonds following the election. The initial trade was to buy USD on higher inflation, yuge tariffs, and bigly deficits. But then we had the reversal of that trade. And now the reversal of the reversal as Lighthizer is named US Trade Rep.

Mexico, Europe, and China are expected to suffer most under a hawkish trade policy. Here is what they did this week (all three are oriented vs. the USD… So: Line go up, means MXN, EUR, CNH up).

EUR and CNH are on the lows, while MXN has held in better for some reason. I prefer to wait until we get a bit more clarity on the policy mix before committing to any USD direction. With China stimulus looking like a huge anticlimax, the temptation is to just get long USD again for US exceptionalism, but like Natalie Imbruglia, I’m torn.

Crypto is raging against the machine as promises of deregulation set a fire under shitcoins and blue chips alike. It’s hard to extract the specifically crypto signal from the “risky stuff is rallying” noise, but it’s notable that crypto has ripped at a time when gold dropped more than $100 off the highs. This could perhaps show that money is flowing out of analog and into digital.

Then again, bitcoin and NASDAQ look like this:

Since TQQQ (3X NASDAQ) is the best TradFi proxy for bitcoin and the best way to compare apples to apples between crypto and tech stocks, let’s see how they performed post election as this might help untangle whether there is a specific bid to crypto on the back of deregulation hopes.

TQQQ trades about as volatile as BTC (50 vs. 40 on 360-day realized vol, with BTC average daily change 2.6% vs. TQQQ at 2.4%–i.e., very similar) and therefore this chart suggests that despite the big headlines, crypto has not done anything particularly differentiated or special. Post-election, TQQQ has outperformed BTC outright, and vol-adjusted. The first bars show the average daily change over the past year, the rest of the bars show change post election.

The sky-high weekly RSI in gold was a good signal. People are scrambling to explain why the larger deficits candidate won and gold went down … But I guess gold was just overcooked. A more satisfying ex-post explanation is that Musk and Co. are going to take a hatchet to government spending and actually end up with rising nominal growth and falling deficit/GDP but umm… Yeah. They always promise this, and it never happens. Tax cuts do not, in fact, pay for themselves. See also here. That’s just a fantasy.

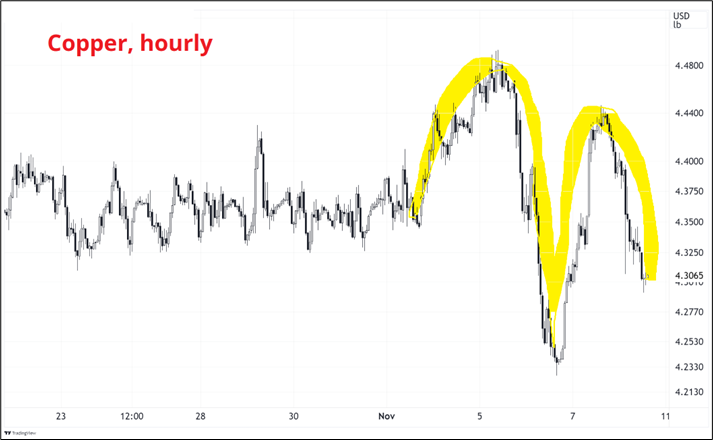

Overall, commodities are not really in play this week as people are focused on first-derivative plays like banks, bonds, and bitcoin. No need to try to guess what a Trump victory means for something like copper when we can’t even figure out what it means for 10-year treasury yields.

In the background, the China stimulus theme has fully anticlimaxed now with a 1.4T damp squib shooting low in the sky as everyone looks elsewhere. Copper didn’t like it, but the net move in the red metal was a deformed McDonald’s Golden Arch, not a big move lower.

Whew! OK! That was 9.314 minutes. Thanks for reading Friday Speedrun.

Get rich or have fun trying.

The Greatest Dunk of All Time (short video clip)

Chris Arnade walks Phnom Penh in Epsilon Theory (long article)

Bill Bishop on Trump 2.0 and what it means for China (free podcast)

Try Spectra School for Free (Learning!)

I have been doing audiobooks lately, so I have not run into any good new music. Please send music ideas. Hard, fast, acoustic, whatever.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

Investment bank outlooks may suffer from extrapolation bias. Tails are the base case.

Stocks and VIX don’t usually matter much for USDJPY. But sometimes they do.