Not a bad time to lighten up on GLP-1 exposure. It’s all priced in. Also: Watch JGBs.

Regimewechsel

There has been a regime change: TINA is hobbling.

Not a bad time to lighten up on GLP-1 exposure. It’s all priced in. Also: Watch JGBs.

Midjourney imagines a photograph of Stan from South Park

Flat

Before we get started today, an announcement:

After one year under construction, our flagship course, Think Like a Market Professional, is now live. Spectra School has launched!

Get the tools and practical frameworks you need to understand markets in the real world. Course info, syllabus, and FAQ on the website.

Check out the video for a quick run-through. The course is perfect for traders, sell-side analysts, wealth managers, RIAs, finance students, econ grads, central bankers, and anyone outside finance who want to learn how markets operate in the real world. www.spectramarkets.com/school

Also! If you would like to roll out “Think Like a Market Professional” inside your organization, please contact me directly (email, Bloomberg chat, or phone) and we can set something up! Corporate packages available.

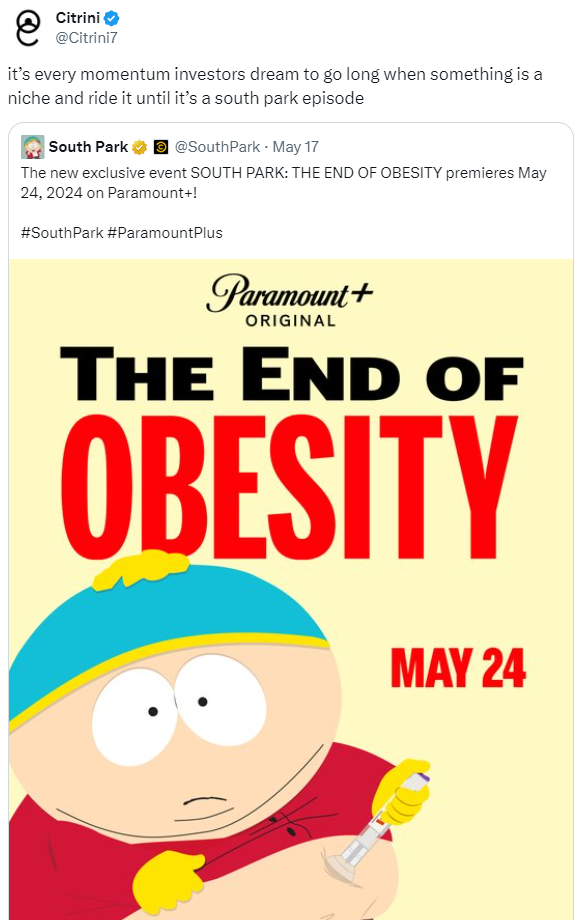

Citrini Research, an excellent follow on Twitter, posted this tweet the other day. Sol pointed me to it. The tweet is funny because it’s true. South Park has a 20+-year history of capturing the cultural zeitgeist and it’s impossible to argue that anything that is lampooned on South Park is not priced in.

That got me thinking… Is there a possible market signal when a company is featured on the show? The logic would be similar to the Magazine Cover Indicator, or The Madden Jinx. By definition, anything featured is well-known and at risk of mean reversion after massive outperformance.

It is difficult, but not impossible, to isolate every corporate mention inside the 328 episodes of South Park that have run since the August 13, 1997, airing of “Cartman Gets an ____ Probe”. I used various websites and Google and AI to do the best I could. I do not promise the list is 100% complete, but I do promise that I did not cherry-pick episodes with the intention of delivering a particular (i.e., contrarian) verdict. I only included shows where:

Here is the big fat table of all the episodes, companies, and ticker symbols.

Similar to The Economist, South Park is a contrarian indicator as it’s rare for a company to appear prominently in the show, and if it does, that’s probably a sign that the company is front-and-center in the current zeitgeist. One year after appearing on South Park, the median stock underperforms the S&P 500 by 7%.

I would also note that new product releases and sector and strategy ETFs can often be a reverse indicator. The logic is that a trend has to be in place for a long time and it has to be extremely popular before a financial company will conclude that a new product to monetize the trend via retail will gain enough assets to be worthwhile.

Some salient ones that I remember are the launch of the Deutsche FX carry ETF in late 2006 before carry crashed in 2007, the bitcoin futures ETF at the peak of the 2017 crypto mania, and the bearish NOPE ETF launched three weeks before stocks bottomed in October 2022.

I mention this because… Oooh baby… Look what we have here:

Caveat emptor. Not a bad time to lighten up on the GLP-1 basket. It’s all priced in.

JGB yields are zipping higher and higher every day. While US yields are way below their 2023 highs, Japanese yields continue to soar.

I am surprised Team Japan (GPIF, Kampo, etc.) have not started a massive rotation back into JGBs.

If you are interested in a corporate package for Spectra School, please contact me directly via Bloomberg or email. My dream is that “Think Like a Market Professional” will become the industry-standard training course for everyone coming into markets. If you run an analyst program at a bank, or know someone who does, this is the ideal product for your peeps. FAQs are here. Check out the video here.

Think Like a Market Professional is perfect for traders, sell-side analysts, wealth managers, RIAs, finance students, econ grads, and anyone outside finance who would like to learn how markets operate in the real world.

Finally, the Wikipedia page on regression to the mean is a good read.

Thanks very much, M’kay?

Midjourney AI imagines Stan from South Park.

Midjourney AI imagines “Kenny from South Park, realistic photo, hood down”.

There has been a regime change: TINA is hobbling.

I am possibly doing something financially suboptimal, but it’s good to be flat on vacation