Before we get started today, an announcement!

After one year under construction, our flagship course, Think Like a Market Professional, is now live. Spectra School has launched!

Get the tools and practical frameworks you need to understand markets in the real world. Course info, syllabus, and FAQ on the website.

Check out the video for a quick run-through. The course is perfect for traders, sell-side analysts, wealth managers, RIAs, finance students, econ grads, central bankers, and anyone outside finance who want to learn how markets operate in the real world. www.spectramarkets.com/school

Global Macro

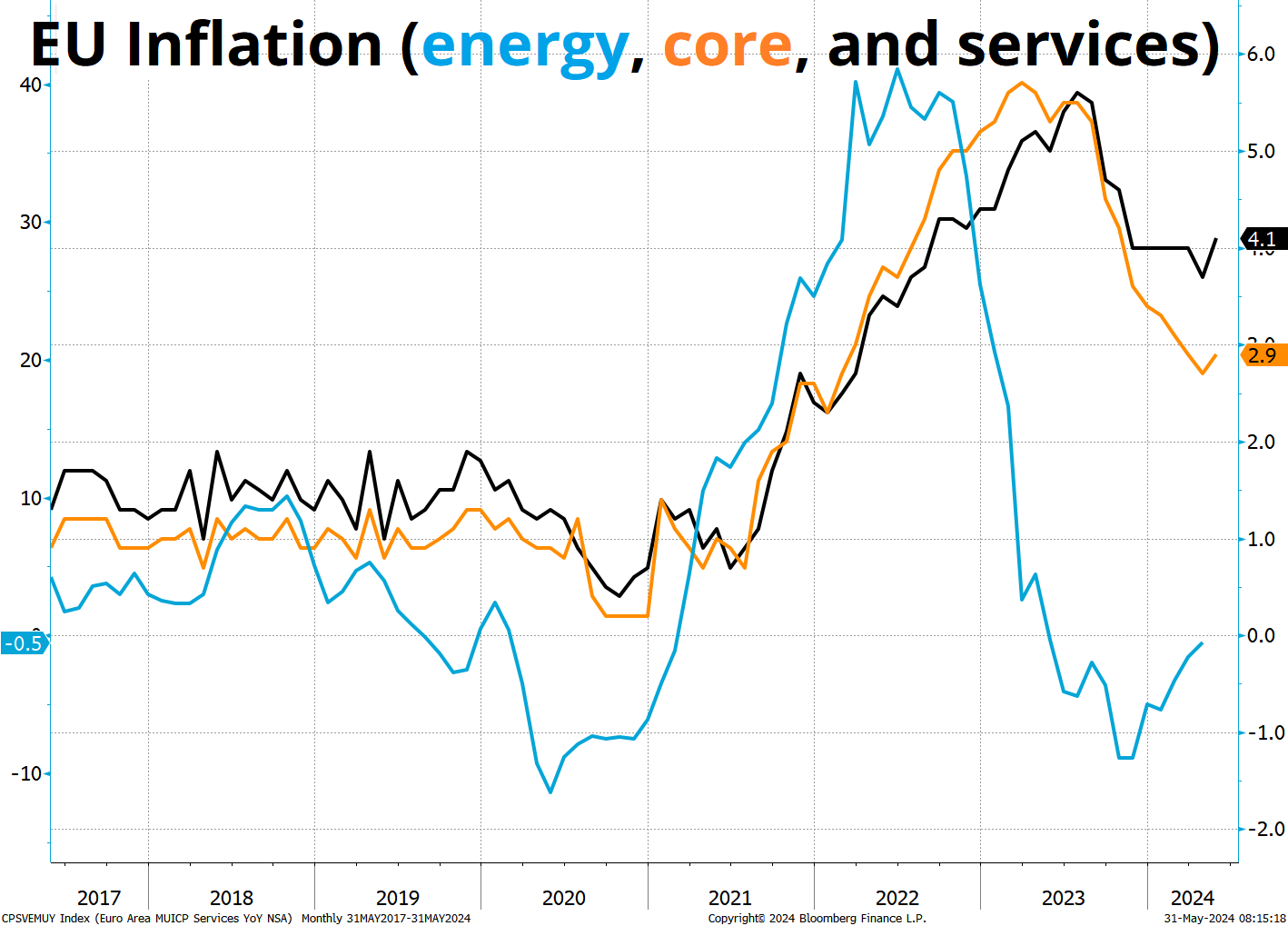

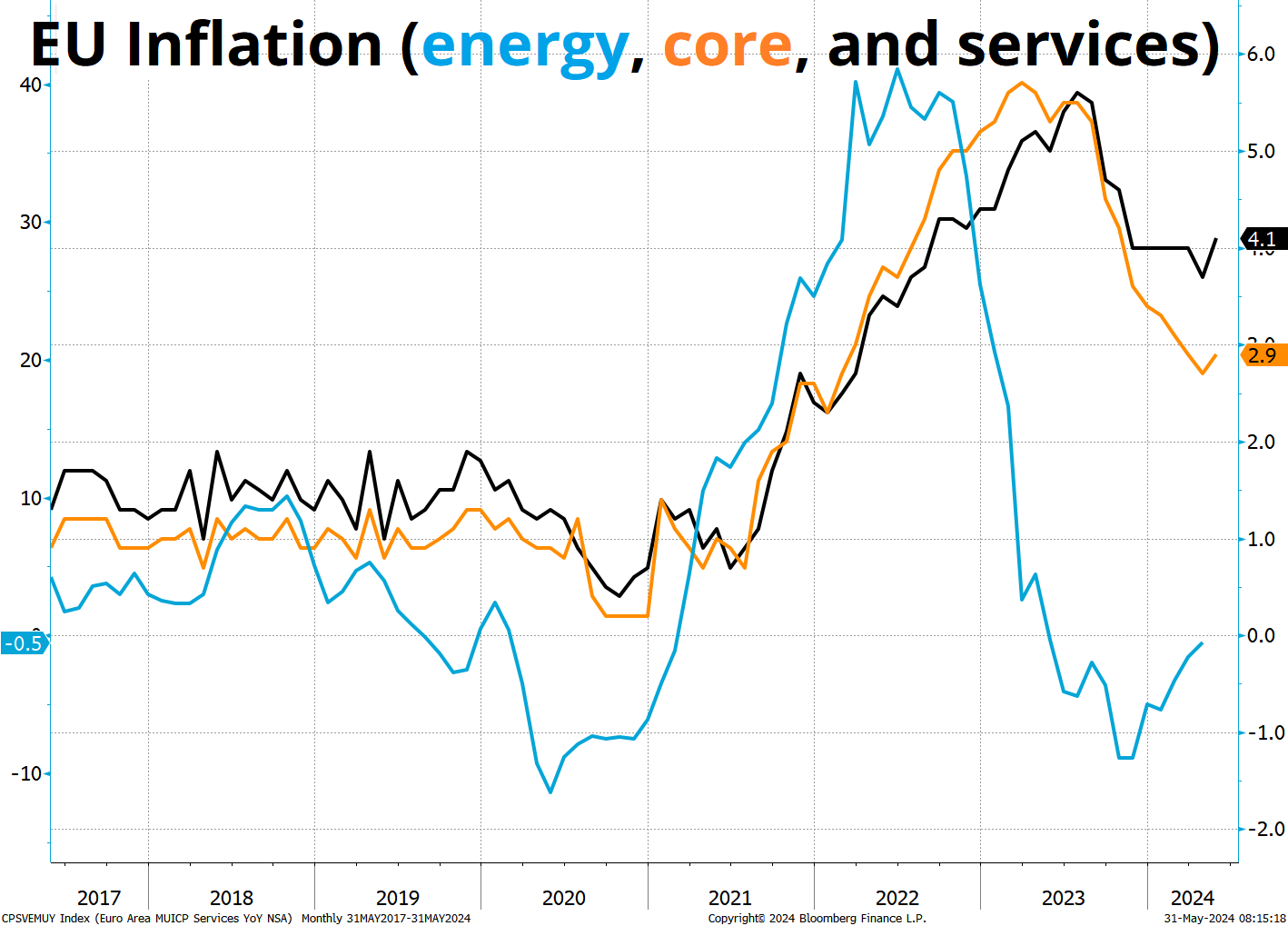

It’s been a bit of a weird week as idiosyncratic positioning, rebalancing, and rotation trades have dominated as there wasn’t much to chew on macro-wise. The story in macro was Europe-centric as inflation came in higher across the Old World, and ECB cuts continue to be priced out.

The ECB essentially promised a rate cut on June 6, and will almost surely deliver that just because. But going forward, the disinflationary winds have stopped, and all the data is pointing to stickiness around current levels.

If the ECB were to enter a higher-for-longer regime, that would be a major surprise. A few months ago, the narrative was that Europe is bad, China is worse, and the USA is amazing. Now, Europe is OK, China looks much better, and the USA is mixed.

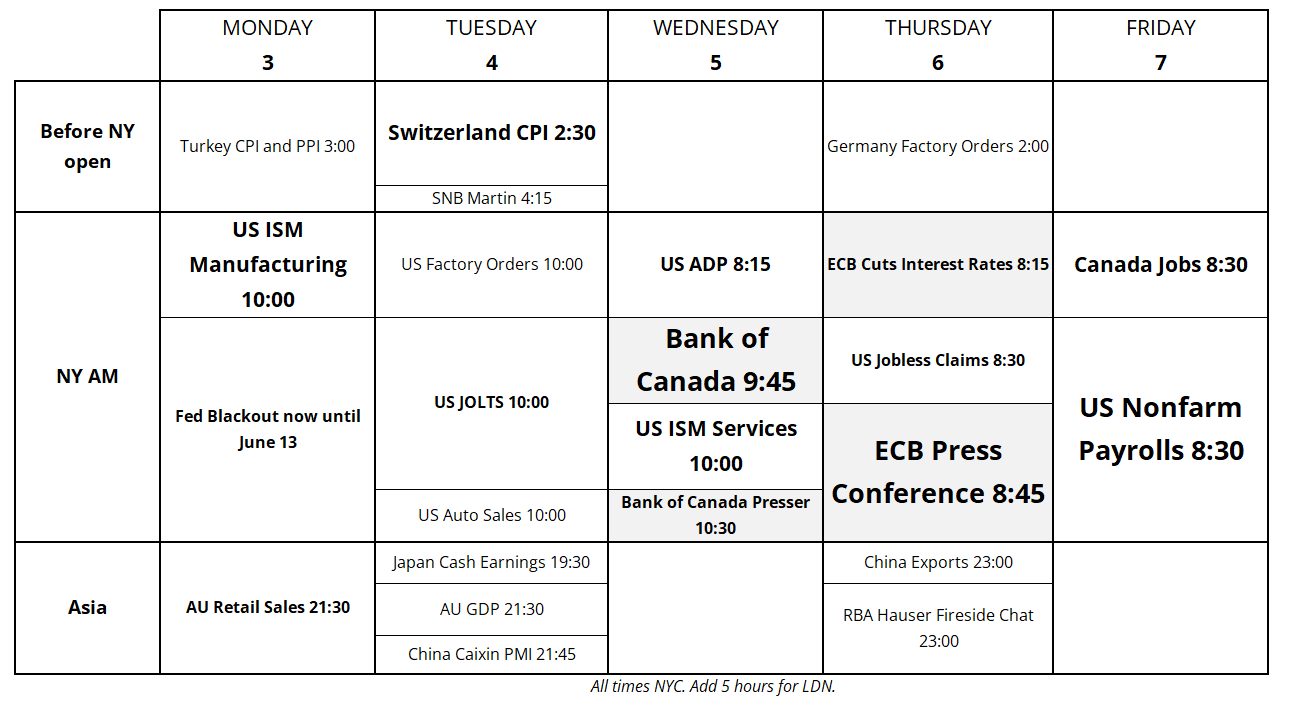

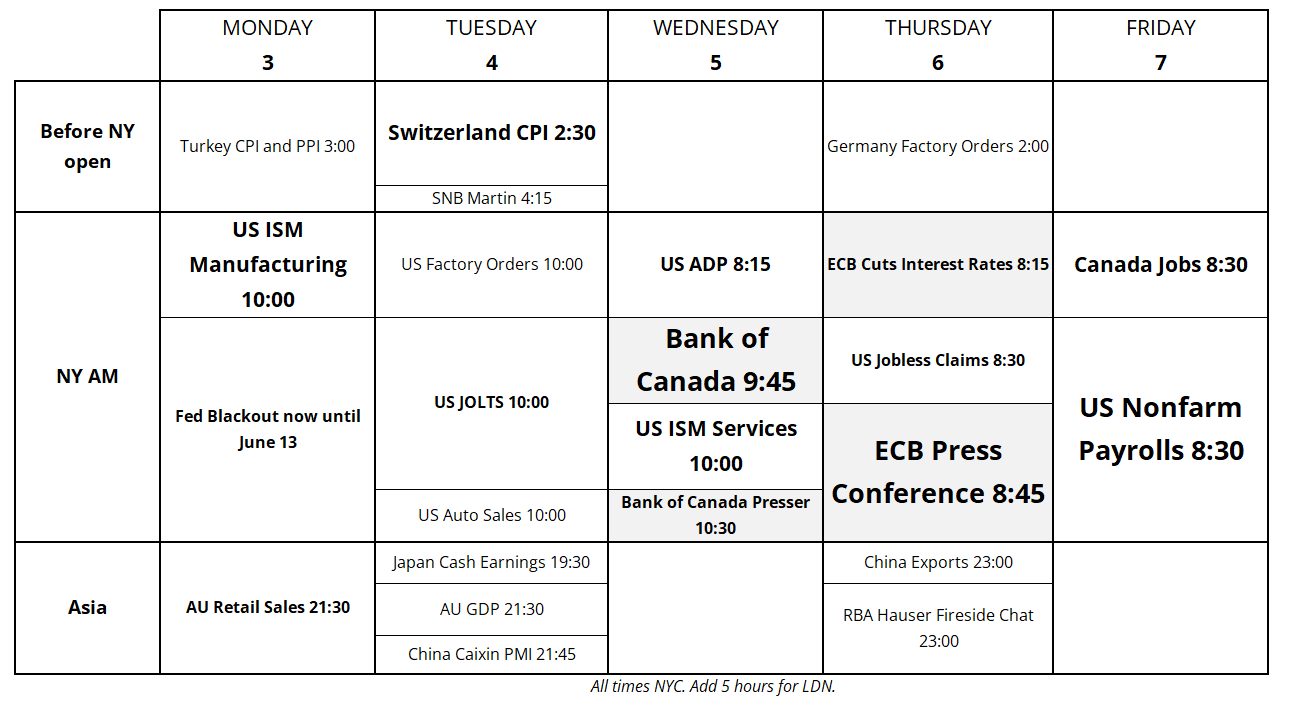

Thankfully, we have entered the blackout period ahead of the June FOMC, so there will be no policymaker cacophony for the next couple of weeks. The main policy events will be the Bank of Canada and ECB meetings, along with a parade of US jobs data.

Here’s the calendar:

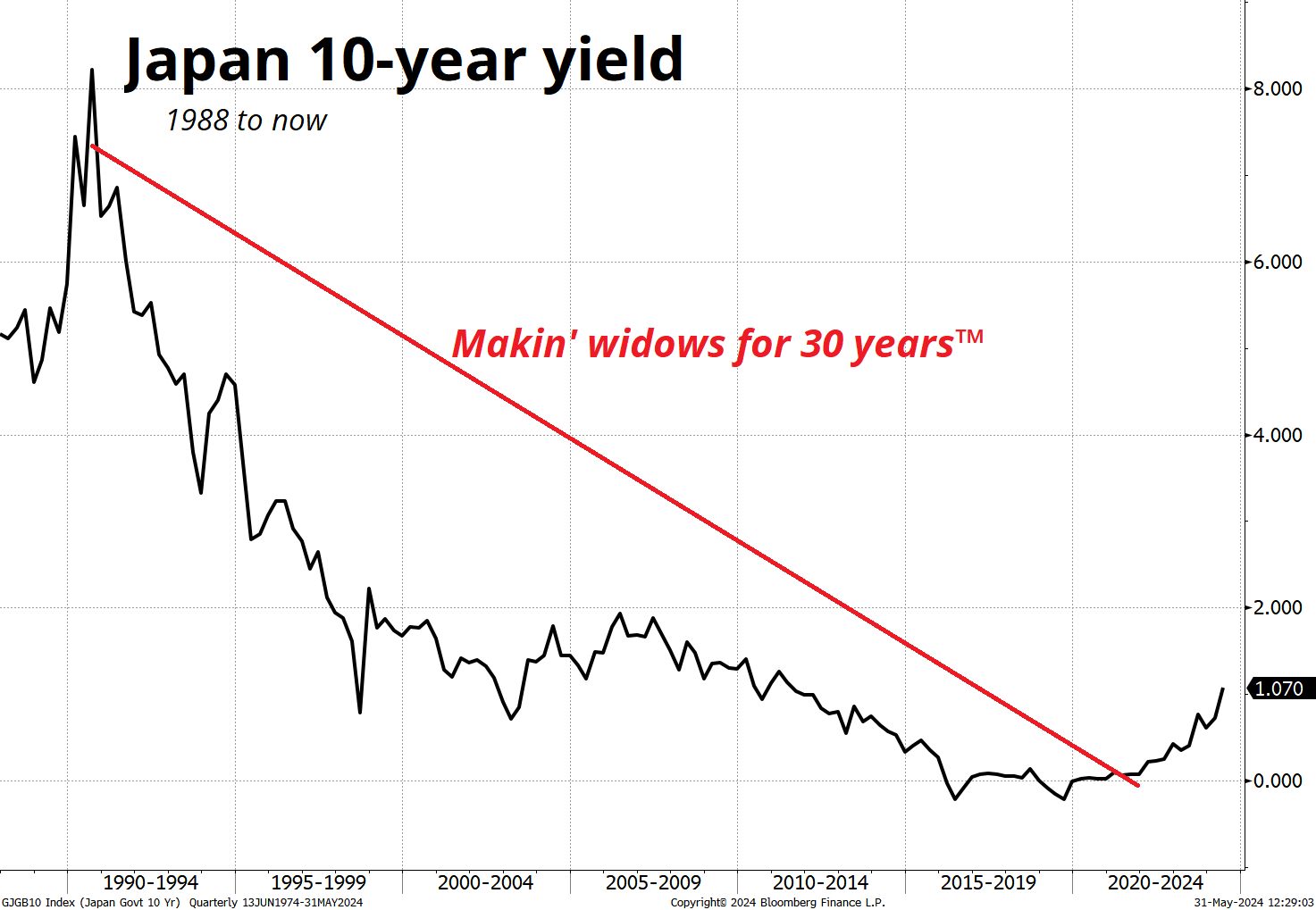

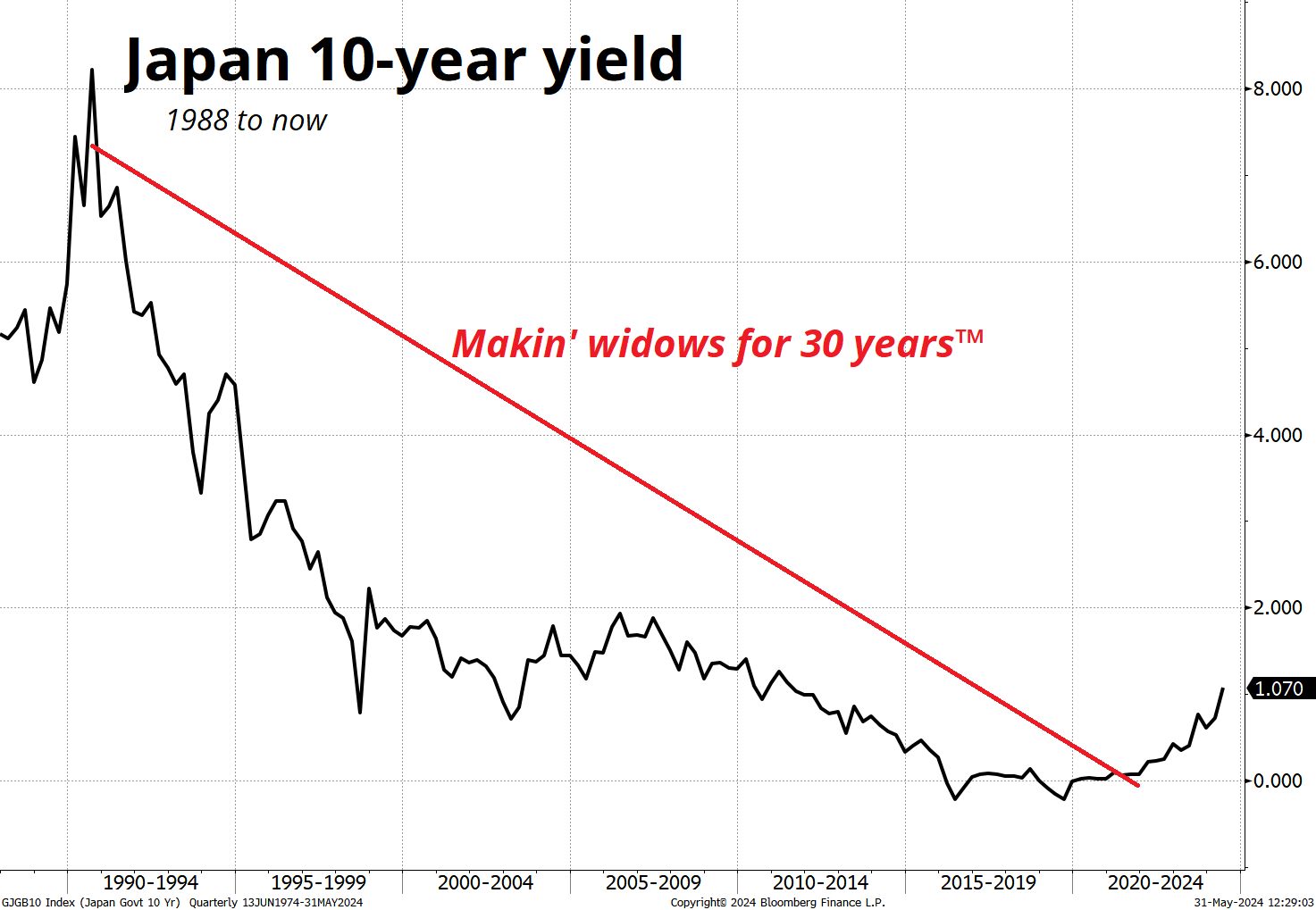

The other macro story is the slow burn in JGBs. For decades, people thought that 10-year bond yields in Japan were stupidly low. For years, those people lost money. They were short JGBs (Japanese bonds), and Japanese interest rates got pegged to the floor. Short JGBs has been known as “The Widowmaker”.

Here is a long-term chart of Japanese 10-year yields. Anyone short JGBs wanted this line to go up. Finally, that has started to happen.

If we zoom in to the period starting with COVID, the chart looks like this:

Husbands are rising from the dead and widows are getting unmade. While the yield of 1.07% is tiny in comparison to yields on bonds around the world, it’s high enough to warrant some consideration from long-term Japanese investors who might believe that domestic assets could outperform going forward now that the MOF and BOJ have both said that further yen weakness is not desirable.

Then again, the MOF has been saying this for ages and they sold $62 billion worth of USDJPY recently and the pair is essentially unchanged despite that. The reflexivity between higher Japanese yields and higher US and global yields continues to make long JPY trades difficult and expensive.

The final data point worth a mention here is the big revision to Canada’s Q1 GDP figure. Canada’s population has been growing in leporine fashion while output in the Great White North remains stagnant. There is much more slack in Canada’s economy than there is in the US, and the Bank of Canada might join the rate cut party this week as a cut is priced about 66% YES / 34% NO.

The global rate cut party was supposed to be a barnburner, but hardly any of the central banks are showing up. The RBNZ and RBA are still talking about hikes!

In theory, the news that Donald Trump was convicted should matter. But in reality, I don’t think it changes much. Voters are wedded to their prior views and no amount of new information is going to change anyone’s mind. The Access Hollywood tapes gave the first glimpse of the Teflon Don phenomenon and there have been dozens since, including January 6.

Trump supporters view everything he does through the lens of his God-like genius and 4-D chess awesomeness, while Dems view everything he does through the lens of “He’s, like totally, an Orange Demon!”. There is literally no news item, however exonerating or damning, that will change more than 14 out of 160 million US voters’ minds. These 34 felony convictions are a 2-day news item and then we’ll move on to whatever’s next.

Stocks

Weird stuff going on in stonks. These two graphics give you a good sense of the crazy behavior under the hood, especially today.

Heatmap of the S&P 500 today (31MAY24, via https://finviz.com/map.ashx)

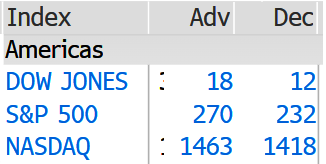

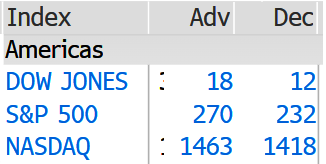

And to put some numbers on it, here is today’s breadth:

To get the NASDAQ down 1.8% and the S&P 500 down 0.8% when more stocks are rising than falling requires some heavy sagging in the big caps. That’s what we are seeing.

Stocks are nervy this week, and the NVDA chart is fascinating, with a rare double gapper up through $1000 and then up again through $1063. It’s hard to get excited about NVDA downside as long as we are above $975, but through there would be an epic reversal of massive post-earnings gains on huge volume.

The AI and GLP-1 phenomena have been important drivers of the stock market rally in 2023/2024 and there are some huge behavioral red flags around the GLP-1 story of late. For a full writeup on why I think the Ozempic story is fully priced in for now, and NVO and friends will underperform the indexes over the next 12 months, please see here:

https://www.spectramarkets.com/amfx/the-south-park-jinx/

Here is this week’s 14-word stock market summary:

Rotation out of megacaps isn’t guaranteed to be bad news for the stock market.

Interest Rates

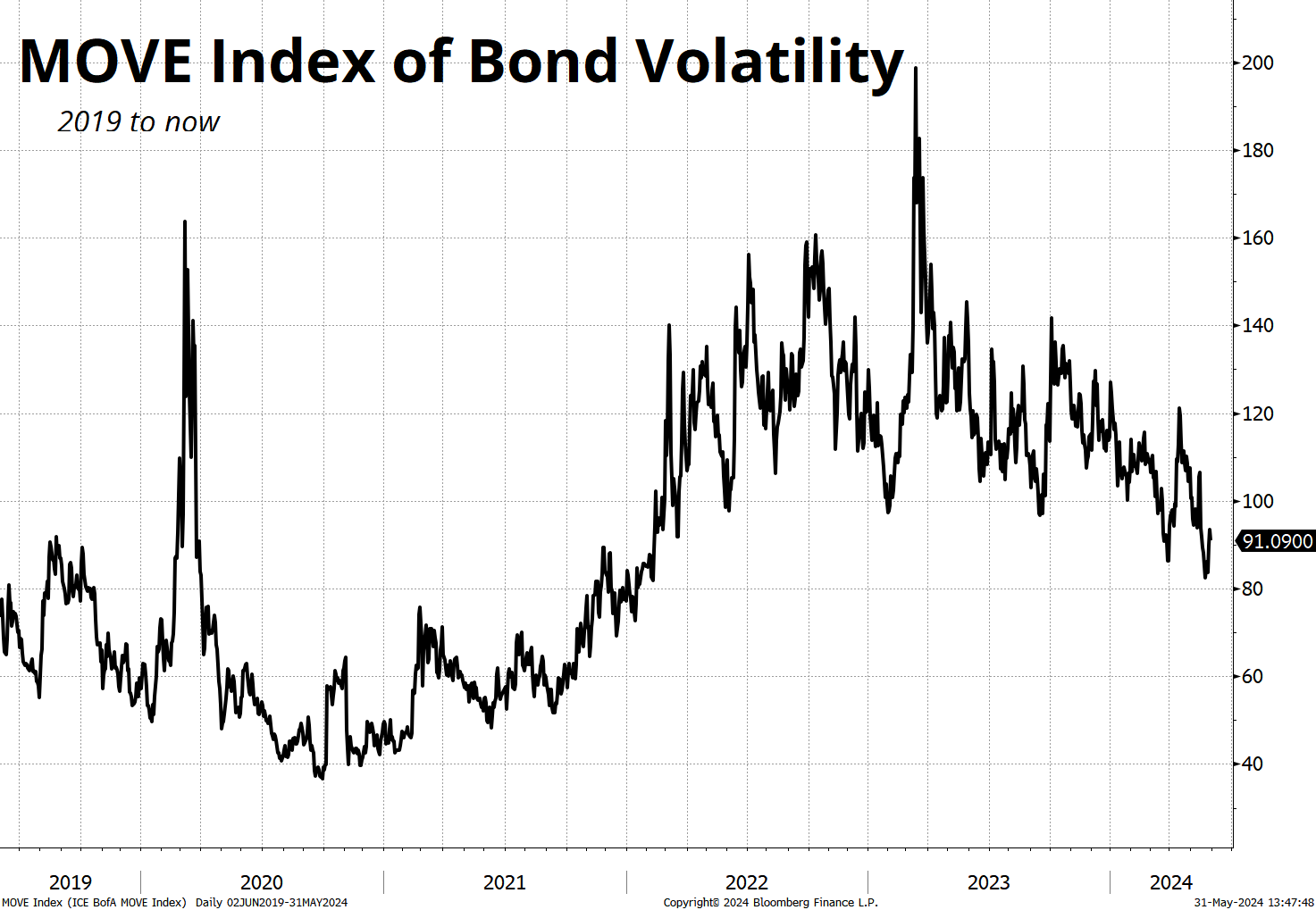

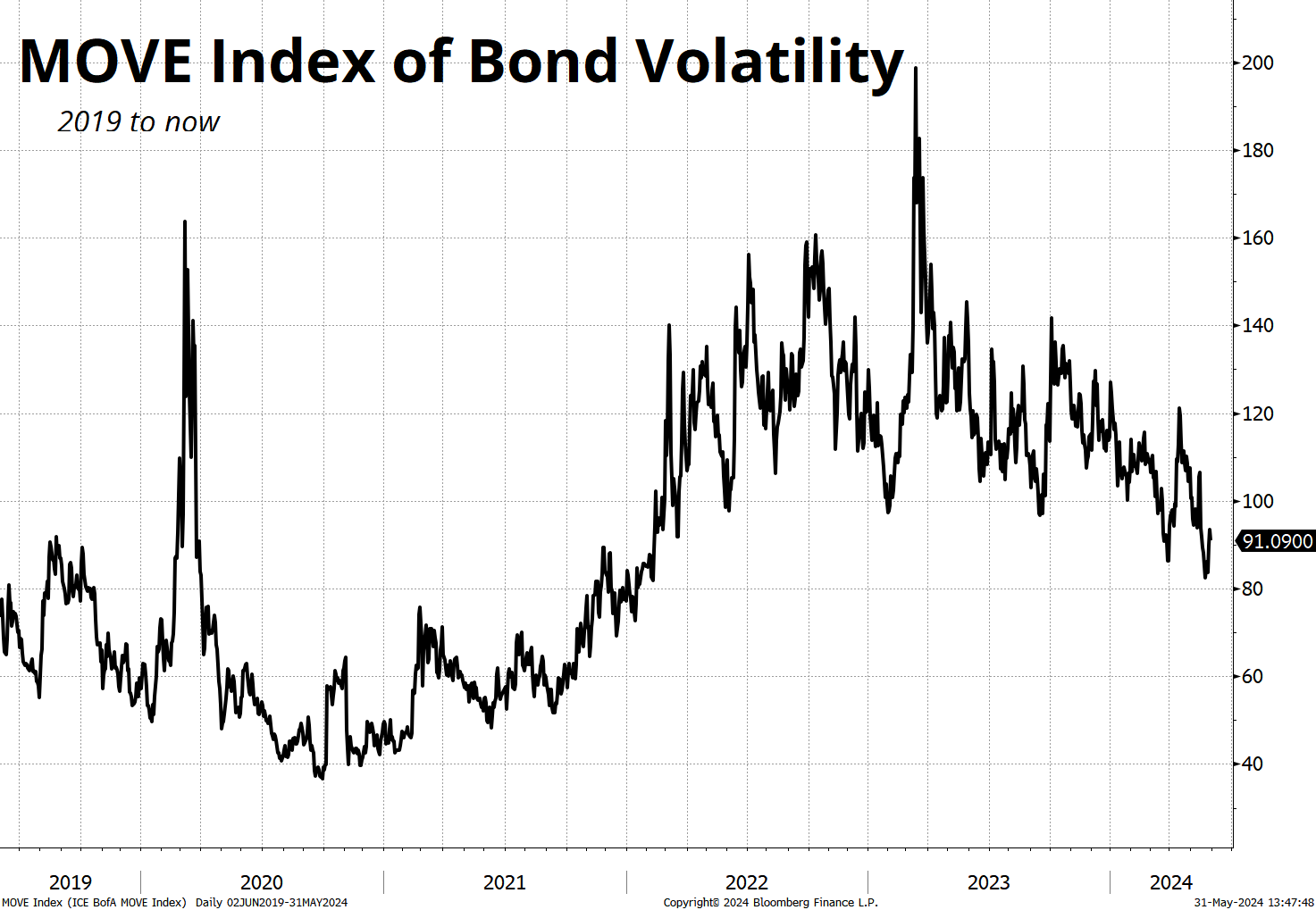

The big news in bond markets over the past few years has been the rise in global yields, the ferocious increase in bond market volatility, and the hedge-fund-destroying blowout in the front end after Silvergate went under. Now, US bond market volatility looks like this:

I have written many times in here and in my other writing about how bond market volatility has become more important than the direction or level of yields. Slow moves higher aren’t the same thing as fast moves higher in yields because the first one isn’t scary and the second one is.

While US yields have gone back up to 4.50%, the pace of the moves in both directions have been more like maple syrup compared to the molasses-like moves pre-COVID and the pentane-like moves in 2022/2023.

Editor’s note: The prior analogy compares the viscosity of fluids. This is a a measure of internal resistance to flow for various liquids. At a temperature of 20 degrees Celcius, the viscosity of various fluids is (in cP): Pentane 0.23, Water 1.0, Blood 10, Maple syrup 175, Molasses 7500, and Peanut Butter 200,000. See here and here.

While US yields have been oscillating, Japanese yields have gone up, up, and away, and yields in other countries have been on the comeback vs. their American brethren.

Fiat Currencies

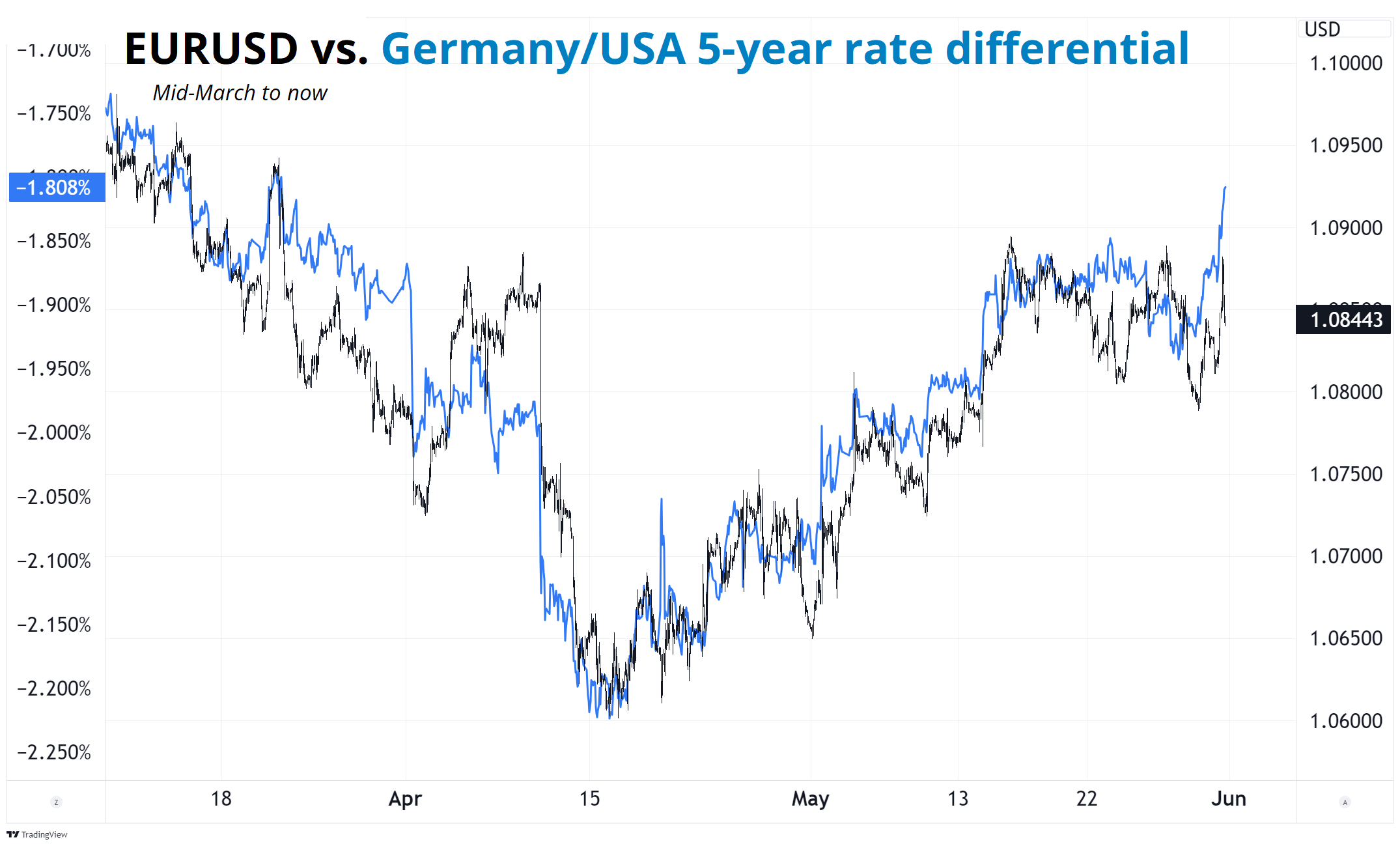

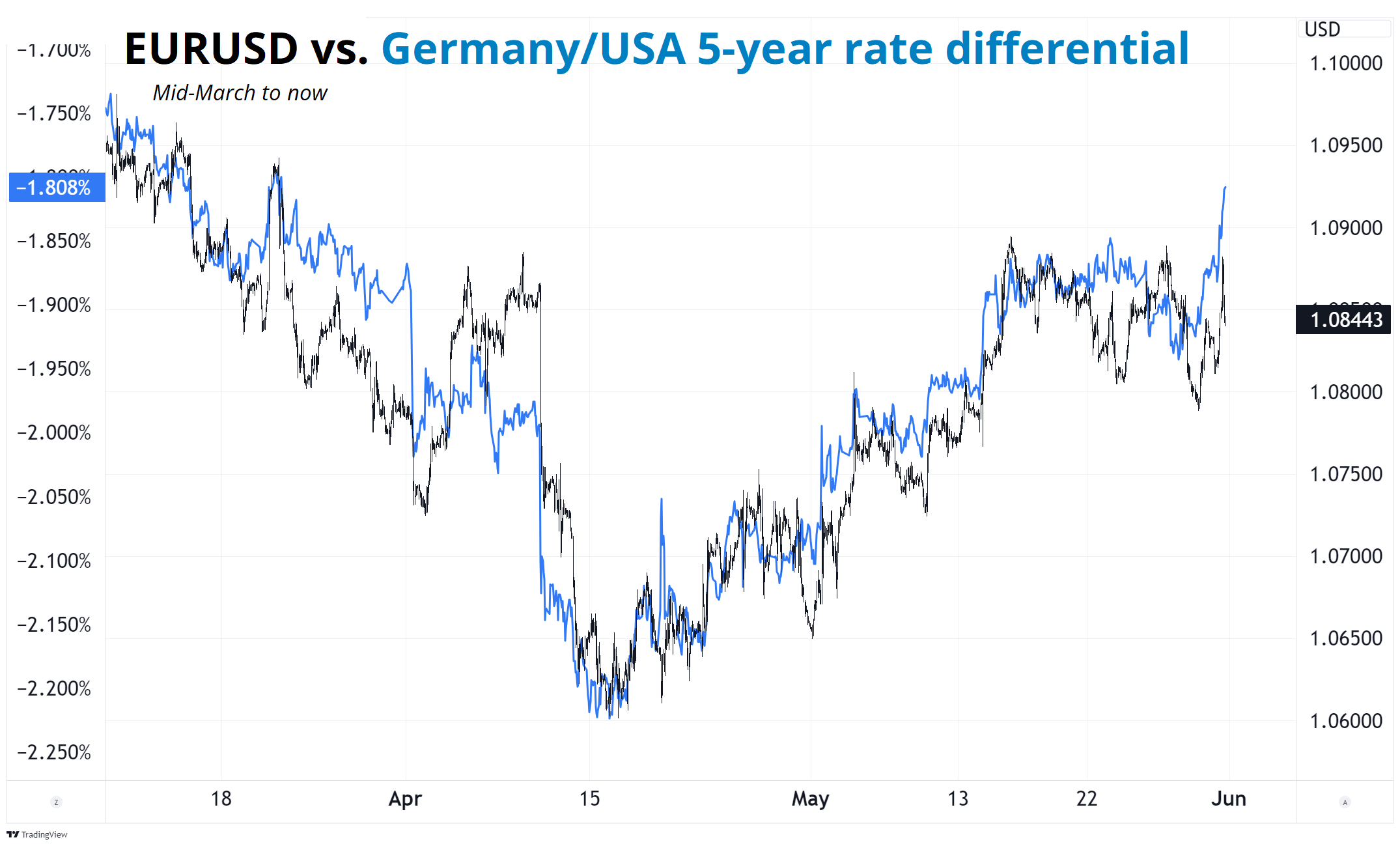

That last paragraph segues nicely to this chart:

EURUSD is grinding upward as the spread between German and US yields converges yet again. Currency trading, at its core, is about predicting divergences between country performance, and with the US economy stable but no longer accelerating, and the German economy bouncing off moribund levels, the relative interest rate story supports the euro.

Nobody likes the euro, because it’s so difficult to tell a positive structural bull story, but the cyclical moves can be large and profitable. I’m bullish EURUSD from here as I think the market will reduce euro shorts into the ECB meeting next week. The ECB has promised the cut, but I think that the communication will be something like “Yes, we’re cutting, but we kinda sorta didn’t really need to. We are now data dependent.”

Pricing has gone from 7 ECB cuts in 2024 to 2.25 cuts now. One more flurry of strong European data, and the market will be saying “higher for longer” with regard to Europe and that should help beaten-down euro sentiment.

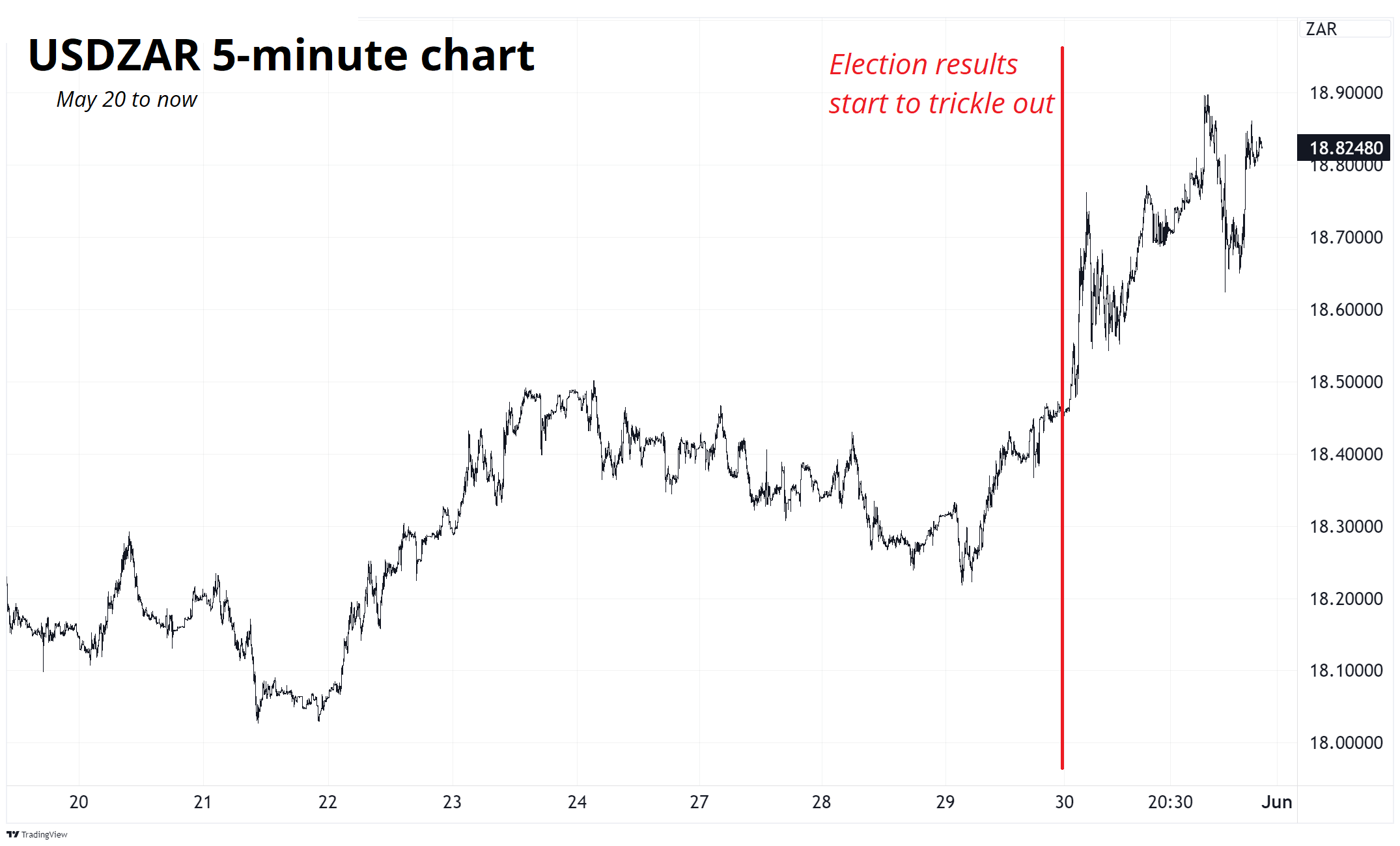

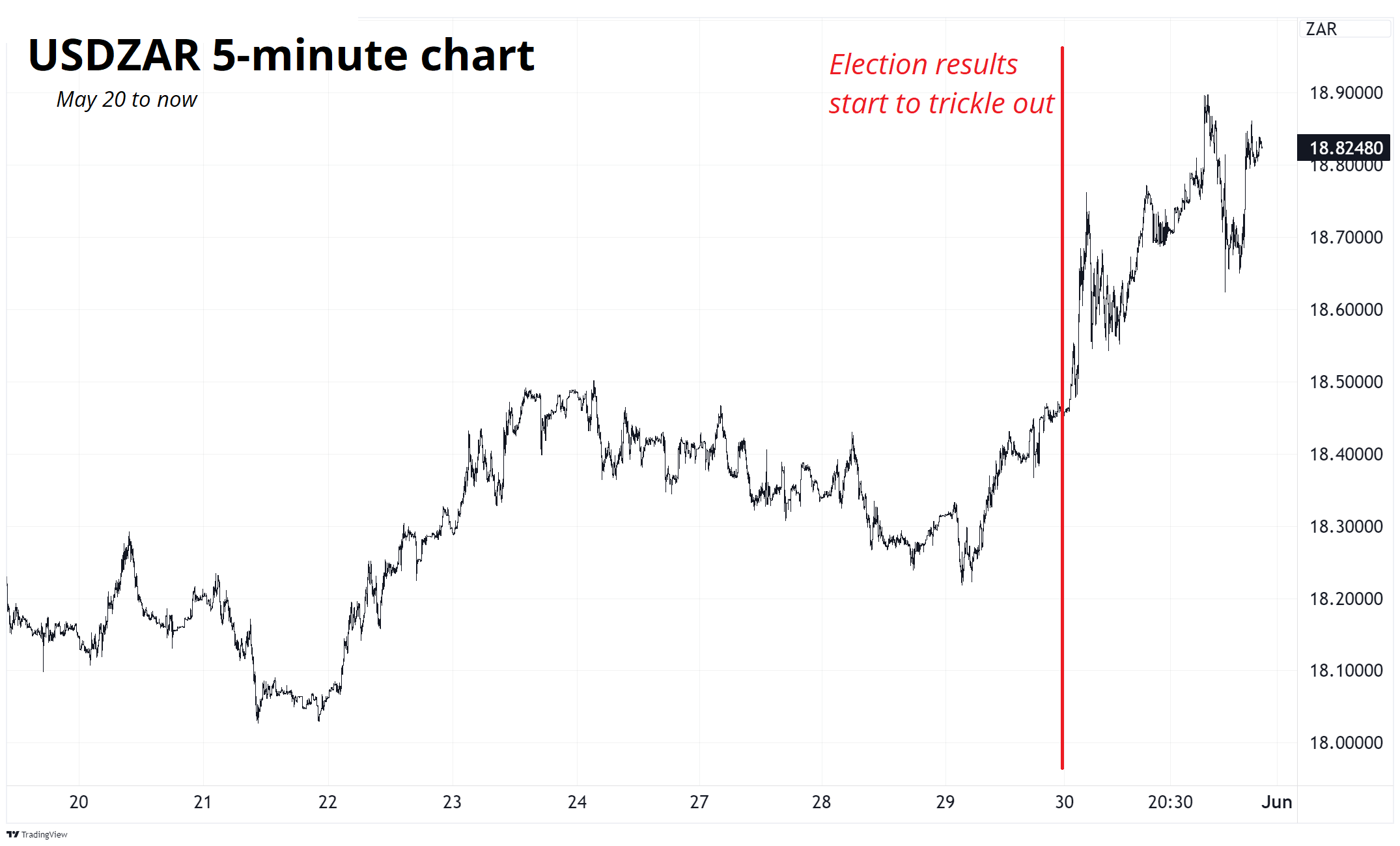

The other main topic of conversation this week in FX markets has been politics. The ANC in South Africa put up a worse-than-expected performance as they got 42% of the vote after dominating post-apartheid politics since 1994. Change and uncertainty are scary for markets and so the ZAR weakened vs. USD. This chart shows USDZAR (up means USD strong, ZAR weak) through the election result.

That’s not a mega move, but it’s enough to hurt a few carry baskets that didn’t reduce risk into the election. That unwind of ZAR, along with the weekend election in Mexico, also pushed USDMXN higher. The Mexican election should be a nothingburger and I expect USDMXN to be back around 16.75 next week (currently 16.97).

Crypto

Last week I wrote about the regulatory transformation in the United States as the ETH ETF was approved and the Democrats seem to have abandoned their crypto-negative stance. Biden has until June 3rd to veto the overturning of SAB 121 and there seems to be momentum towards a non-veto. This would signal that the president has joined the bipartisan ranks supporting crypto and US regulators’ disjointed, haphazard, and keystone coppish anti-crypto approach is done.

Pro-crypto has become the second bipartisan issue in the United States, along with anti-China. As Mike Novogratz put it:

“There’s been a seismic shift in the political landscape in the last two weeks.” Novogratz said. “I’ve been in D.C. trying to tell people this is a bipartisan issue, but over the years the Democrats seem to have lost the plot. Or as Novogratz said by way of comparison, “the Democratic party was the party that doesn’t like dogs.”

“Can you imagine a party coming out and saying we don’t like dogs?” Novogratz said.

HT R40. Mike Novogratz’s point is that there are 65 million dog owners and 90 million crypto owners in the United States. Bad-mouthing crypto is worse than bad-mouthing dogs. In a tight election, it’s a stupid hill to die on.

The more the regulatory taboo against crypto lifts in the United States, the less career risk there is for institutional asset managers who invest in it. This regulatory change is a new “buy the dip” factor that is structurally bullish crypto even if it doesn’t mean much for the short term.

June 27 could be an interesting event trade for crypto as it’s the first Presidential Debate. Positive crypto vibes and negative China vibes are likely to emerge into and during the event.

Commodities

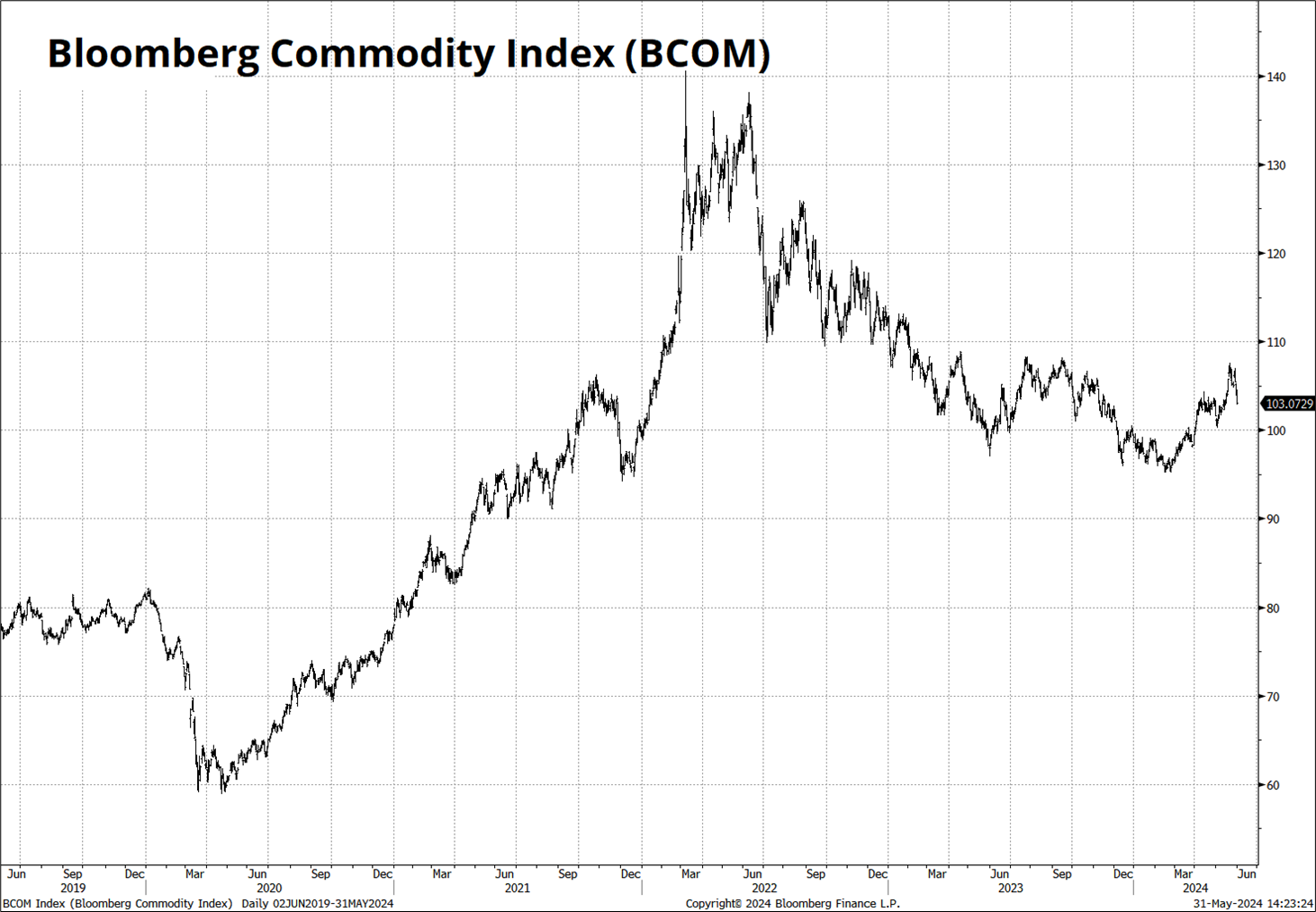

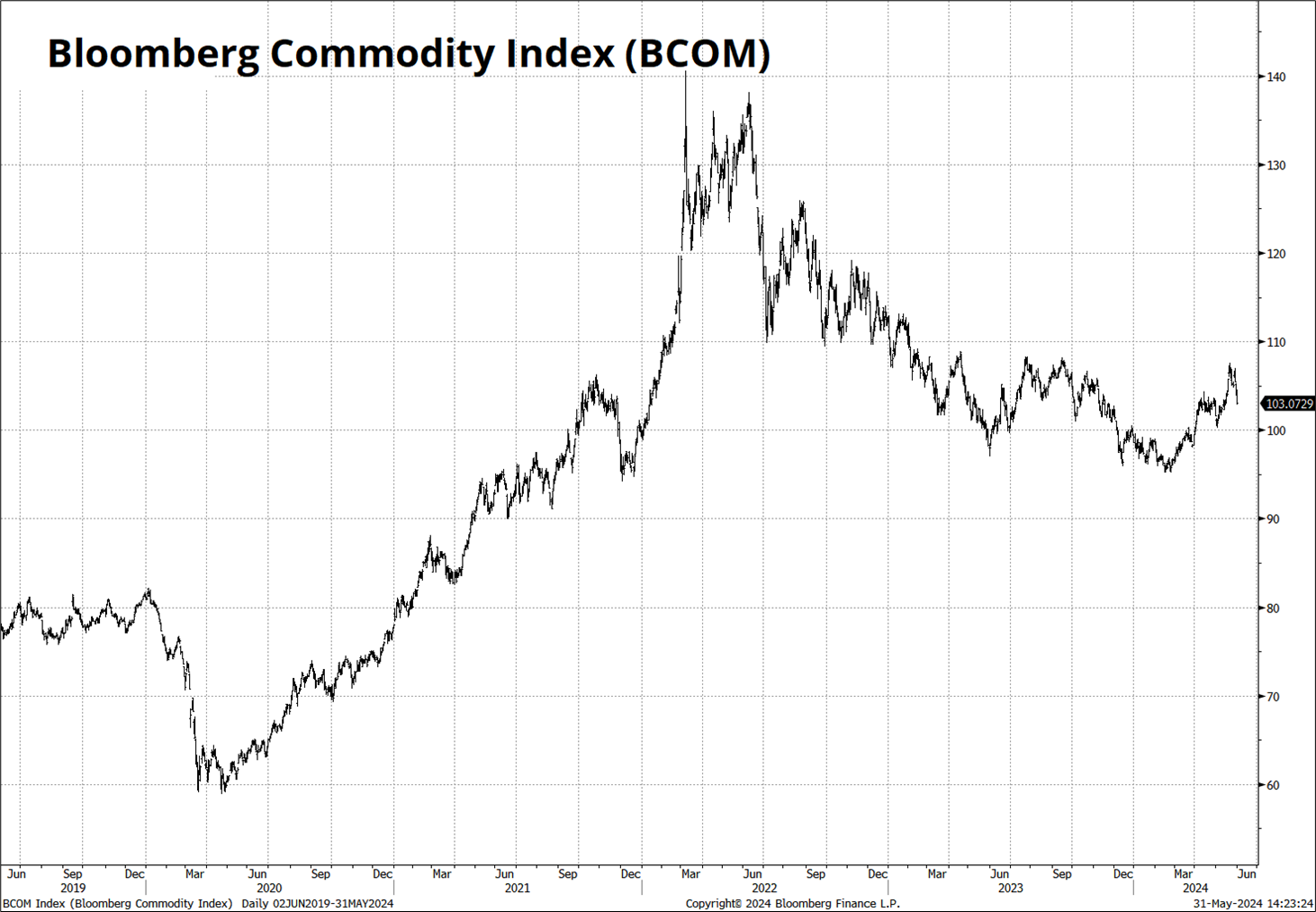

Commodity prices have been a major topic of discussion this year with gold and silver flying and cocoa going kookoo, but overall the net movements in the index have been muted.

That index started the year around 99 and it’s trading 103 right now. Energy prices are offsetting gains in other areas, and they represent 30% of the index.

I am endlessly fascinated by silver for some reason, and last week I highlighted the super important $30 level. It bounced smartly off there, but as I typed this it has done a full round tripper and is again down in the low 30s.

The way the letter “y” in “thirty” goes below the line just caused me to flash back to Grade 2 cursive handwriting exercises. They don’t teach cursive much these days, unless you send your kid to Montessori school. There are almost zero hills I will die on, except for that Montessori is the best way to educate young kids. It does all the right things and none of the bad stuff. If you have toddlers, I urge you to consider it!

Stare at this long enough and you’ll start having existential angst. WHYYYYY????

OK! That was 9 minutes. When I asked last week, nobody said this thing was too long, so my target is now to make this a 5-10 minute read, not 5-7.

Get rich or have fun trying.

Links of the week

Smart, interesting, or funny

- The Spectra School Video

There are not many things more pleasurable than writing a script for something, then watching it come to life. Even if it’s under two minutes long.

- My Career Alphas by “systematic longshort”

I recently discovered this guy on Twitter. His writeups are excellent and this one “My Career Alphas” is solid.

- Poetry camera

Neat. Courtesy of Jon Walsh.

Short Film

The Windshield Wiper

This 2022 short film about love is 100/100. Super artistic, deep, well-animated, super cool. It won Best Animated Short at the 2022 Oscars.