The zone is officially flooded. Gold bull market may be done.

Stagflation is a bad word

Even a whiff of stagflation risk should make you concerned.

The zone is officially flooded. Gold bull market may be done.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Try Spectra School for free!

If you’re looking for a good way to spend 35 minutes or so, check out Lesson 3 of our flagship course “Think Like a Market Professional” for free. https://spectramarkets.com/lessons/tlmp3/ There, you will find the entirety of Lesson 3, for free, along with a link to my Learning From Legends video with Ben Hunt.

The lesson is called “Surfing the Narrative Cycle” and delves into how you can understand the stories the market is telling itself. If you like it, you can sign up for the full course and use coupon code LESSON3 for $250 off the $1200 price (i.e., you pay $950 for 16 lessons and 10+ videos.)

The zone is flooded.

The market is clearly becoming desensitized to the threat of tariffs as the credibility of threats is mixed. Yes, the tariffs on China are real, but for every utterance there is only X probability of it being true and it’s close to impossible to assess the value of X for each individual threat. We need to go back to the overriding framework of Trump’s communications, as outlined by Steve Bannon in 2019:

Steve Bannon: The opposition party is the media. And the media can only, because they’re dumb and they’re lazy, they can only focus on one thing at a time… All we have to do is flood the zone with sh*t. Every day we hit them with three things. They’ll bite on one, and we’ll get all of our stuff done. Bang, bang, bang. These guys will never — will never be able to recover. But we’ve got to start with muzzle velocity.

And there has been plenty of muzzle velocity so far! Tariffs on Colombia. Or not. Tariffs on Canada and Mexico. Or not. Tariffs on China. Reciprocal tariffs by April 2 or maybe later or maybe not.

The market is fatigued by the tariff story and had front run it in huge size throughout November, December, and January, so the shock and awe factor has dissipated and the market is not feeling very fearful.

On the economic data side, we saw a tick higher in CPI and PPI as new year price resets continue to be a feature as companies push the envelope as much as they possibly can in this new era of slightly unanchored inflation psychology. The thing is, the details of the CPI and PPI feed into PCE in a super benign way, so the big selloff in bonds after the CPI figure has completely reversed. Now the market is trying to gameplan the impact of potentially massive cuts in government hiring and spending.

And meanwhile, in China, Xi seems to be backing off the common prosperity theme. One of the big knocks on Chinese stocks, and part of why US investors declared them uninvestable, has been Xi Jinping’s revival of the traditional Chinese / Marxist idea of “Common Prosperity” in 2021. In the second half of 2021, the Communist Party cracked down on the billionaire class.

So BABA, the poster child for Chinese tech, has ripped higher in extremely disorderly fashion.

The other big theme in macro is the potential end of the Russia/Ukraine war as Zelensky is left with very, very few outs now that Trump is set to pull US support. This has created a big demand for peripheral Europe (Poland, Hungary, etc.) as the thinking is that the rebuild of Ukraine and the trade balance improvement will benefit Europe. The contra to that is that leaving Europe alone to deal with Russia could actually be bad, but that’s a geopolitical argument more than an economic one.

Equity bears need a constant flow of bad news to make money as the positive drift in equities is always the default. While news on tariffs looked bearish, and the rise in yields looked bearish… Now we have grace periods aplenty before tariffs get enacted, and the credibility of the tariffs is nowhere near 100% as they continually get threatened and removed and delayed.

So in the US, we have seen a chopfest marked by huge gaps lower in cash, with face melting rallies afterwards.

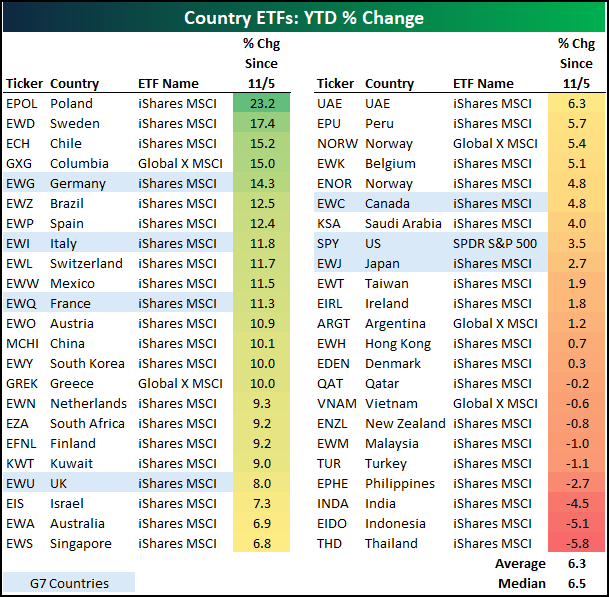

The real story is how the USA is no longer the only game in town. In fact, people are more interested in China, Poland, Europe, and other markets as MAG7 earnings look like they might be starting to plateau on the back of massive, potentially overexuberant capex spending. The old acronym was TINA (There Is No Alternative) but TINA is on holiday this year as you can see in this lovely table from Bespoke:

https://x.com/bespokeinvest/status/1890086585972191607

Every year we get a revival of the “US is overvalued and too concentrated” viewpoint and it’s alive and well right now.

This week’s 14-word stock market summary:

TINA is on holiday, or possibly dead. Look at all these other wonderful alternatives!

As mentioned, yields have been all over the place as the market is trying to cling to a view that Bessent will successfully push 10-year yields lower somehow. While CPI was hot, it wasn’t hot enough to sustain higher yields, even as the Fed is firmly and indefinitely on hold.

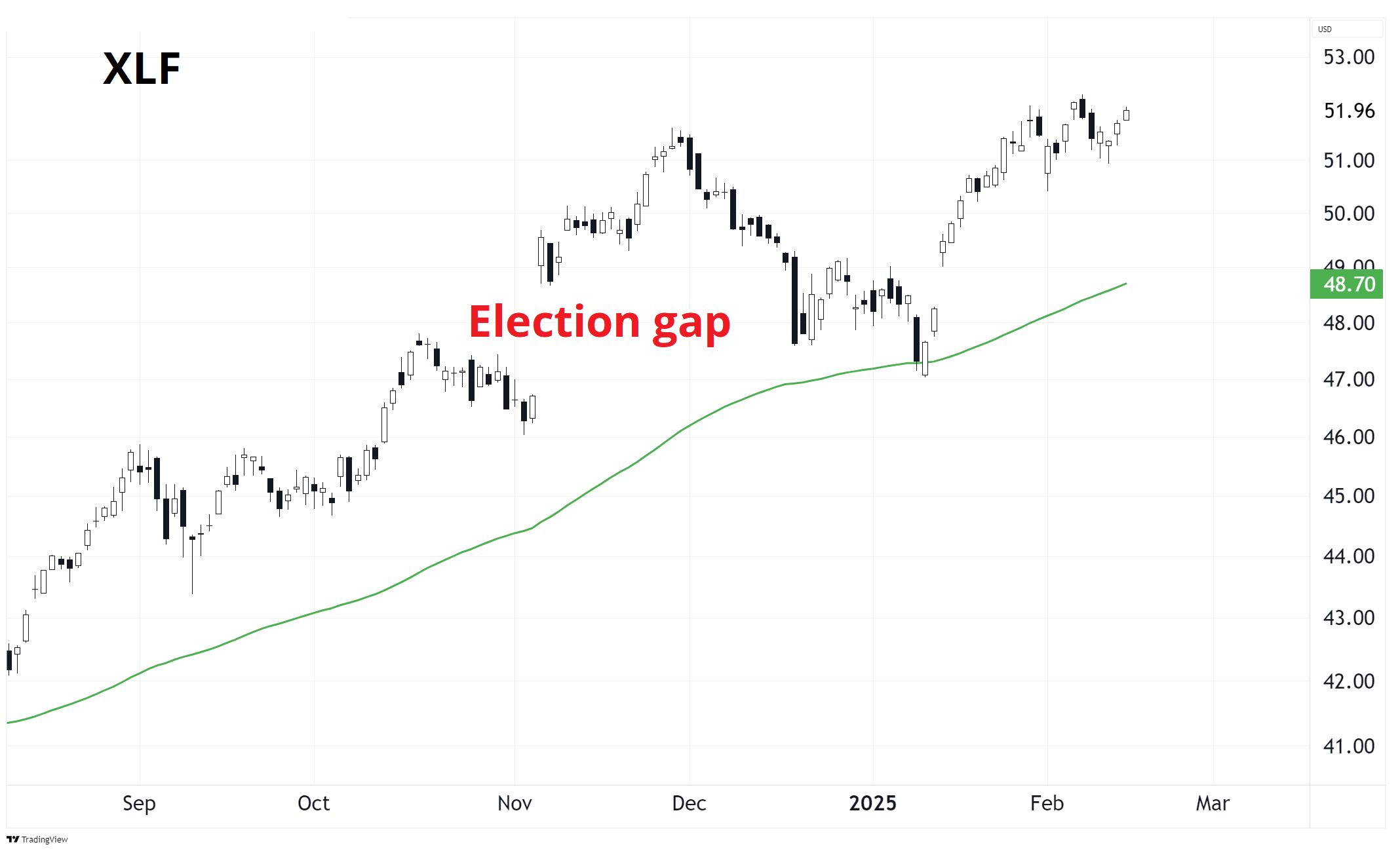

This drop in yields was painful for all concerned. It’s going to be super interesting to see the data going forward as the seasonal quirks all steer towards stronger data in January and February and then fade quickly after that. The fade in seasonality is likely to coincide with DOGE job cuts, and falling business confidence as it’s impossible to invest in an environment where you don’t know the rules. The promise of tax cuts and deregulation are candy on the horizon for investment in the long run but in the short term you are losing government as the dominant positive driver of GDP and investors hate uncertainty. The good news from deregulation is also somewhat to very priced in. See XLF (the US bank ETF) for example.

The market has exhausted its ability to hold onto huge long USD positions as the tariffs are not coming hard and fast enough, the economic data is steady, there is no chance the Fed hikes rates, and global equity markets outperform the US. As the market loses interest in the MAG7 as the only place worthy of investment dollars, it’s harder for the USD to stay afloat.

Much as equity bears need a constant stream of bad news to stay profitable, USD bulls now need a constant stream of good news for the dollar or bad news for Europe, and they’re not getting it. Much like we saw after everyone got long USD for Trump in 2017 and then the dollar went straight down all year, the policy actions can’t come fast enough to support the DXY at these levels.

We are falling toward the 100-day moving average now (green line) and the dollar is well in negative territory for 2025. It’s been tough sledding for USD longs this year.

The potential resolution of Russia/Ukraine is also hurting USD longs as that has led to substantial buying of EUR, PLN, SEK, HUF, and NOK. This weekend’s meetings in Munich are a substantial moment as we will see how willing Zelenksy is to fold under pressure from the Trump/Putin alliance. Another key moment for FX will be the German Federal election on February 23.

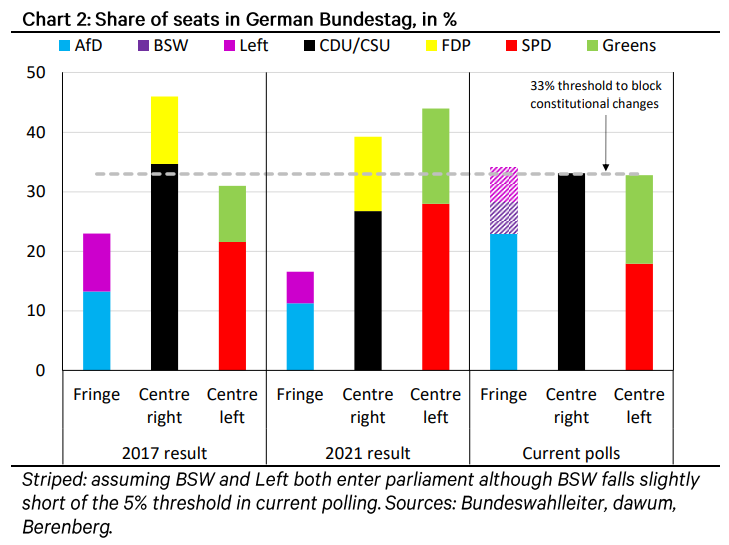

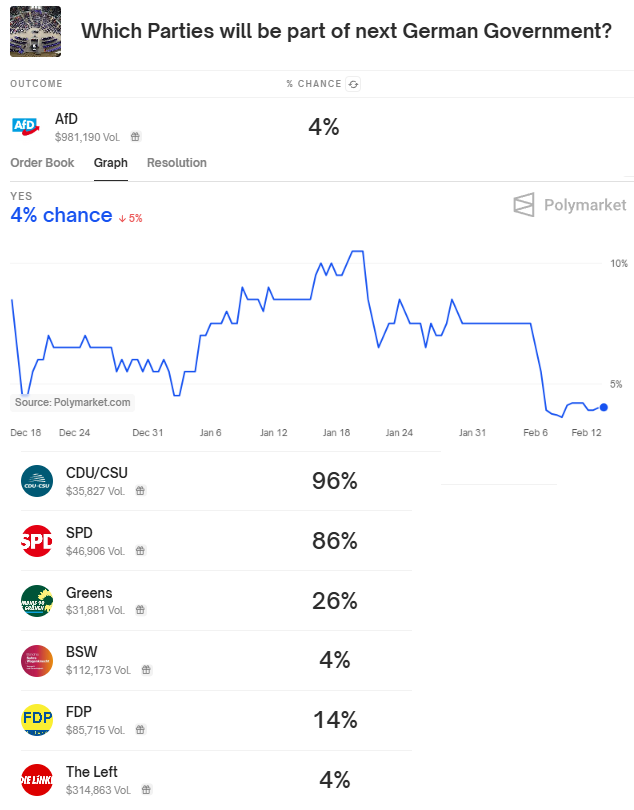

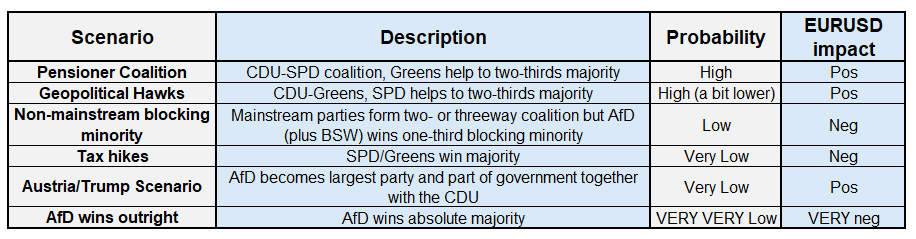

The German Federal Election on February 23 is not getting all THAT much airtime but is on the radar as the date approaches. Here is the latest polling situation.

Berenberg wrote a good piece about the tail risk of a fiscal veto for the fringe parties as the small Left party gains in the polls (see black arrow in my graphic, “Linke” means “Left”). While a removal of the debt brake doesn’t necessarily mean a massive fiscal stimulus is coming for Germany, the non-elimination of it would lead to unwanted fiscal tightening. The Berenberg piece says that a “fiscal veto for the fringe parties remains a tail risk, in our view. However, the tail has become fatter.”

Here you can see how tight the race for parliamentary influence might be using various assumptions.

Polymarket also sees the fringe coalition as a small tail, and the AfD’s odds have been dropping as the market had them as 10% likely to be part of the government a month ago and now that contract trades at 4%. The order book is liquid; the bid/offer is 3.8%/4.2% on the AfD contract.

Here are all the odds:

The problem with handicapping the result is that the coalition negotiations could last for months. So, the focus will be on the performance of the AfD as that’s the really obviously currency-negative variable. Here’s a scenario analysis from Citi (via Morningstar):

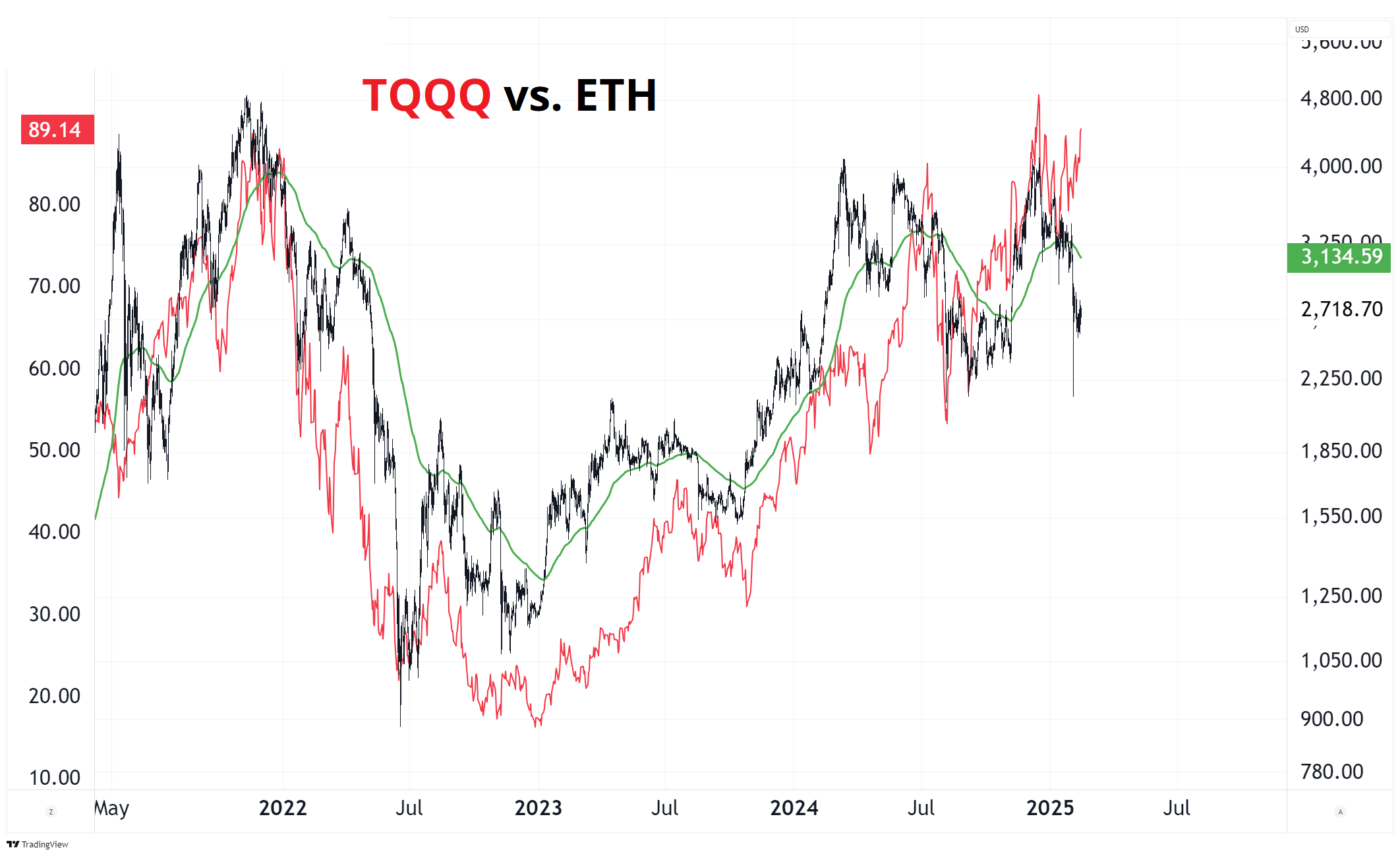

Crypto is in a holding pattern as ETH never recovered from its collapse on the tariff announcements, memecoins are all going to zero faster than expected, and people are generally bored of Saylor’s buying and are no longer inspired by the MSTR story.

I thought ETH was a buy, but now I’m really not sure what to make of all this. Crypto and TQQQ (the turbo NASDAQ ETF) tend to move together as both are high-beta risky assets, but ETH has opened up a huge wedge now with NASDAQ back near the highs while ETH is… Not.

You could use this chart to argue that ETH is lagging and way too low and ready to rip again, or you could say that ETH trades horribly. Your call. With 40,000 to 50,000 new memecoins created daily, there’s plenty to gamble on besides ETH.

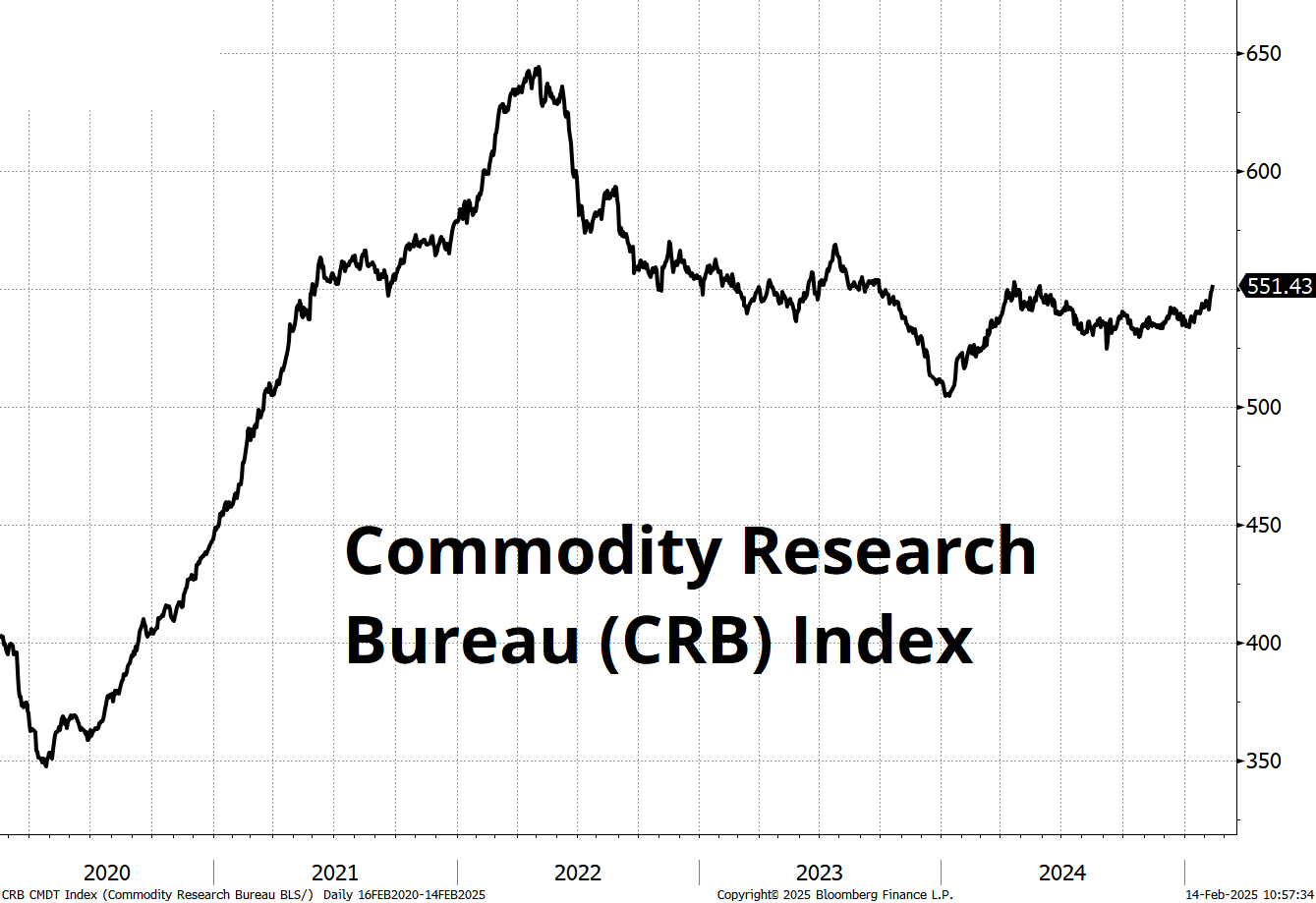

Tremendous dispersion in commodities as copper heads toward the moon, oil chops around, cocoa corrects, and coffee percolates higher every day. The net result is that the CRB Index is looking perky.

Gold is the star of the commodity show, as usual, as it punctured 2900 and has now made a bit of a double top at 2940. The 5-day moving average has defined the trend very well and we are right there as I type this.

Time for a rethink on gold? Less government spending and less war is bearish.

That’s it for this week.

Get rich or have fun trying.

How big food is attempting to short circuit Ozempic

Plentiful food has been an enormous good for the world but it’s turning into an enormous bad.

Call Me Maybe with every other beat removed. Wacky.

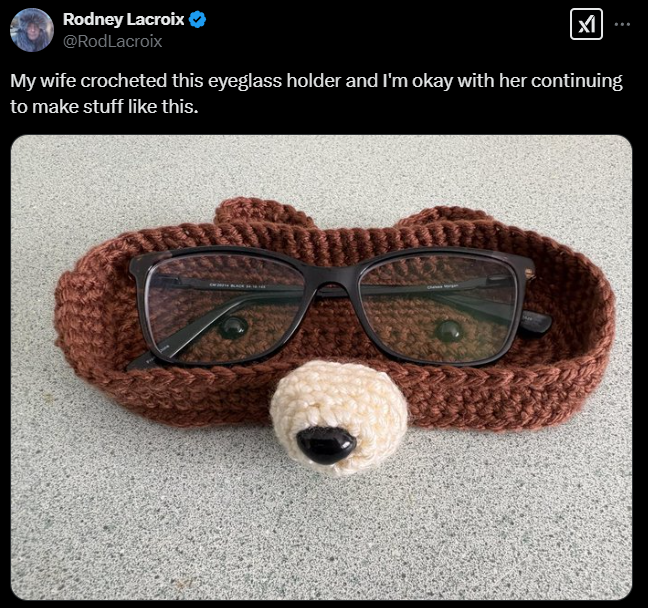

A cute tweet for Valentine’s Day

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

Even a whiff of stagflation risk should make you concerned.

New Year momentum trades often lose their mojo around mid-February.