Three more sleeps ’til Tariff Time!

Rollah Coastah

NASDAQ sharply unchanged in quiet trading this month.

Three more sleeps ’til Tariff Time!

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Try Spectra School for free!

If you’re looking for a good way to spend 35 minutes or so, check out Lesson 3 of our flagship course “Think Like a Market Professional” for free. https://spectramarkets.com/lessons/tlmp3/ There, you will find the entirety of Lesson 3, for free, along with a link to my Learning From Legends video with Ben Hunt.

The lesson is called “Surfing the Narrative Cycle” and delves into how you can understand the stories the market is telling itself. If you like it, you can sign up for the full course and use coupon code LESSON3 for $250 off the $1200 price (i.e., you pay $950 for 16 lessons and 10+ videos.)

Before we get going: If you’d like to hear Alf and I discuss what’s what re: tariffs and trade structuring (options vs. cash)… Here’s this week’s podcast. YouTube is video with charts, the other formats are audio.

The market is on pins, needles, and tenterhooks now as there are just three more sleeps until inauguration. Will Christmas come 339 days early for USD bulls? Or will we get a repeat of 2017, where everyone sat on their seat edges with butts clenched and waited for shock and awe that never came?

I am betting on the first. I think Trump regrets the pointless time wasted wrangling over Obamacare and flight bans and such and will not make that same mistake again. Instead, I think he’ll invoke the national emergency reasoning or some other section number thingy to burst out of the gate in his attempts to reorder the global trade and monetary systems.

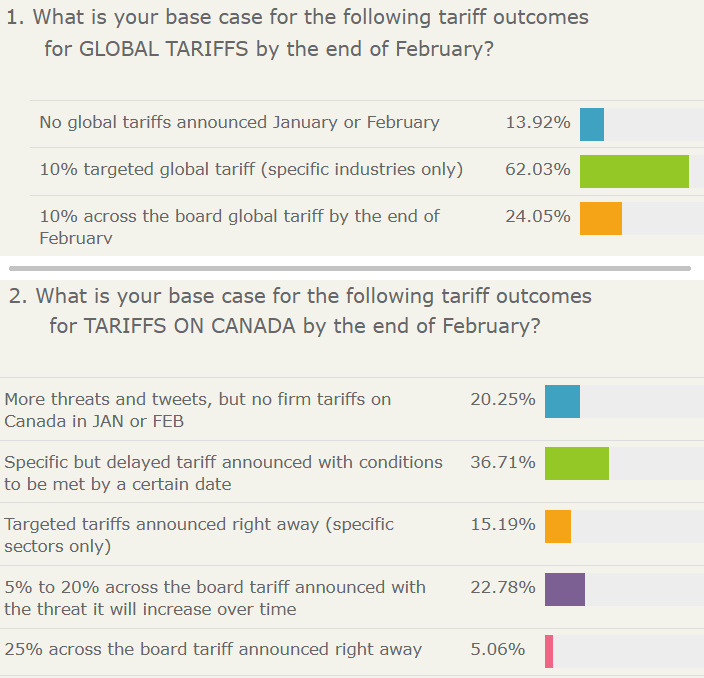

I did a reader survey in am/FX this week and respondents were pretty blasé about tariffs. The VIX is also not scared.

If you don’t subscribe to am/FX; you probably should. I write about FX, macro, trading strategy, and all that stuff. Just like reading my books, but in real-time.

https://www.spectramarkets.com/subscribe/

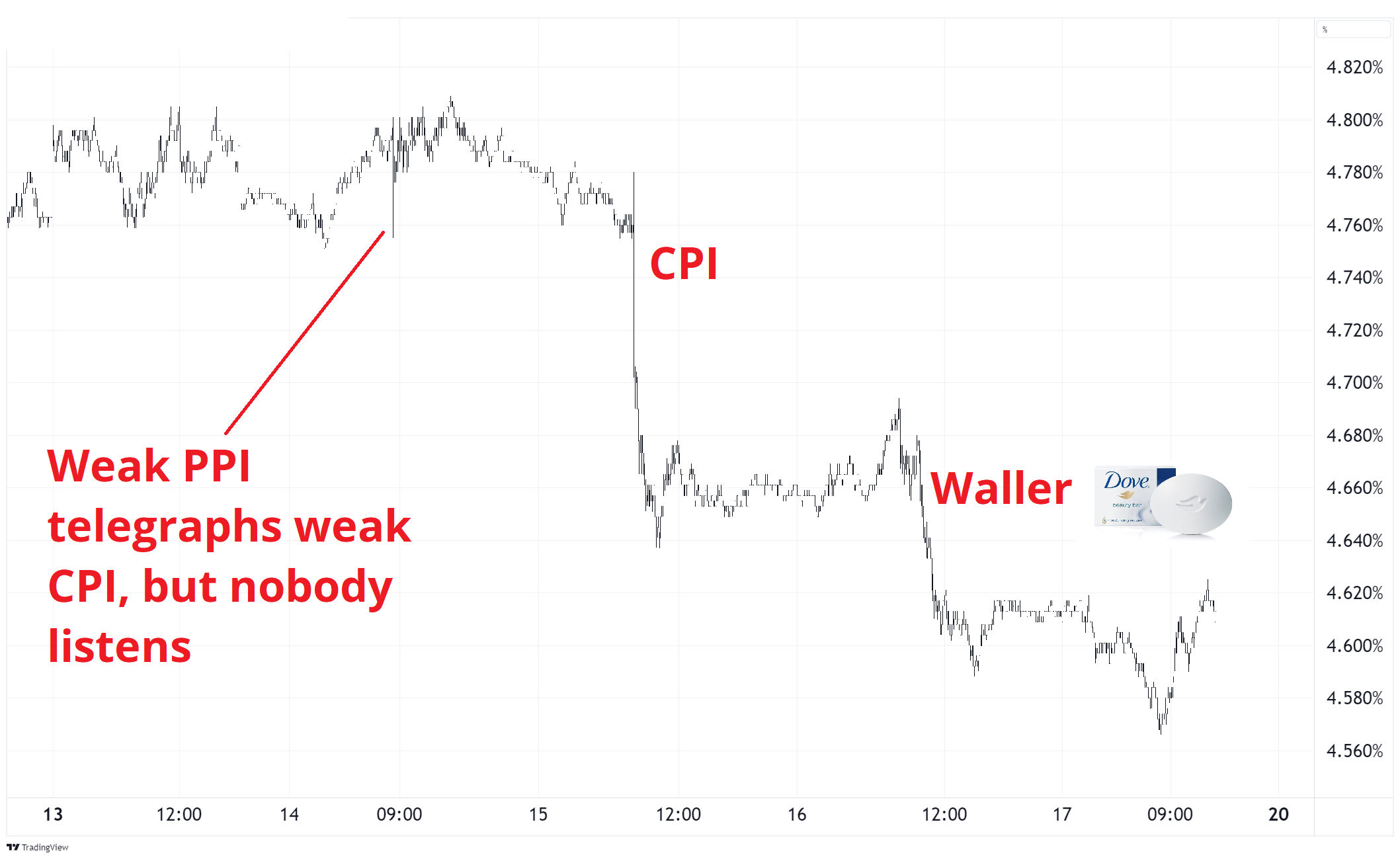

The wait for tariffs was punctuated by a few other macro stories as Waller sounded insanely dovish and the Bank of Japan basically said they will hike rates as long as risky assets don’t soil the bedsheets after inauguration.

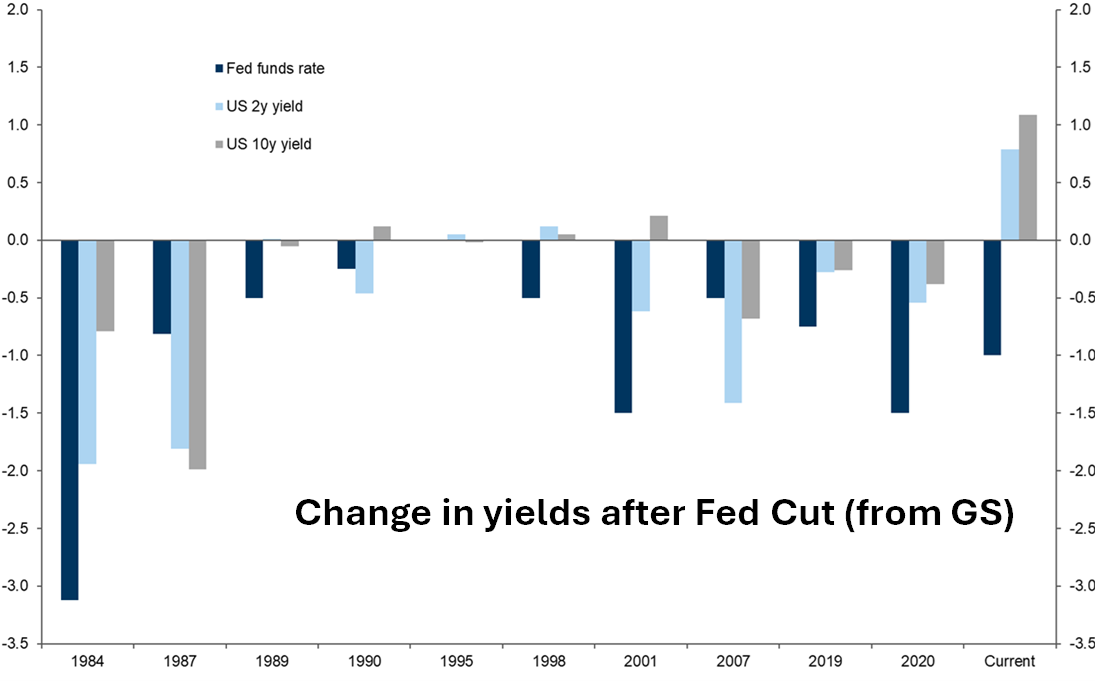

The Waller comments are a bit of a shock as he is one of the bigger names at the Fed and he continues to hang on to the idea that Fed Funds is way above neutral, even as the market screams otherwise. When the Fed cuts rates and yields shoot higher, that’s not highly suggestive of a Fed Funds rate way above r*.

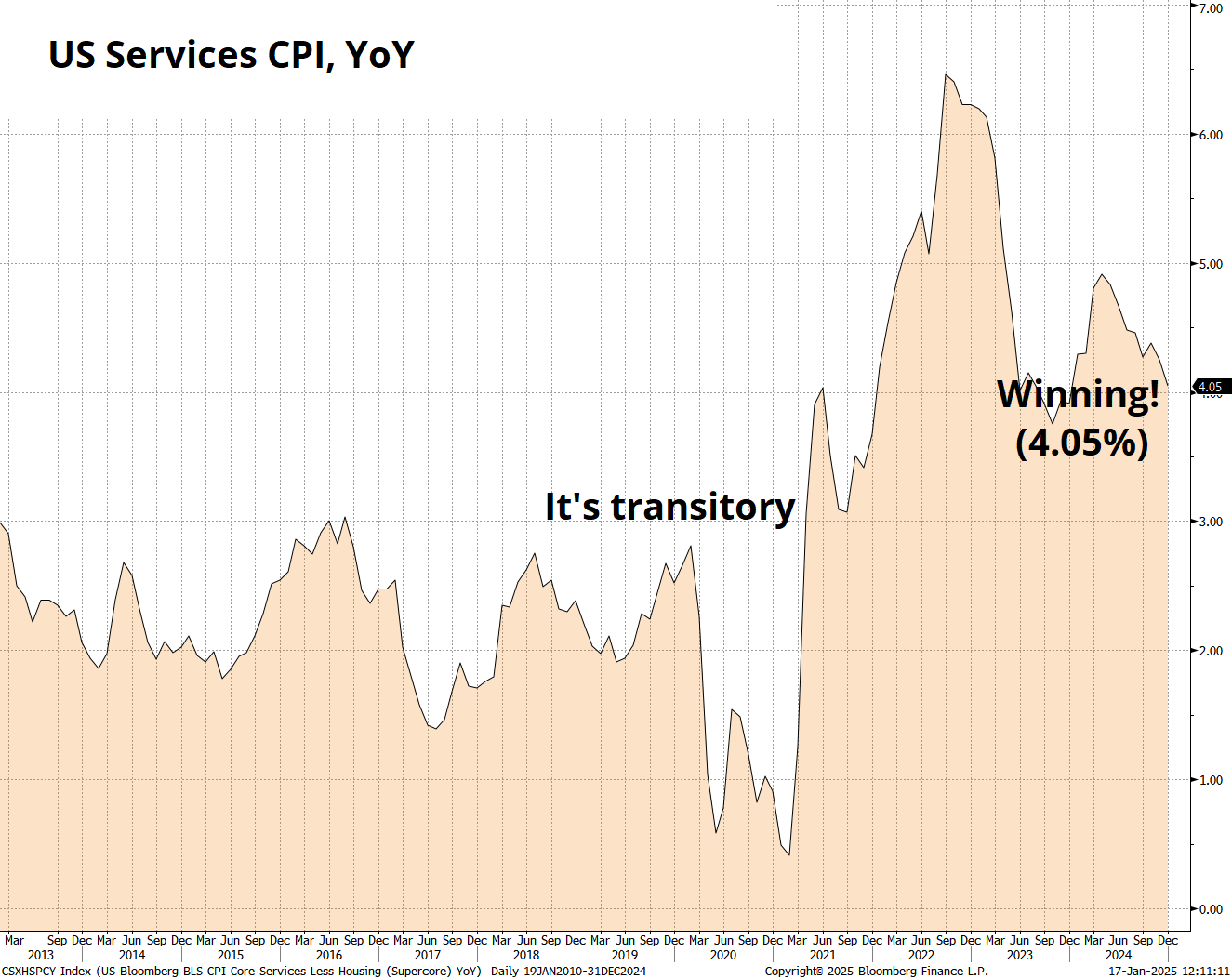

This reminds me a fair bit of the whole Transitory thing in 2021 because back then the market was equally unconvinced by the Fed’s rhetoric and eventually proved correct. The Fed was wildly behind the curve in 2021/2022 and now looks way too far ahead of the curve on its decision to cut and promise more cuts.

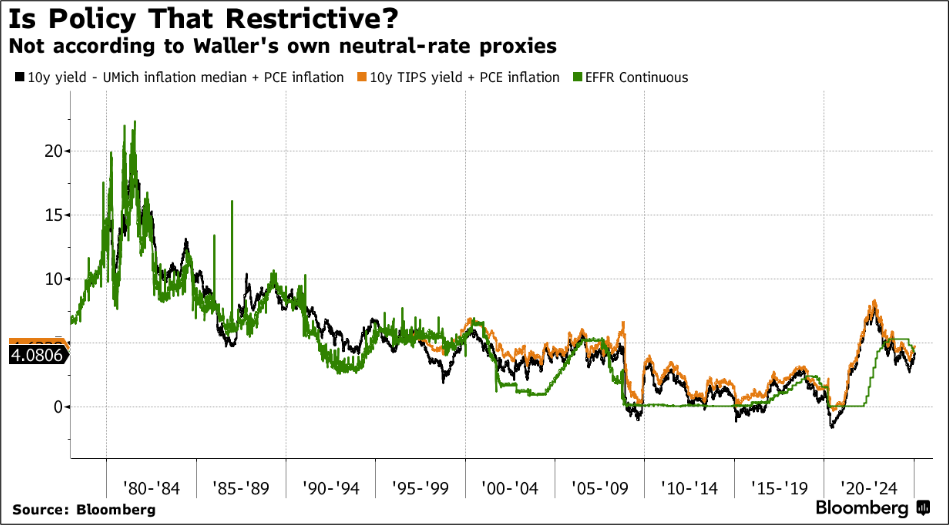

Cam Crise (aka MacroMan) makes the point that Waller isn’t even following his own rules on where the neutral rate might be.

The Fed just keeps pressing on the gas, even as commodities are ripping, inflation expectations are a teeny bit sus, and services inflation, which comprises about 2/3 of US consumer spending, still looks like this.

After years of below target inflation, CPI has now been above target for 44 months in a row and yet the Fed has enough confidence to signal sooner, faster rate cuts. Pretty amazing.

Worth noting, too, that there is a seasonal quirk in CPI which makes the December number weak and January strong and so there is absolutely no reason to think inflation is a solved problem. PCE is lower than CPI, but also above target at 2.8%. And oil and copper have roofed in January. And ISM Prices Paid is ticking up. There’s just no reason for Waller to be making these sort of promises. Even if he’s right, it’s still a bad idea to juice financial conditions in this regime, especially with so much uncertainty on fiscal and immigration policy.

Don’t forget to buy the 2025 Spectra Markets Trader Handbook and Almanac here.

It’s hard work being short stocks. One of the great short selling firms, Hindenburg, shut down this week and that is another one bites the dust moment as the mathematics, politics, and horrendous convexity of short selling in a long-term bull market make it super unattractive as a business model. And they were freaking good at it!

The letter he sent out was very classy. I don’t know him but he comes across as a well-grounded, bad ass dude.

Nathan Anderson, founder of Hindenburg

So yeah, speaking of shorting is hard…

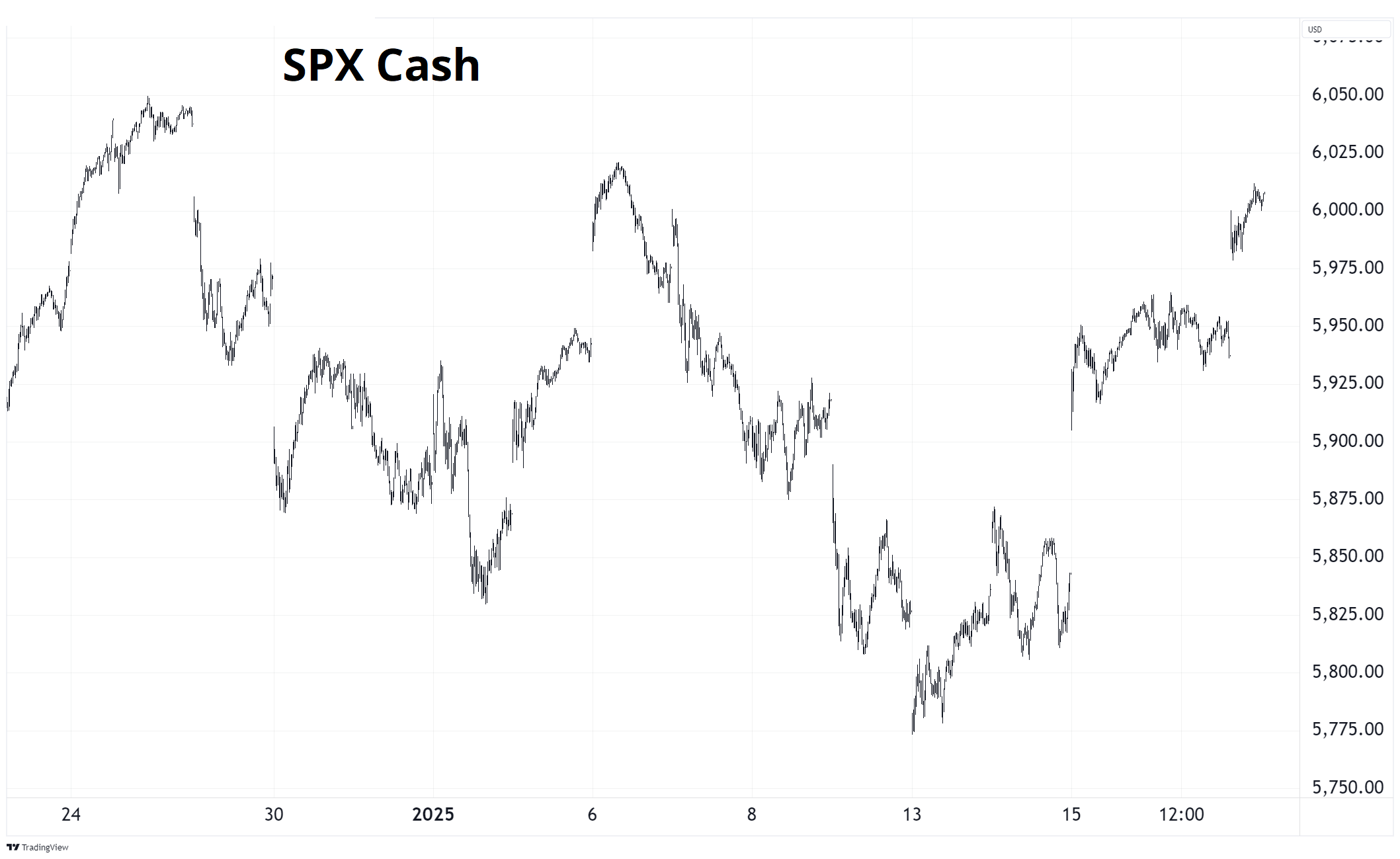

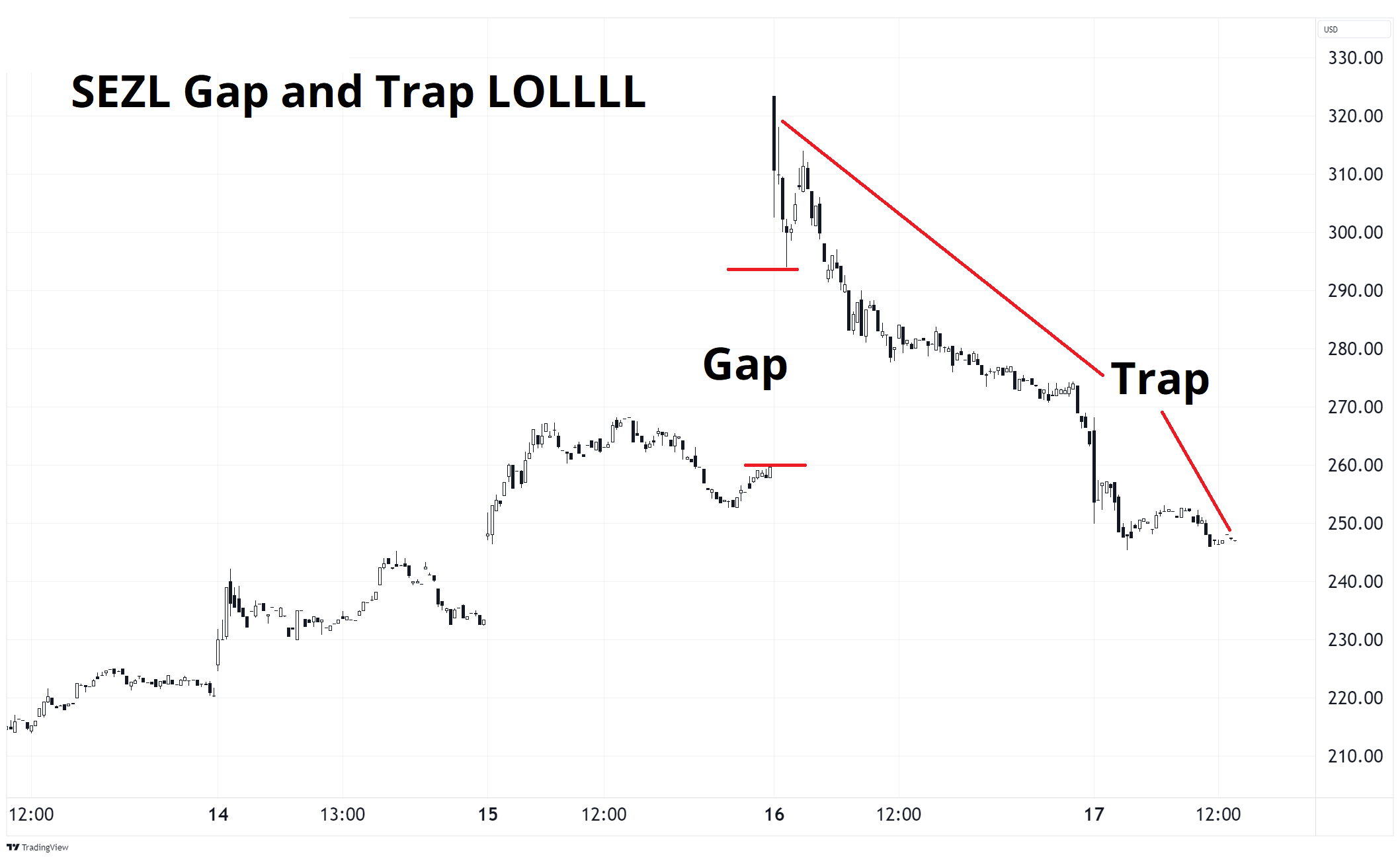

This chart screams “not fun” for anyone other than day traders. It’s a trader’s market for sure right now as the stupidest stuff like fartcoin is roofing and other stuff (QUBT and other quantum stocks) is crapping out. I am a huge fan of the gap and trap trade where something gaps massively after hours, opens up with a huge gap, then trades the other way all day. SEZL did one for the ages this week!

These are fun to trade, but incredibly hard to risk manage. If you were doing SEZL with 200 shares you risked $2,000 approx to make $10,000 and you were never OTM. They often work like that. If you’re OTM, the trade is usually wrong. If you know what you are doing, you can assess whether the gap is nonsensical or position-related and fade the ones that are and ignore the ones that are not. It’s a skill!

This week’s 14-word stock market summary:

Let’s have a face ripping rally right before the risky asset bearish tariff announcement!

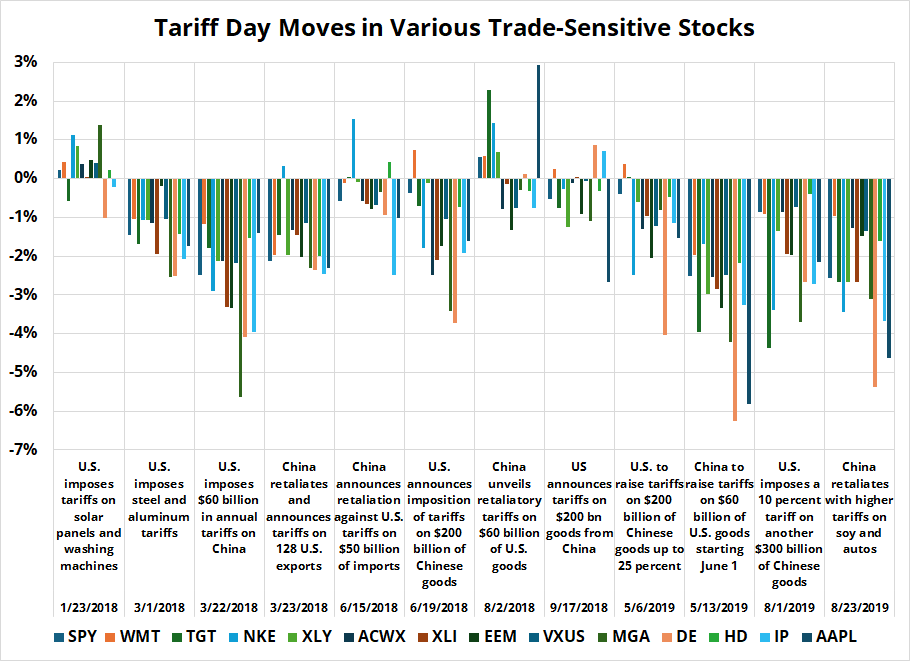

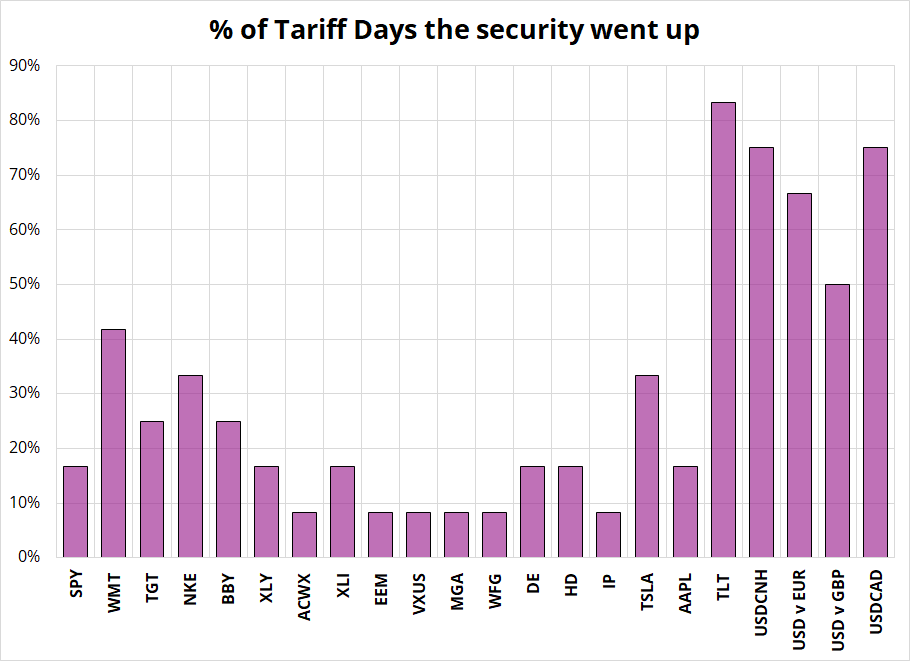

Here is the performance of various equities on the major tariff announcements in 2018 and 2019. Again, this was in am/FX earlier this week. And I also told readers that both PPI and CPI would most likely be weak. Before they were released. Subscribe, dude.

Meanwhile, the German economy hasn’t grown in two years. That must be bad for the German stock market right?

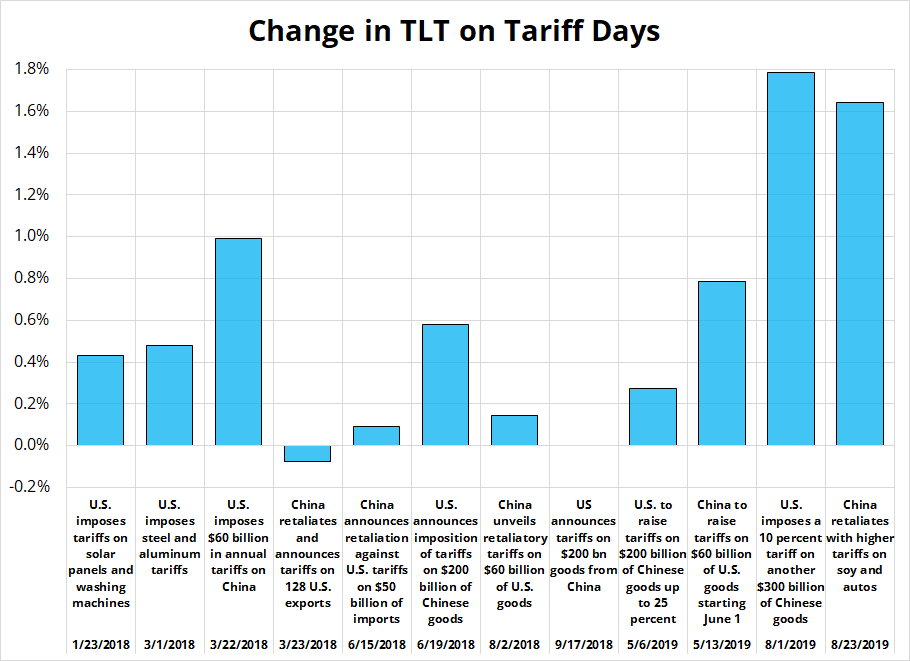

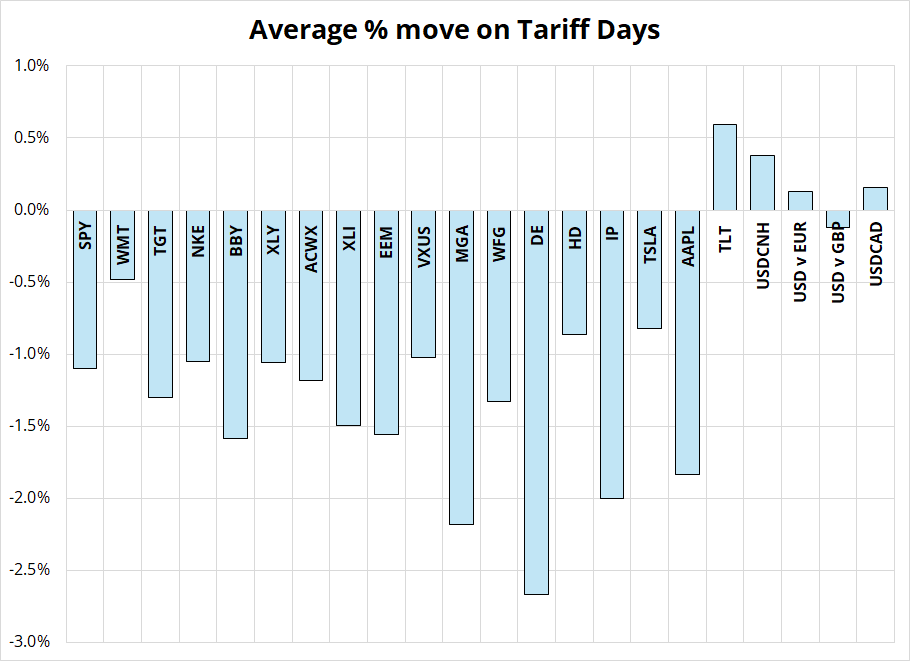

Are you curious what bonds did on tariff announcement days?

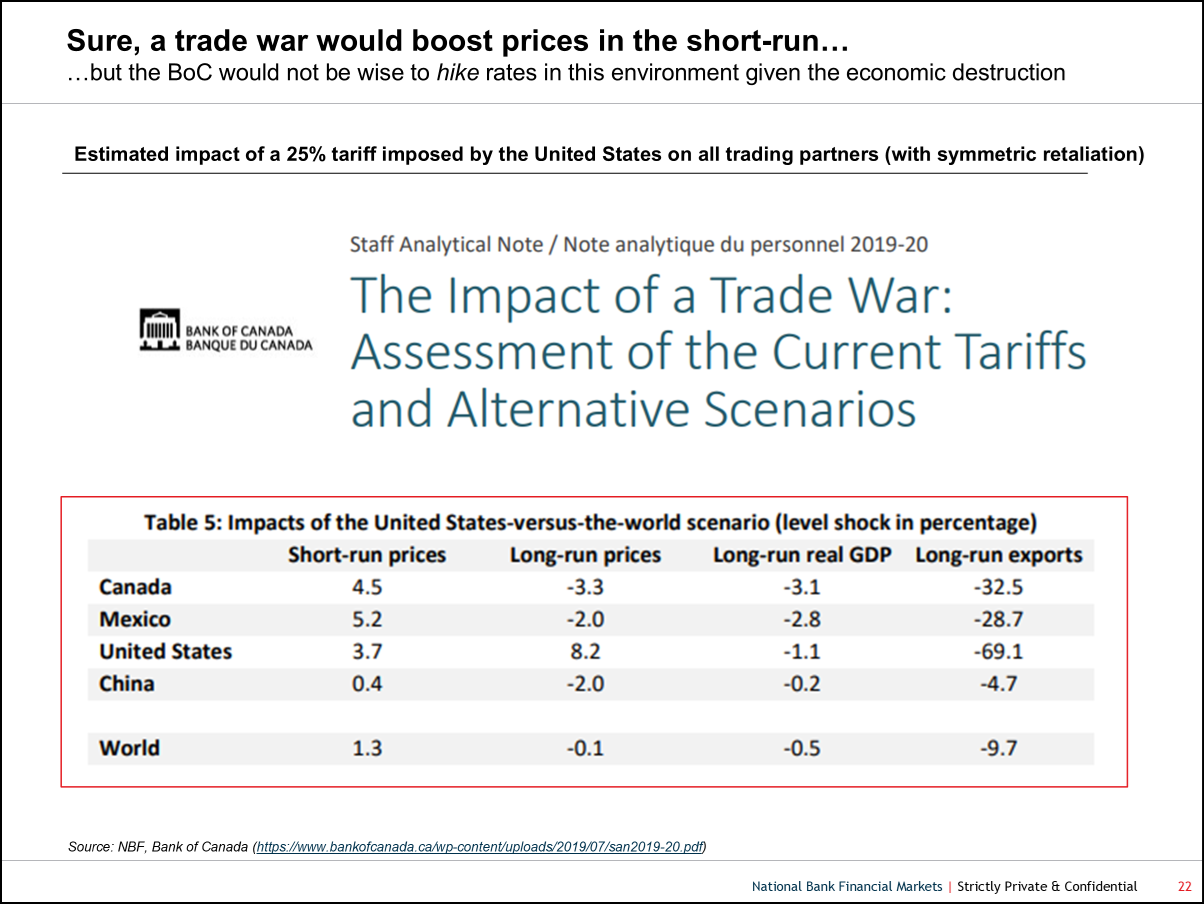

They went up, mostly. People try to argue that tariffs are inflationary but they are not. Inflation is a persistent rise in prices. Tariffs are a one off shock like a sales tax. They create a step change higher in the price level, but no inflation. Bonds look at the future path of growth and inflation and tariffs don’t really affect that very much.

In fact, tariffs have a negative economic impact as trading partners retaliate and they are bad for risky assets, so the announcements create a flight to safety (buy bonds) trade.

Here’s a worksheet from the Bank of Canada.

Don’t sell bonds on tariffs!

The madness of King Waller and the weaker-than-expected PPI and CPI figures triggered a zippy rally in bonds this week as we once again hit the wall on Fed expectations just as people start talking about a resumption of rate hikes. The bar for the Fed to hike rates is incredibly high and the bar for them to cut rates is like:

So every time we get to a point where someone calls “rate hikes!!”, yields do the Fosbury Flop.

Here’s the highlight reel for 10s this week.

The Bank of England also came in super dovish this week, arguing that sky-high gilt yields are a reason to frontload rate cuts. This might be true in the UK, but the irony is that if the Fed cuts to try to tame the long end, the long end will sell off more as the Fed’s inflation fighting credibility will further erode. To tame the long end, you often need to hike rates, not cut them. That is especially true in emerging bond markets such as Mexico, Brazil, and Great Britain. Hard to say if BoE cuts will help the gilt situation, but they should definitely hurt GBP.

Tariffs or no tariffs?

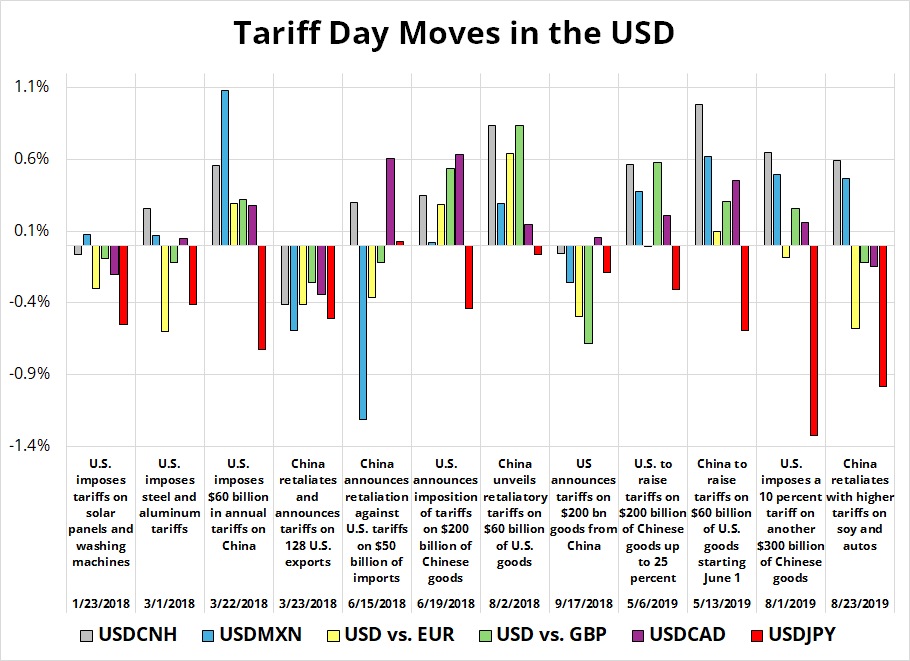

What impact will tariffs have on FX? There’s a spreadsheet for that! In FX, the outcomes are predictable and consistent. USDCNH and USDMXN mostly go up, EUR down, USDCAD up, and USDJPY down. That makes sense and translates to cross/JPY lower.

It is important to note that the USDJPY and cross/JPY moves are contingent on the bond move, as cross/JPY listens to yields and not the other way around. So, if you think tariffs are going to be viewed as bond-negative, short cross/JPY is not the answer on large tariffs.

Last two charts here summarize the reliability of all the assets I studied by showing the percentage of days the security went up, and the average move.

I think tariffs are coming next week and the USD will head towards Mars even as the position is already crowded. When huge macro events happen (e.g., Abenomics, ECB QE, etc.) positioning doesn’t tend to matter. USDJPY started at 82.00 in Abenomics, and was SUPER crowded at 95.00 and straight-lined right to 125.00. The runup to ECB QE took EURUSD from 1.40 to 1.30 then the actual QE took it from 1.30 to 1.05. Positioning matters but macro can be bigger, by far.

I’m often a donkey on crypto but last week’s warning to stay away from MSTR shorts was nice as we are ripping into inauguration and a possible stock split next week. The big MSTR shareholders meeting takes place January 21.

I am not sure if inauguration will be a buy rumor / sell fact trade for crypto. It’s been washing around 90k/105k for ages and doesn’t feel like the typical massive speculative runup into a big event. Then again, if he says something like “not considering bitcoin strategic reserve” or whatever, leveraged longs might have some headline risk.

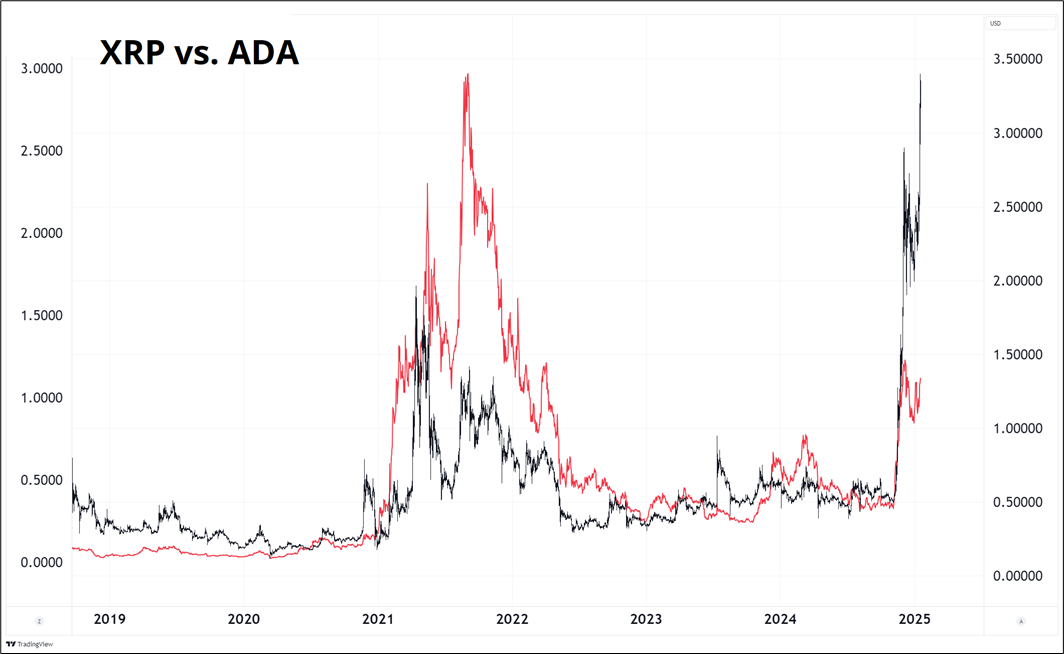

In the earlier days of crypto, people used to always talk about Ripple and Cardano as two great coins with impressive use cases. We have subsequently learned that the use case is mostly just to gamble and/or “invest”. But I was curious how those two brothers were doing these days, so I took a look.

You can see ADA was a bigger winner in 2021 and now Ripple is the bestest. The most amazing thing is that there is enough money out there to chase all these 1000s of shitcoins and payment solutions and all that. There is an endless supply of new money coming in each cycle whether it’s Dog Wif Hat or Fartcoin or Jeo Boden or whatever.

I love that you can just type “fart” into TradingView and it autocompletes right away with “FARTCOIN / USDT”. This is the technology we deserve!

Bitcoin as money remains an oasis out there a few years in the future and has been that way for 15 years now. The near-complete absorption of bitcoin by the TradFi and USD-based systems has been intriguing and sometimes confusing, but now we are in 2025 and basically bitcoin is another risky asset with higher vol and some uniquely cool optionality. Nobody really questions the fact that the USD and bitcoin go up in tandem, even though bitcoin was supposed to be a substitute for the greenback. Instead, it’s another (more fun) layer of the USD system. That’s not a criticism, I just find it super intriguing how wrong the thesis was and yet how delicious the gains have been.

And now the narrative has evolved to: “We want the government to protect us by buying bitcoin.” The hated banks and governments win again. But so do the HODLers. Someone needs to write a PhD thesis: “The Horseshoe Theory of Bitcoin: Where Libertarians, Oligarchs, and Republican Governors All Meet.”

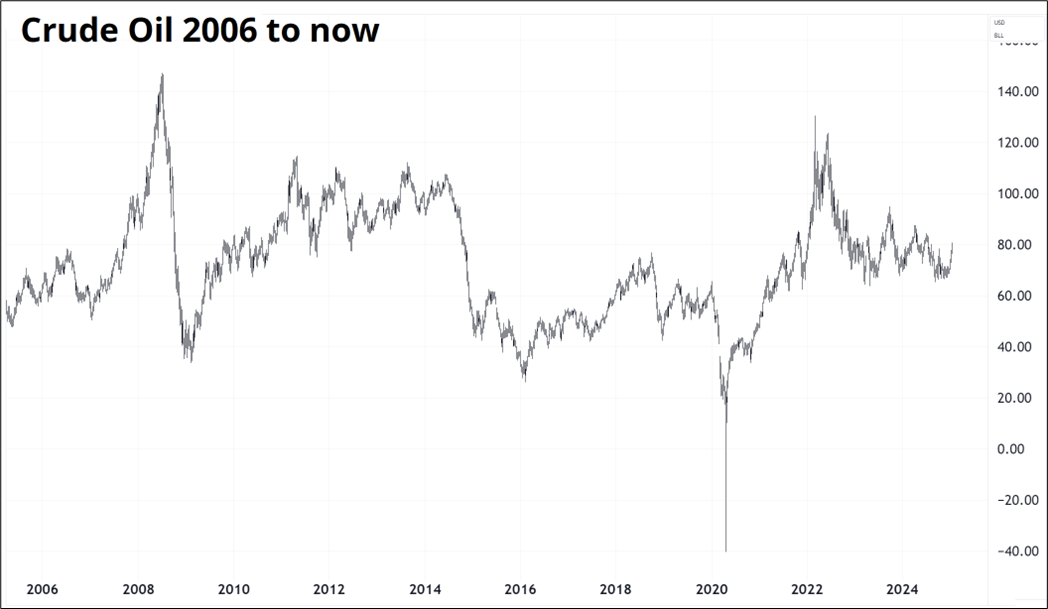

Commodities are ripping as everyone tries to get whatever they need before the tariffs and a decent short base in oil and copper are rinsed. It’s hard to make money in something that looks like this:

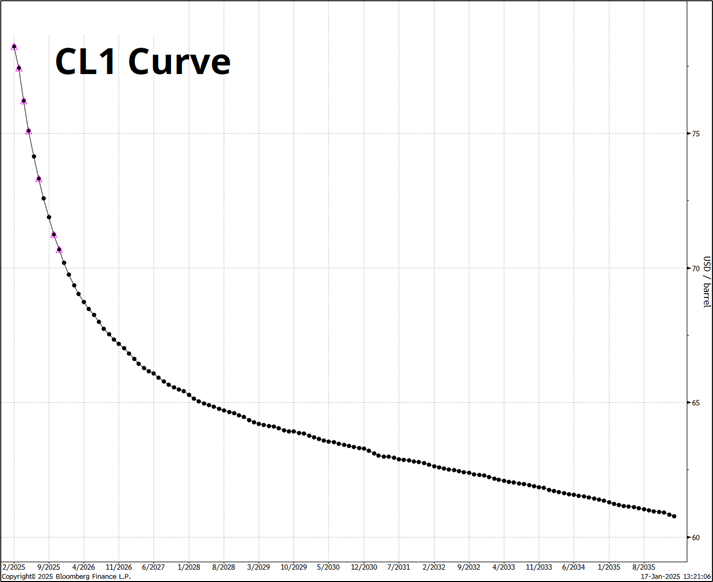

When the curve looks like this:

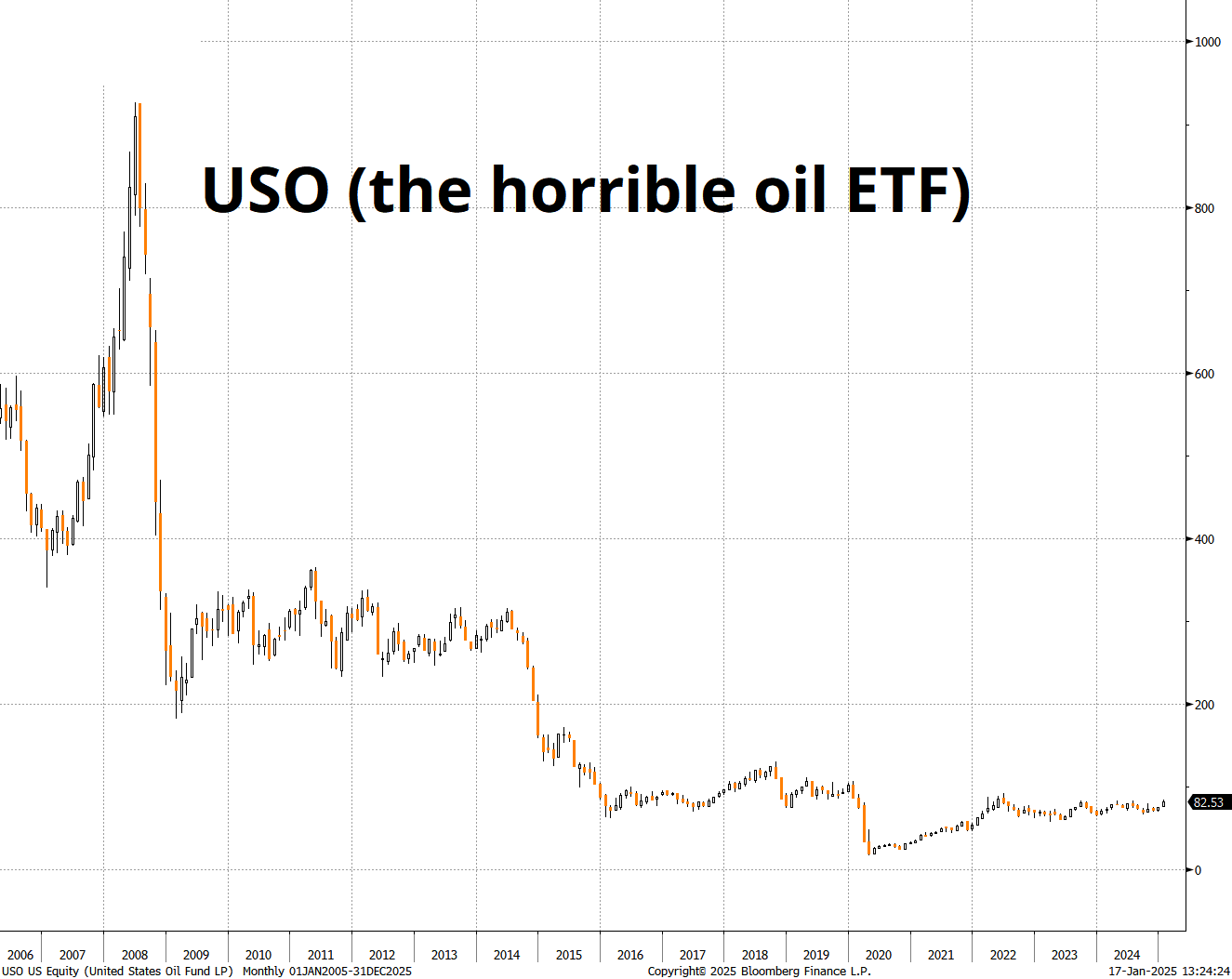

You end up with an ETF that looks like this:

To be clear about the label on that chart: It’s a horrible ETF that does a bad job of tracking crude oil. It’s not an ETF that invests in a product called “Horrible Oil”. I can see why you were confused.

That’s it for this week.

Get rich or have fun trying.

Netflix is deliberately making shows dumber

Studios now target surefire mediocre.

While we wait for Phoebe Bridgers to re-emerge, this will have to do. Cool video as she walks around NYC.

The Greatest DJ Set

One of the best nights of my life and definitely the greatest DJ set I ever heard was my 30th birthday at System Soundbar in Toronto. That place was special. Jen, Mandy, Christine, Tom, and I don’t remember who else. :]

Amazingly, I recently found the entire 4+-hour set in high-fidelity on SoundCloud. The best part is when he mixes Everything in its Right Place (Radiohead) with Climbatize (The Prodigy) in Part Four 1:04:00 to the end. Climbatize comes in around 1:09:00. Savage. Keep in mind this was 4 hours into the headliner so probably around 3:30 a.m. Back in what they call “the good old days”.

If you need great early-2000s trancy house, check out the whole set it’s about four and a half hours long total.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

NASDAQ sharply unchanged in quiet trading this month.

It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

Time of day patterns in foreign exchange are surprisingly persistent and have never been more relevant.