Trudeau resigning is probably bullish CAD. Scaled tariffs are probably bearish USD.

Rollah Coastah

NASDAQ sharply unchanged in quiet trading this month.

Trudeau resigning is probably bullish CAD. Scaled tariffs are probably bearish USD.

20% of Anguilla’s GDP in the past few years has come from selling .ai domains. Lucky!

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC 7:30 a.m.

Short EURSEK @ 11.52

Stop loss 11.7110

Cover 31DEC 7:30 a.m.

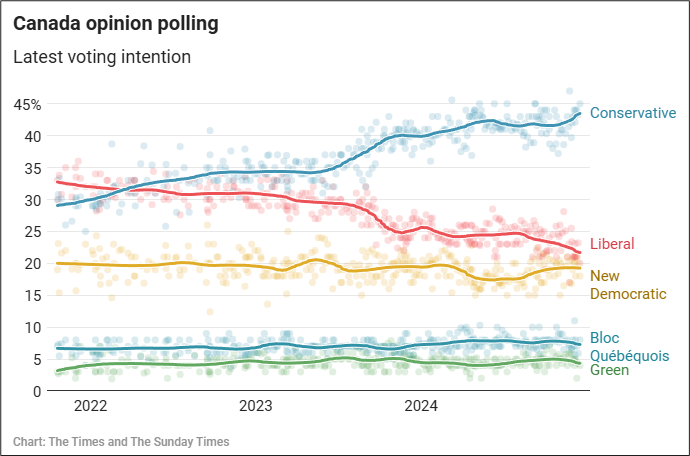

I am getting a lot of emails asking what happens if Trudeau resigns. I think the kneejerk reaction would be a quick USDCAD pop, but that pop is a fade and USDCAD will end up going lower because:

So that’s my view. USDCAD up 30 down 60 on a Trudeau resignation. Trudeau’s resignation is bullish CAD, but would only be the start of a long process where perhaps Chrystia Freeland first becomes PM and an election comes in Q1 2025.

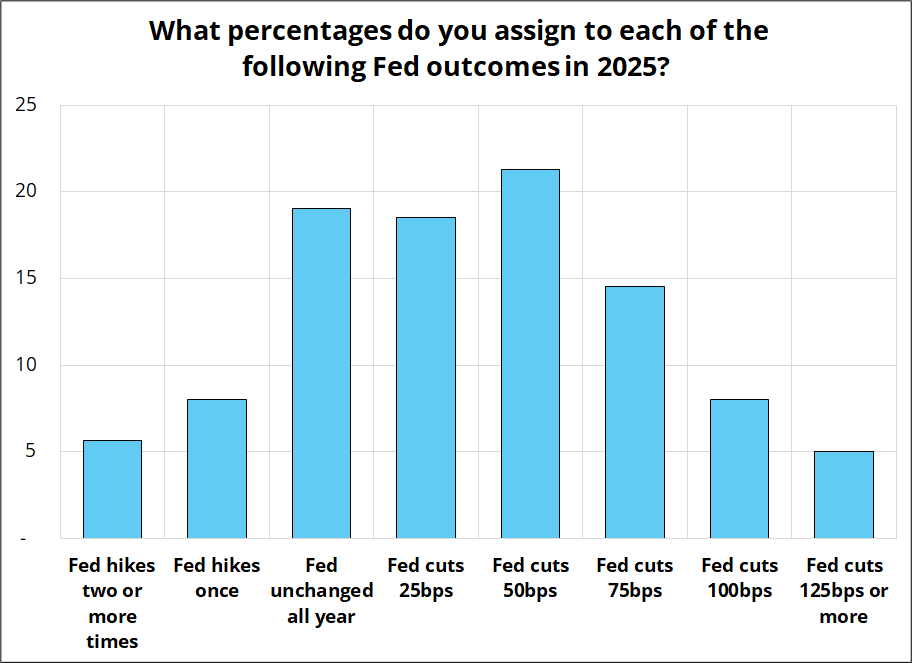

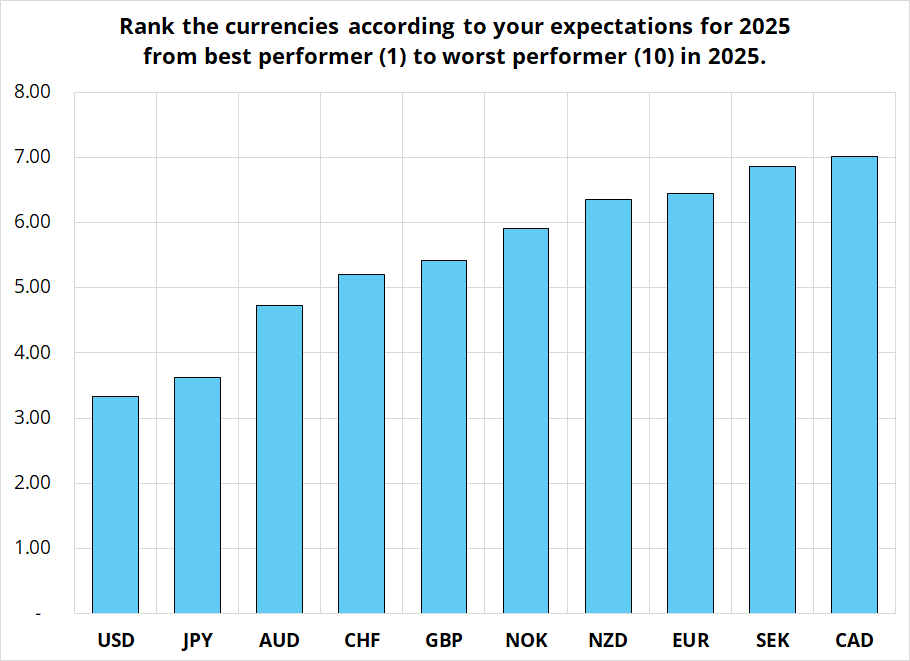

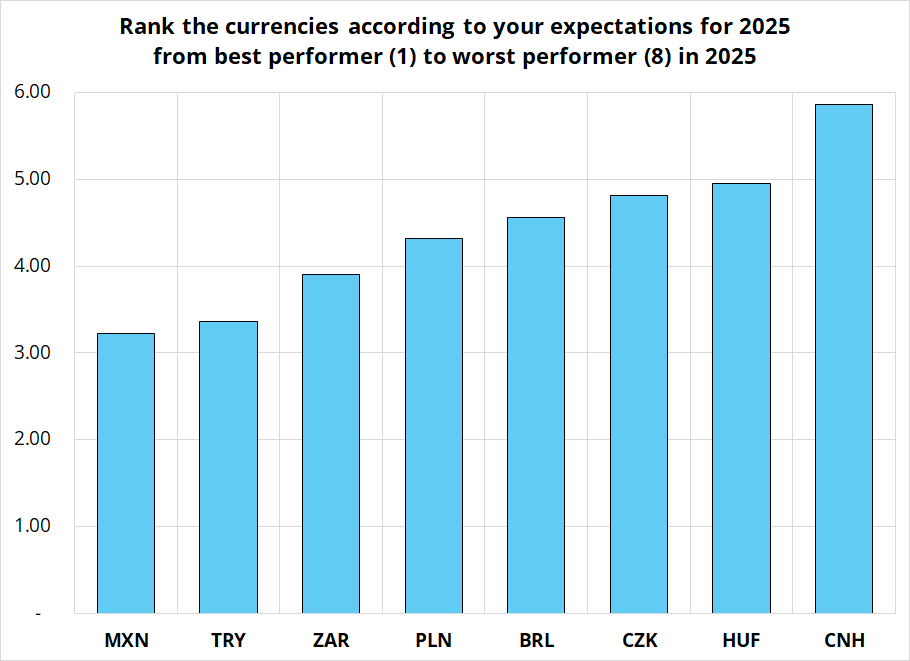

Results are mixed on the Fed, and extremely bullish risky assets. People prefer USD, JPY, MXN, and TRY and hate CAD, SEK, CNH, and HUF. The y-axis on all charts shows the percentage of respondents that picked each result.

As one might expect, the USD is the favorite currency, and CAD is the least favorite. The chart reads left to right, most to least popular (because a rank of 1 is best, and 10 is worst).

Less dispersion in the world of EM as nobody knows what to do other than sell CNH. I don’t understand why MXN is so popular vs. CAD. They should logically be in the same bucket and the Mexican border is causing way, way more problems for the United States than the Northern one. I have been screaming about how USDCAD topside was too cheap and vol was too low in CAD but now it looks to me like if you’re a tariff person, you should be getting out of CAD topside and buying USDMXN topside. The CAD trade has happened now and the risk is Trudeau is out, and things rapidly become more conciliatory and Mexico becomes the 51st state instead of Canada. Whatever happens, the sentiment gap and positioning differential between Canada and Mexico both make absolutely zero sense.

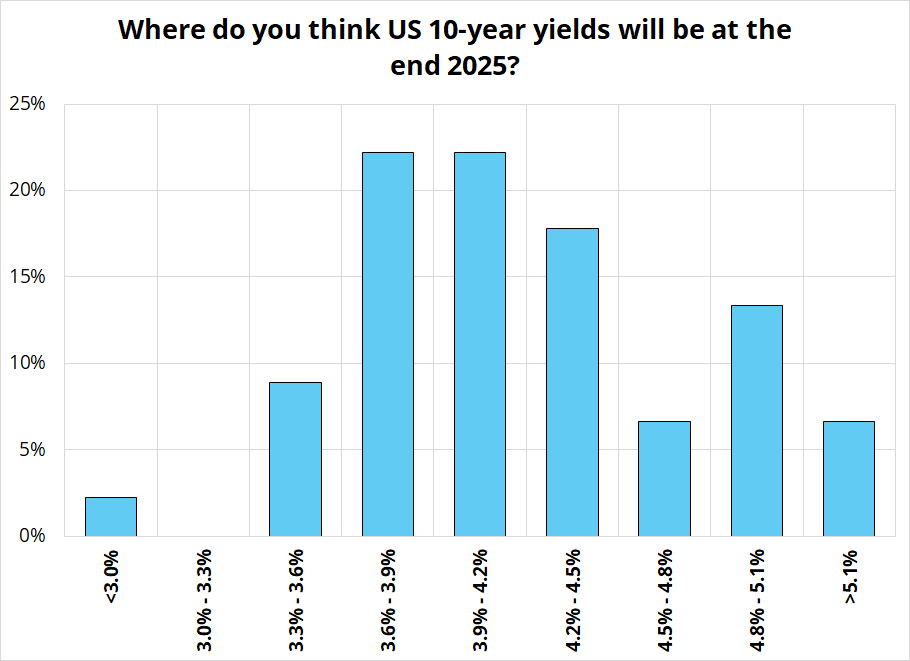

People mostly expect lower or way higher yields. The “unchanged” bucket is underloved.

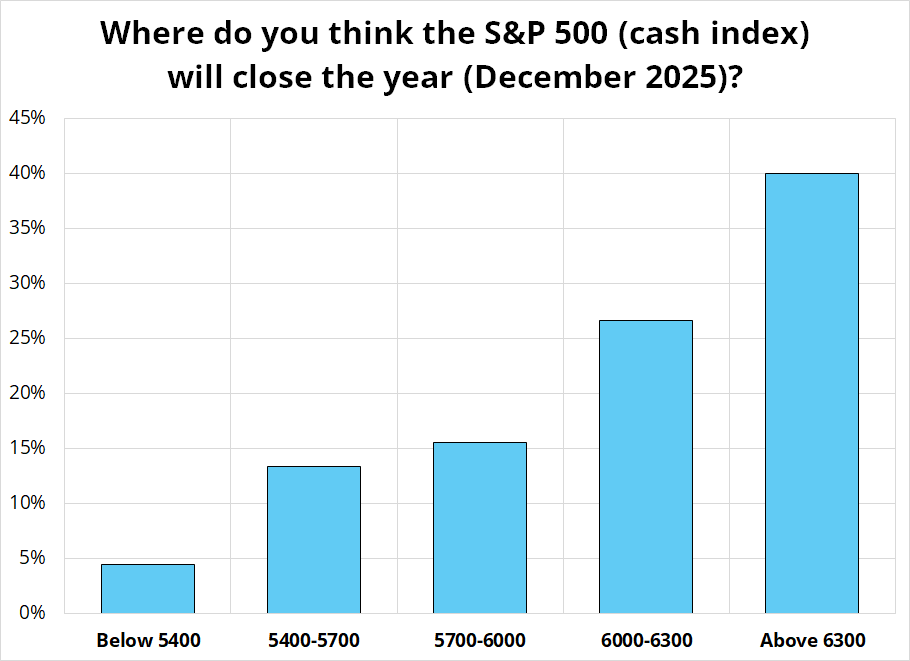

I probably made the buckets wrong for this one because 40% chose the highest one! LOL. This is consistent with every strategist on the street, every survey, and every positioning analysis. The Fed is no longer a tailwind, they’re back to just being a put again. I think people are way too bullish.

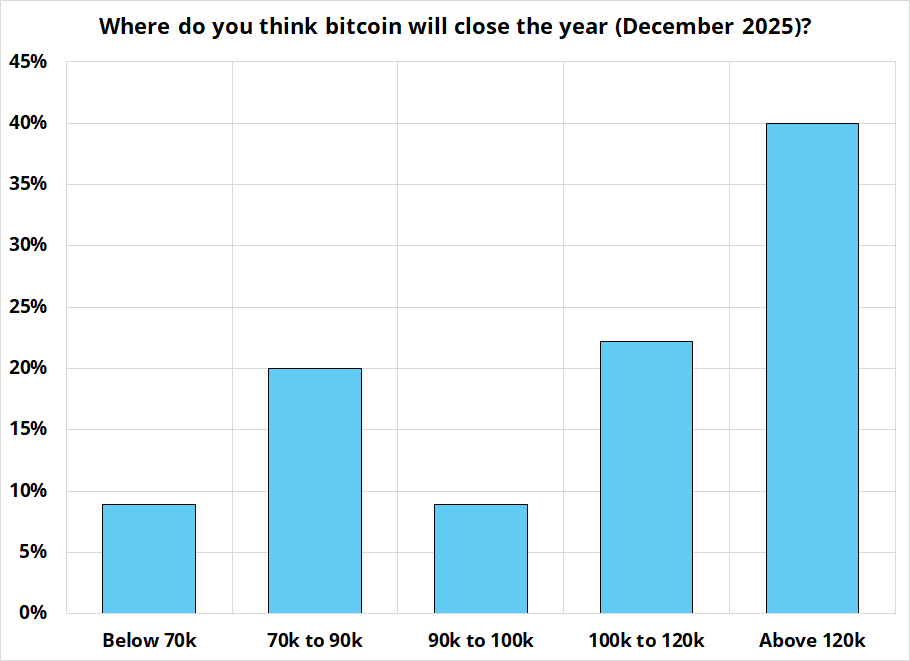

Same deal with bitcoin. Everybody on one side of the boat. Given my readership skews heavily tradfi, this is even more stunning.

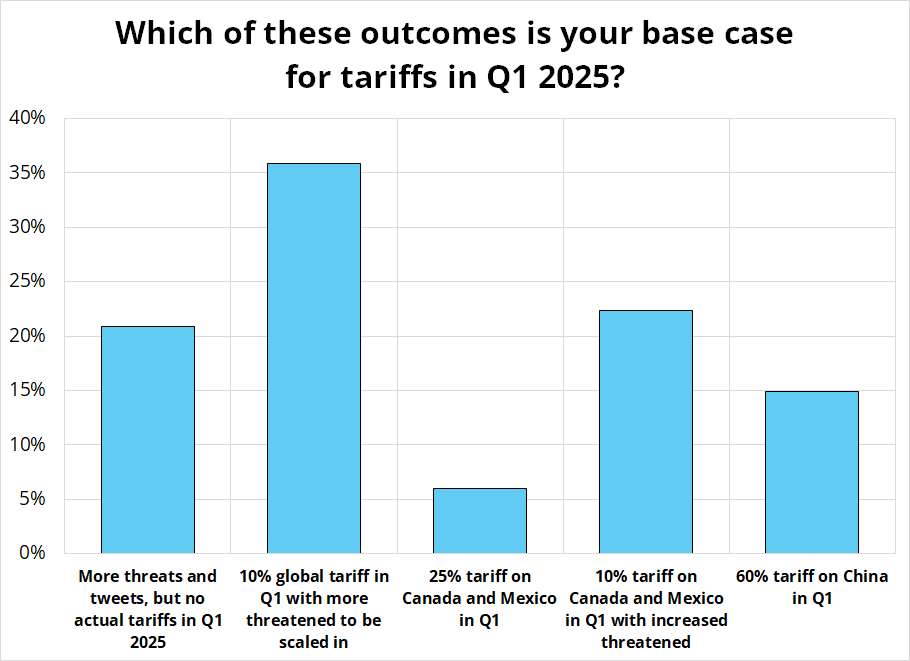

The final questions asked how the Q1 tariff story might play out.

This all makes sense to me.

DJT nominated Stephen Miran to head the Council of Economic Advisors over the weekend, and that is an excellent segue from my last survey question. Conveniently, Miran has written a bit of a magnum opus on tariffs, and I suggest you take the 20 minutes to check it out. He provides a good description of why tariffs are easy and devaluing the dollar is hard and how tariffs could lead to a lower USD later in Trump’s term. Miran wrote the essay as a Senior Strategist at Hudson Bay Capital, but it presumably reflects his worldview. You can read it here.

I often excerpt from long form pieces like this for your convenience, but I think I would be doing you a disservice in this case because it’s worth reading the whole thing. Thanks DH for sending it to me.

The super interesting question that emerges from this essay is: How do markets trade if Trump announces a 2% tariff on Day 1, with a 2% increase every 2 months for 2 years. This is an example of something that could happen, and it’s a pretty confusing one to trade! The market will see “tariff” and buy USD but then realize that the slow-motion scaling in is perhaps bearish vol and logically reduces the economic impact while maintaining maximum pressure on allies and foes alike. This approach would also be consistent with Bessent and Musk’s views that scaling tariffs is smarter than one big supply-chain distorting tariff on Day One.

If tariffs are a national security and geopolitical negotiation tool, and nobody wants to destroy the economy with a massive hammer right out of the gate, the slow and scaled approach makes sense. The market implications are confusing, but my guess is that we would see:

The more I think about it (and especially after reading Miran’s piece and remembering Musk and Bessent’s views)… The base case is probably some kind of low tariff with rapid scaling. You need to figure out what that would mean for your portfolio before January 20th. Please let me know if you disagree with this as the base case because maybe I am missing something.

As I think about this scaled-in approach and contrast it with extreme USD positioning and sentiment, I am less confident that long USD is the trade right now. While I am too scared to go short USDCAD (even though that’s probably a fair play right now given the RSI, positioning, and high tariff expectations), I can at least take profit on the short EURUSD. I will do that now. The main reasoning on the short EURUSD was that I expected a very hawkish FOMC. We got that, and the trade seems played out for now. Year end is pretty random.

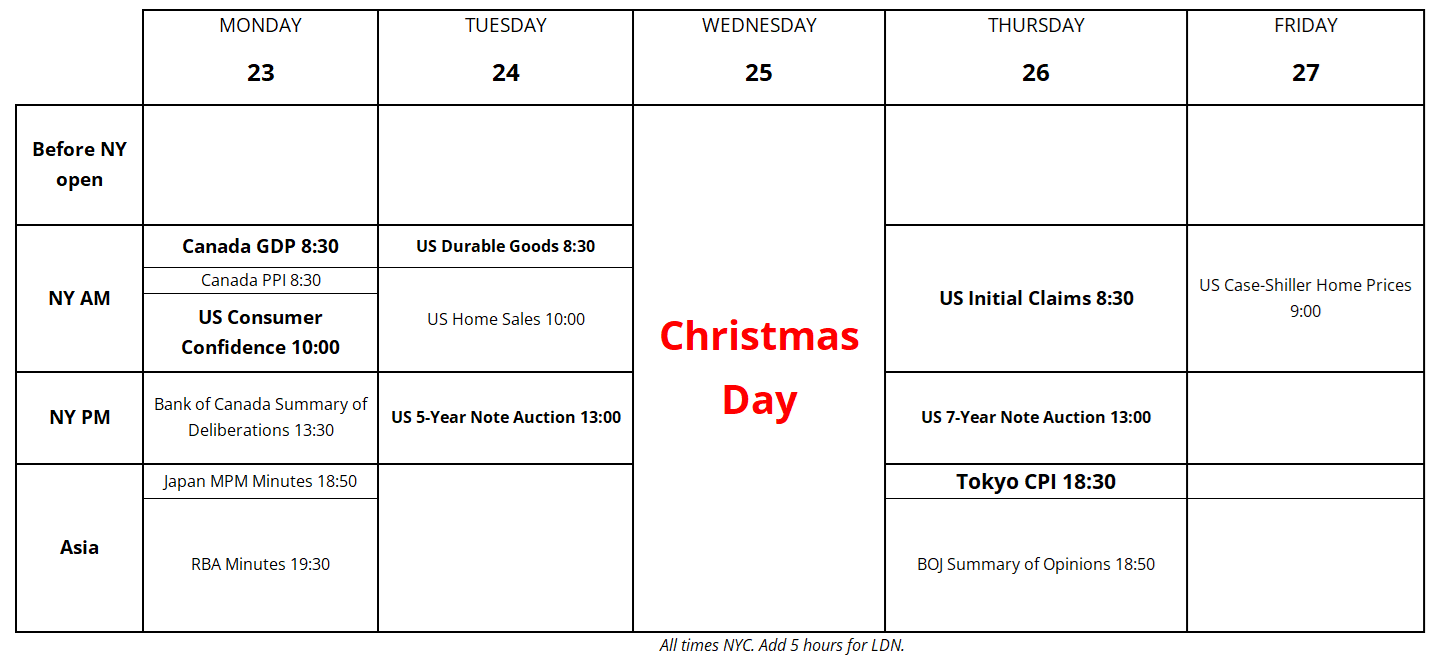

This week’s calendar is light, as one might expect, but please note that I missed a Ueda speech when I created the calendar last week (thanks ASY!) There is no time listed for the speech, and it’s not on Bloomberg, but the Bank of Japan’s website shows Ueda speaking 25DEC24 (no time listed) at the Meeting of Japan Business Federation in Tokyo. Given the dovish tenor of everything lately, a hawkish speech would be the surprise.

On this arctic cold day, you might consider donating to a homeless charity in your area. Finally: This is the last am/FX until Monday, December 30. Thank you to everyone who has subscribed to and interacted with my work this year. Merry Christmas, Happy Hannukah, and happy everything else! I appreciate the opportunity to continue to do such a fun job after so many years. Have a healthy and peaceful holiday!

20% of Anguilla’s GDP in the past few years has come from selling .ai domains. Lucky!

NASDAQ sharply unchanged in quiet trading this month.

It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

Time of day patterns in foreign exchange are surprisingly persistent and have never been more relevant.