Peripheral debt and EUR in the spotlight as memories of the Eurozone crisis bubble up.

An odd version of disinversion

Lot of strange things going on. Feels like a bit too much leverage out there.

Peripheral debt and EUR in the spotlight as memories of the Eurozone crisis bubble up.

The selection of Microsoft Excel themed pillows available is wider than I would have thought

Flat

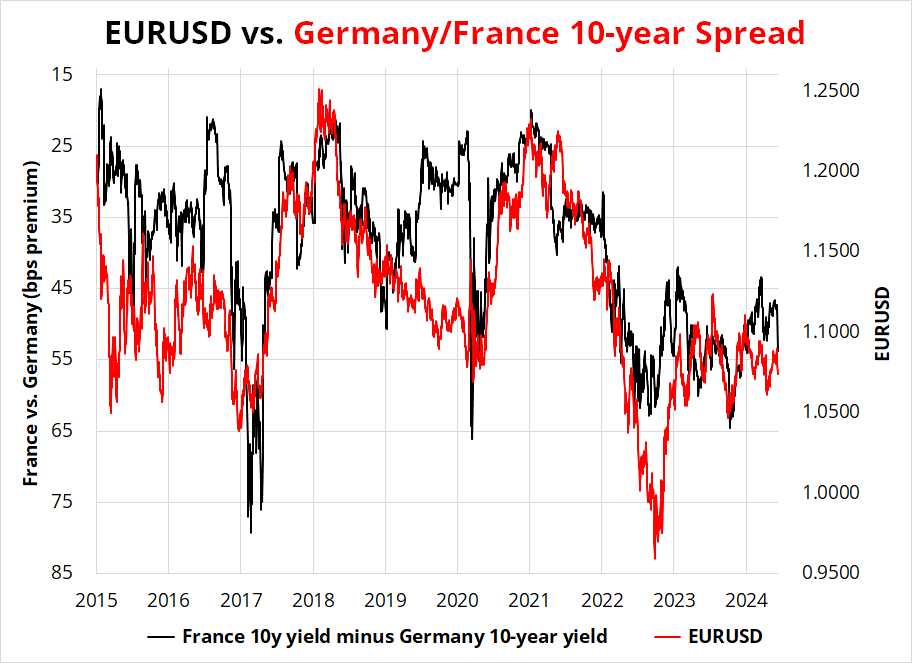

The spate of bad news in European politics over the weekend came out of nowhere, as once again the market (including me) was unprepared for an important political event. Even before this weekend, non-German bond yields in Europe have traded with EURUSD because: a) Long periphery (or even France) is long carry and trades like a risky asset and b) the EU energy crisis in 2022 was bad for all European assets and hurt higher beta assets more than German ones.

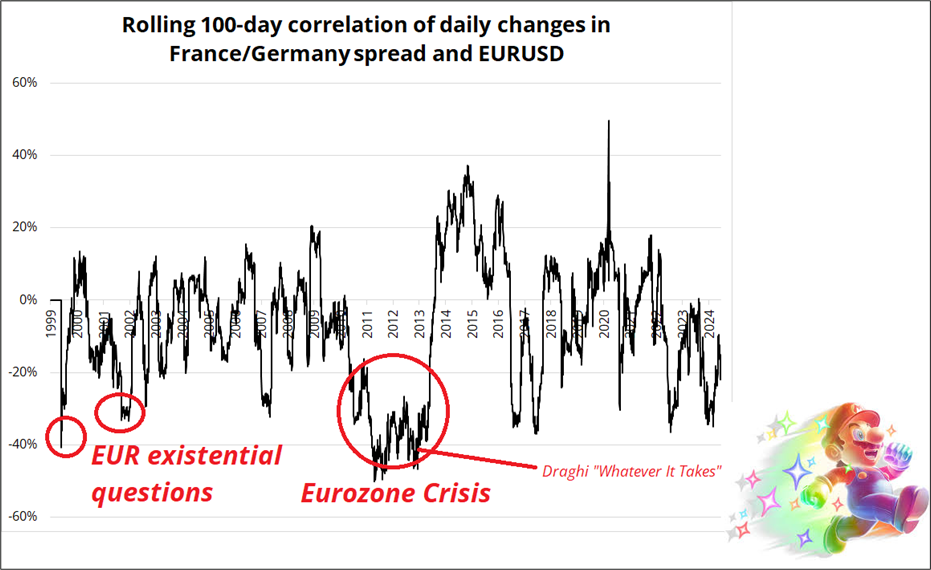

This Germany vs. X Country in Europe spread chart was all the rage in the Eurozone crisis because the spread between Germany (safe) and other EU countries (less safe) was a perfect gauge of Eurozone breakup… And so was the EUR. If people were more afraid that Greece or Italy or Portugal were going to Grexit, Italexit, or Portugexit, they sold those bonds and sold EURUSD.

They bought XAUEUR, USD, and funders like JPY and CHF. The next chart shows the correlation between EURUSD and the France/Germany yield spread. Negative correlation means stress because that would be “spreads higher, EURUSD lower” and vice versa. Then Super Mario snagged an invincibility star.

If you trade EUR, make sure you have some peripheral spread charts up.

My kneejerk reaction to the weekend news was that Macron is still likely to be president until 2027 and therefore this EUR selling should be somewhat limited. But! Then I think about the fact the election is coming so soon and therefore the pressure on the currency (and the periphery) could continue because people are scarred from too much complacency on the Mexico news, and nobody is going to want to hold European assets into the June 30 vote, just in case. As such, there will be plenty of sellers of peripheral debt as those are big positions in carry land, and there will be few eager buyers. A buyer’s strike could thus keep this thing going, even if the odds of a Eurozone breakup in the next 10 years have only ticked up marginally.

I think this could be a two-week trade (EUR lower) given the market is long EU peripheral debt and is likely to now overreact to the EU news after initially underreacting to the Mexico news.

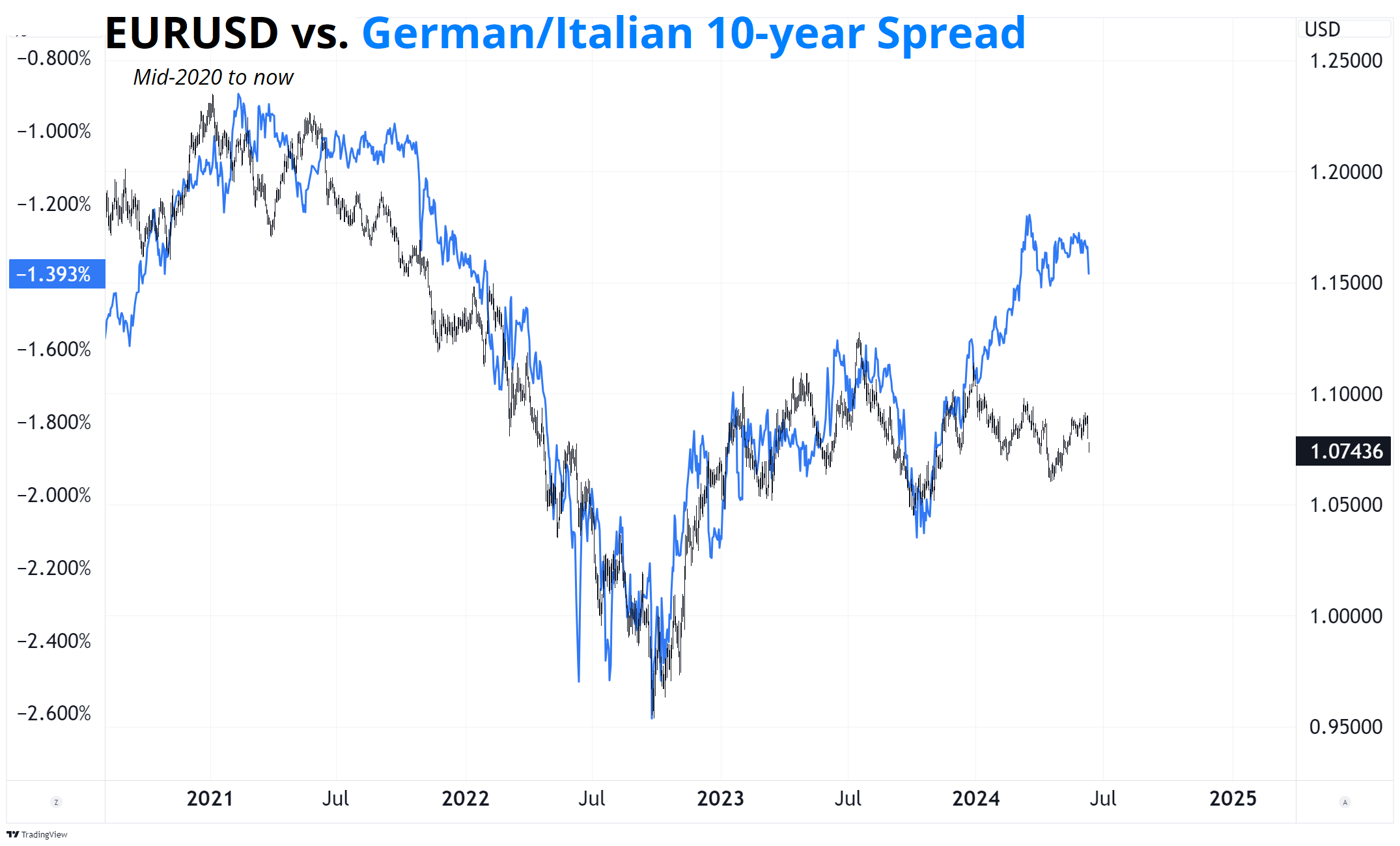

If you believe this theme continues, I would suggest that selling BTPs (or maybe OATs) is probably a cleaner play than shorting the currency. Yes, the currency should be correlated to peripheral spreads, but the spreads are coming from a super-tight starting point because of the carry-fest in 2023/2024 as you can see in this chart.

That chart is Italy. While the political news is emanating out of France and Germany (CDU, etc.), Italy is a high beta play for these stories and the entry point is rather spectacular. Also, if you are short euros, you are taking more CPI and FOMC risk. Less so with BTPs.

Here’s a good, short piece on Macron’s strategy:

https://think.ing.com/articles/macron-snap-election-a-tactical-move/

And the wiki for the French election is informative. June 30 and July 7 are the two rounds.

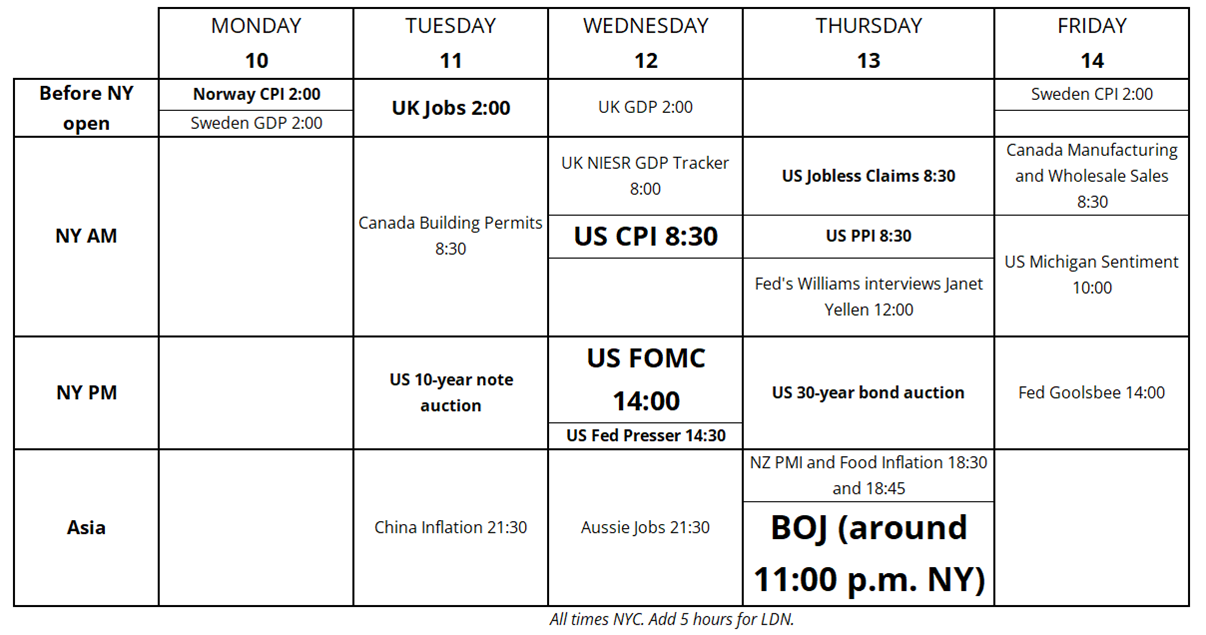

This week’s calendar is initially light, then US CPI and FOMC mid-week… And BOJ Thursday night (thx Dan!)

Megacaps and hot stocks tend to trade poorly in the 2- or 3-days post-split. It’s a miniature buy rumor / sell fact trade because while stocks splits have no economic meaning, they certainly have a behavioral impact. NVDA downside risk, now ‘til FOMC.

Have an Excelent Day.

I asked my dad if he knows any formulas in Excel.

He said, “Yeah, SUM.”

Lot of strange things going on. Feels like a bit too much leverage out there.