The most damaging economic policy announcement of my lifetime.

Rollah Coastah

NASDAQ sharply unchanged in quiet trading this month.

The most damaging economic policy announcement of my lifetime.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

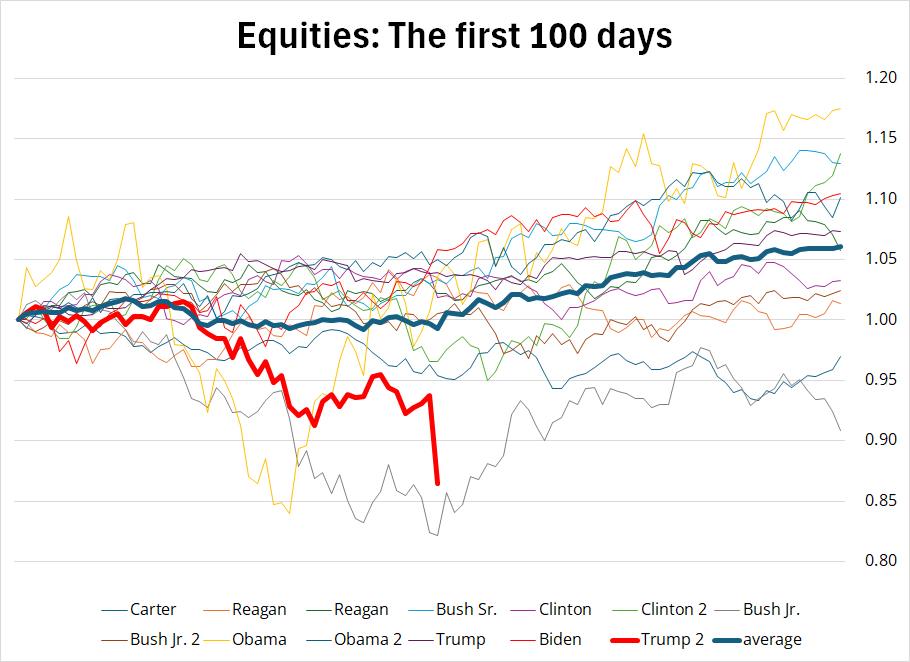

If you imagined the worst possible post-election outcome, you would never have come up with something as bad as what is going on right now. Liberation Day has been a complete clusterflack and stocks are reacting as one might expect them to react if the US government made an announcement that would receive a grade of F- if submitted by a 9th grade economics student. The math behind the new policy is a sad joke and shows that no literate economists were present when it was formulated. Scott Bessent, who was expected to be the voice of reason, does not seem to be part of the team on tariffs, as suggested by this clip, where it’s clear he has no idea what is going on.

https://x.com/MeidasTouch/status/1907590196352418279

That red line is lower again as I type this.

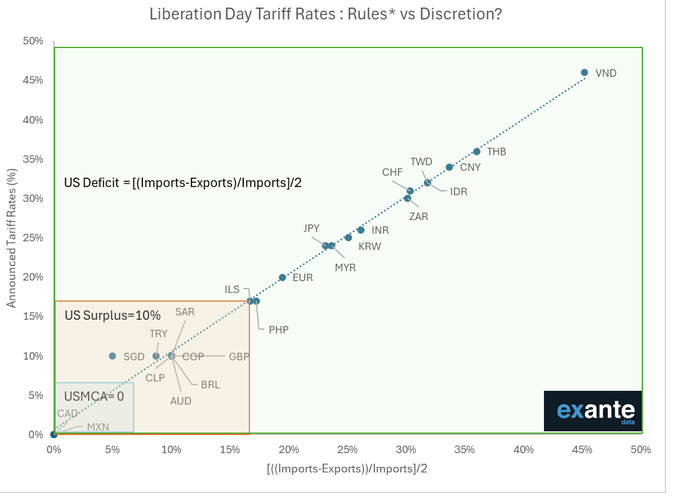

I presume you have seen some of the hit pieces on this policy move, but in case you missed it, the methodology for determining the tariff rates has been much discussed and ridiculed: While the administration claimed to be incorporating foreign tariff rates, VAT, and non-tariff barriers, what they did instead was essentially use the formula:

(Imports – Exports / Imports) / 2

And then if that number showed a trade surplus, they just used 10%. This back-of-the-napkin methodology leads to some strange results, as you can see.

Here’s Brad Delong railing:

https://braddelong.substack.com/p/tariffs-by-chatbot-trumps-trade-policy

The collapse in business and consumer confidence is perfectly justified as we are about to see a supply shock, a one-time US price shock, collapsing real GDP, and probably a US recession by year end. This, of course, is all up in the air as you could also see a complete removal of the tariffs as Trump claims victory after beautiful negotiations. Let’s hope penguins are good negotiators:

https://www.npr.org/2025/04/03/nx-s1-5350897/trump-tariffs-heard-mcdonald-remote-islands

While it’s easy to make jokes and memes about all this, real lives and real money are at stake and any attempt to lower the US deficit is hopeless in the face of recession and collapsing asset prices. The scenario where the US comes out stronger feels hard to imagine, but I will keep an open mind.

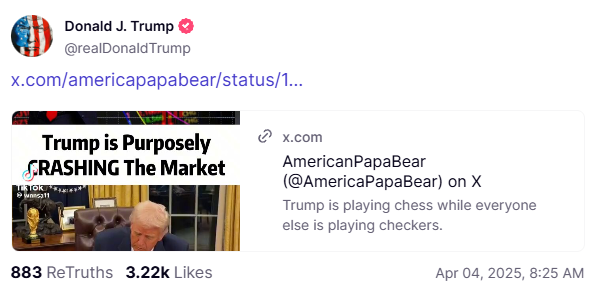

In the meantime, Trump has doubled down this morning, saying his policies are not going to change and he doesn’t give two shits about a collapsing stock market. In fact, continuing the hard to understand flood of DGAF from the President, he reposted this, as if to confirm that wealth destruction is the goal, not an unintended consequence.

It’s all pretty weird.

Meanwhile, China has hit back with tariffs of their own and the fall in the stock market will hamper Trump’s negotiating power as former allies see the car crash playing out in slow motion and will probably be less likely to acquiesce at this point. We will see who kisses the ring and who punches back.

Tariffs go into force on April 9, so that becomes an important date on the calendar because:

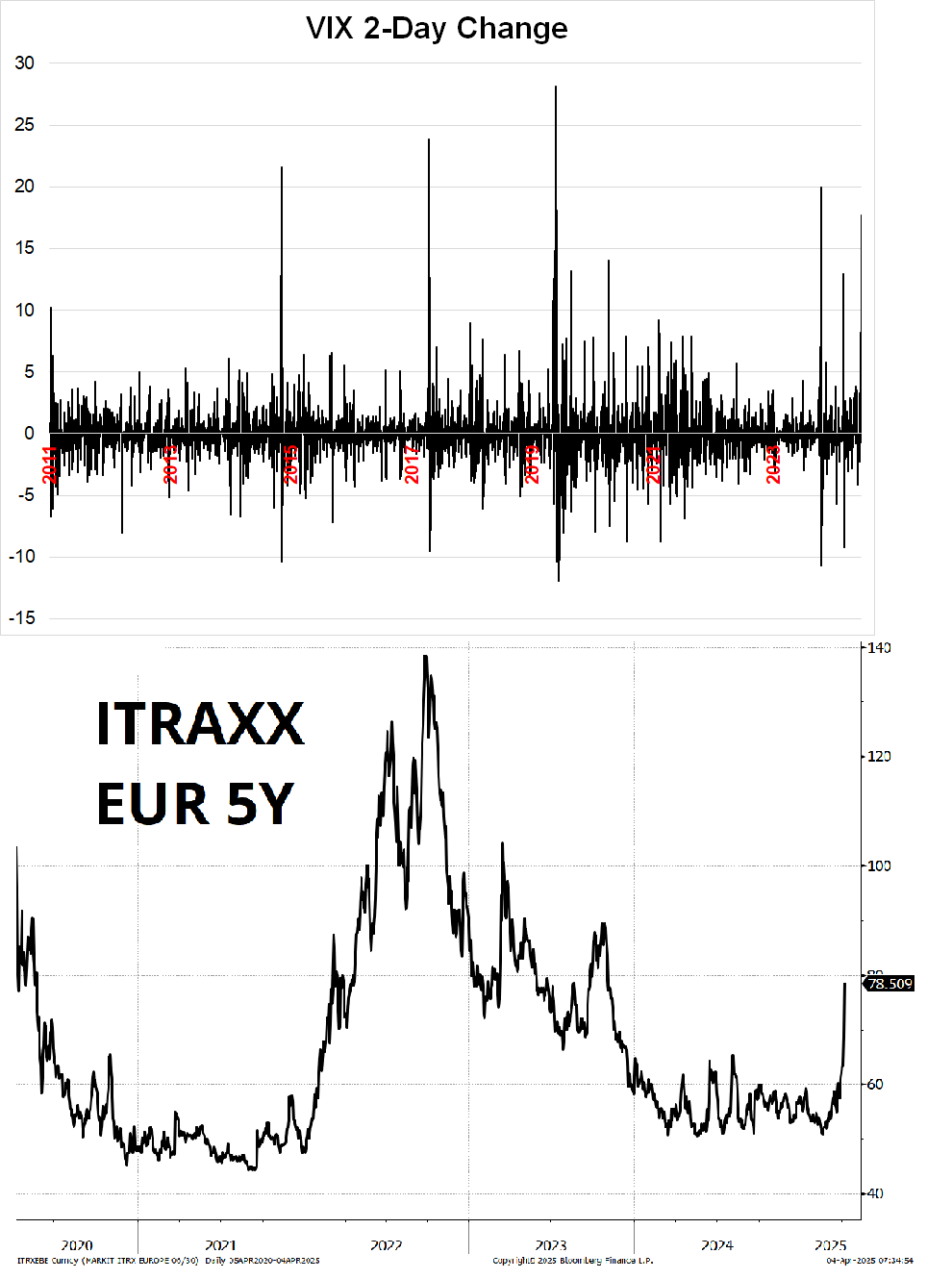

This thing is turning into a liquidity event as European stocks crap out (EU banks, for example), credit widens, and US funding is getting scarce.

The moves in credit and vol are big, but as you can see from the charts, there is still plenty of room for things to get much, much worse.

It’s hard to think of what the solution is going to be here, other than a complete cancellation of the Liberation Tariffs. I suppose the delta of that rises with every 1% in S&P. Eventually, you will get Fed noise and action, but they don’t usually come in until stocks have dropped 20%. It’s hard to believe that SPX was 6146 on 19FEB, and now we’re sub-5400.

A 20% correction in cash SPX is 4916.

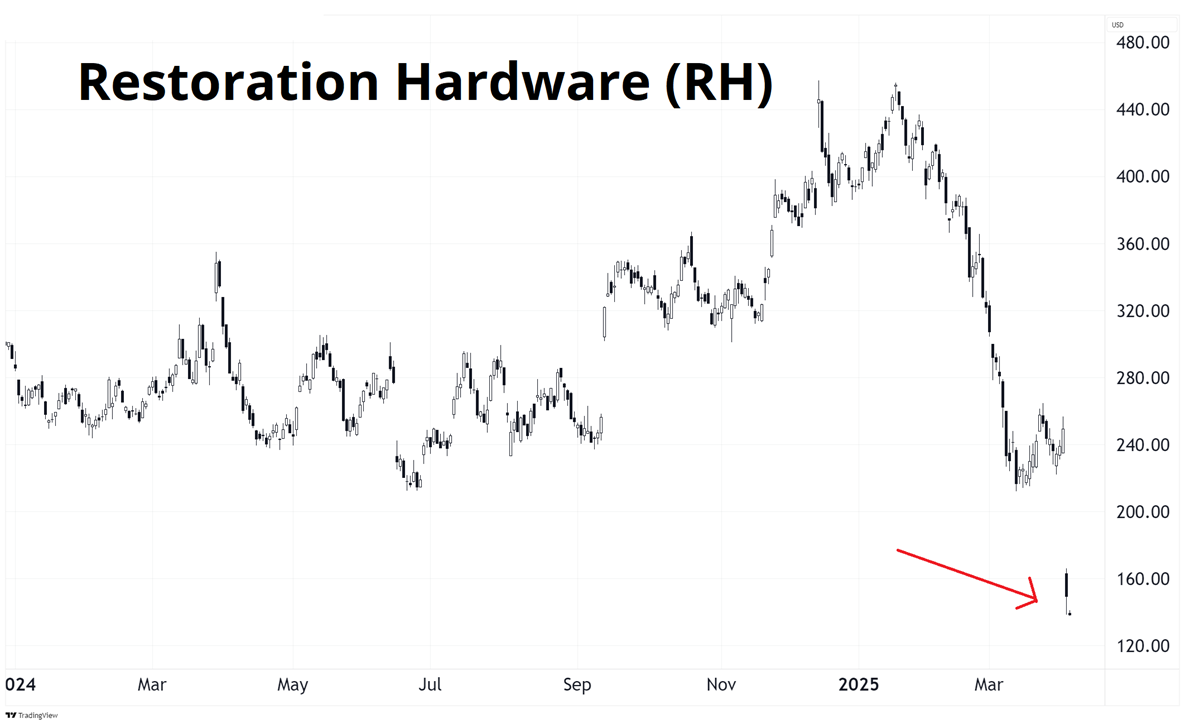

Stocks that produce high-margin (overpriced?) goods super cheaply in Vietnam or China or wherever got bludgeoned this week. Here’s Restoration Hardware, which is a bougie interior decorating chain that’s big in Fairfield County:

And here’s a chart of Nike, a stock that can’t take tariffs as its brand has gone from the gold standard to super uncool in a few short years.

Again, I don’t see what stops this until maybe the Fed starts chirping. With inflation high, recent economic data still strong-looking, and the future impact of tariffs hard to handicap, the Fed won’t do anything until they are absolutely forced. That probably will happen when the S&P is on a 49 handle.

This week’s 14-word stock market summary:

The most bearish economic policy announcement in my lifetime happened and stocks reacted accordingly.

While tariffs might lead to supply chain issues and higher prices in the short run, the economic damage they will do (along with the collapse in the stock market) will eventually lead to lower inflation. And when you are taking money out of US stocks, you need to put it somewhere, so you put it in bonds.

I had that meme in last week’s Friday Speedrun, but some people obviously didn’t read it! The market tried to buy USD, AGAIN!, after the tariff announcement and again, that did not work. It’s literally the 7th time the market has done this and it didn’t work any of those 7 times. Cray cray.

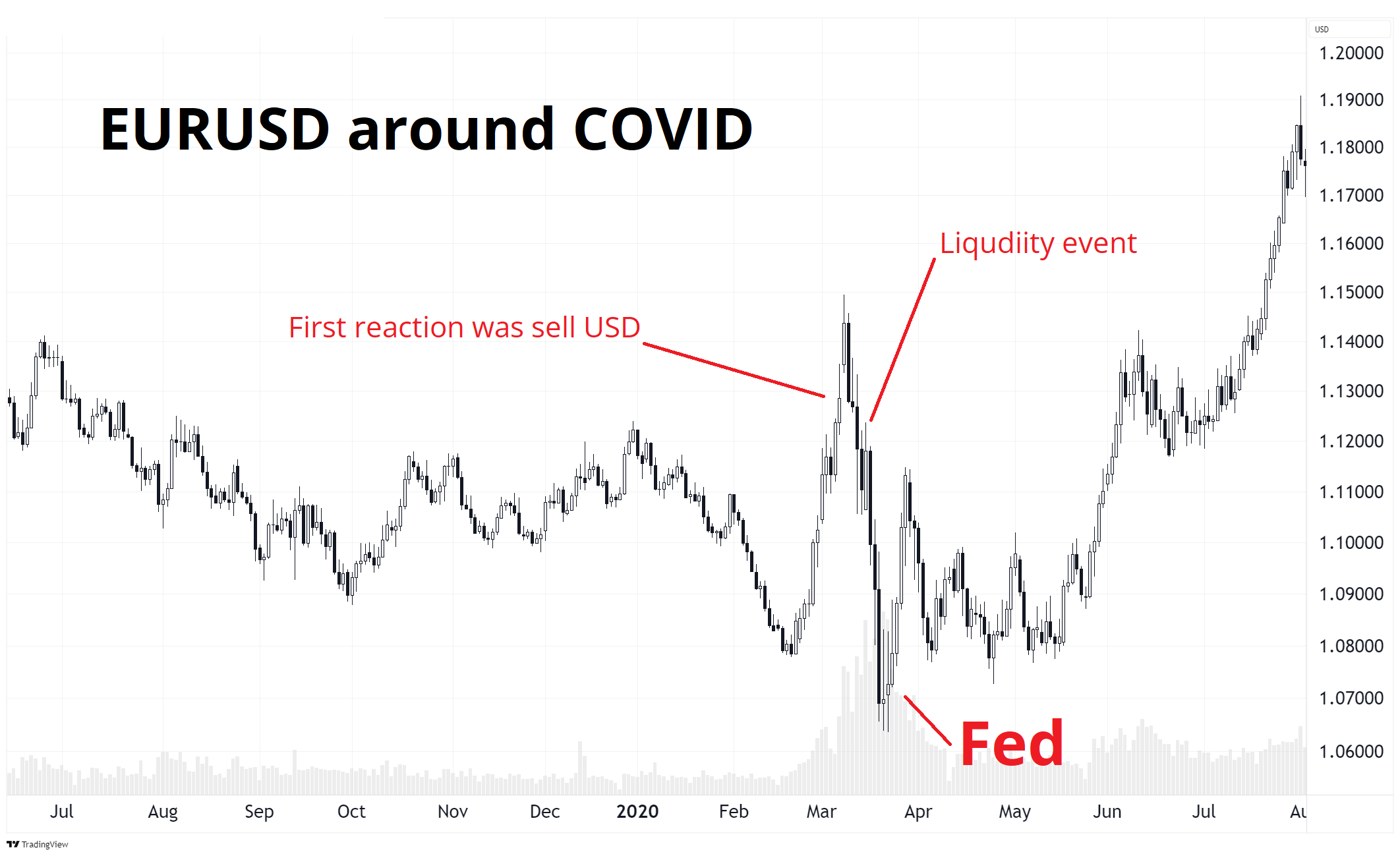

Volatility in FX has been completely insane this week and we saw one of our biggest weeks ever on the trading side as volumes are gigantic and everyone is doing all kinds of stuff. The big theme has been selling USDJPY because it’s a good US recession proxy and it’s a good US yields proxy and US yields tanked (and so did USDJPY). Elsewhere, the nascent BUY EUR theme is in trouble as liquidity events are not good for EUR. Even if money is flowing out of the US, it’s also fleeing European equities now, too, and long EU equities is the most crowded position out there.

The USD is flying all over the place as we are seeing exactly what one might expect: EUR, CHF, and JPY are strong and AUD, CAD, and EM are weak. That’s standard for a credit and equity meltdown. The price action in EUR is getting dodgy and while I like the USD down in general, I would not be long EURUSD right now. When liquidity starts to drain from the system, you tend to see a strong USD. First you get it against the commods, then eventually you get it against EUR and GBP. Recall when the COVID shock first started, EURUSD rallied for a few days, then collapsed as the liquidity got sucked out of the system. Hiding in EUR or gold doesn’t work in these situations. The only safe short USD trade is USDJPY.

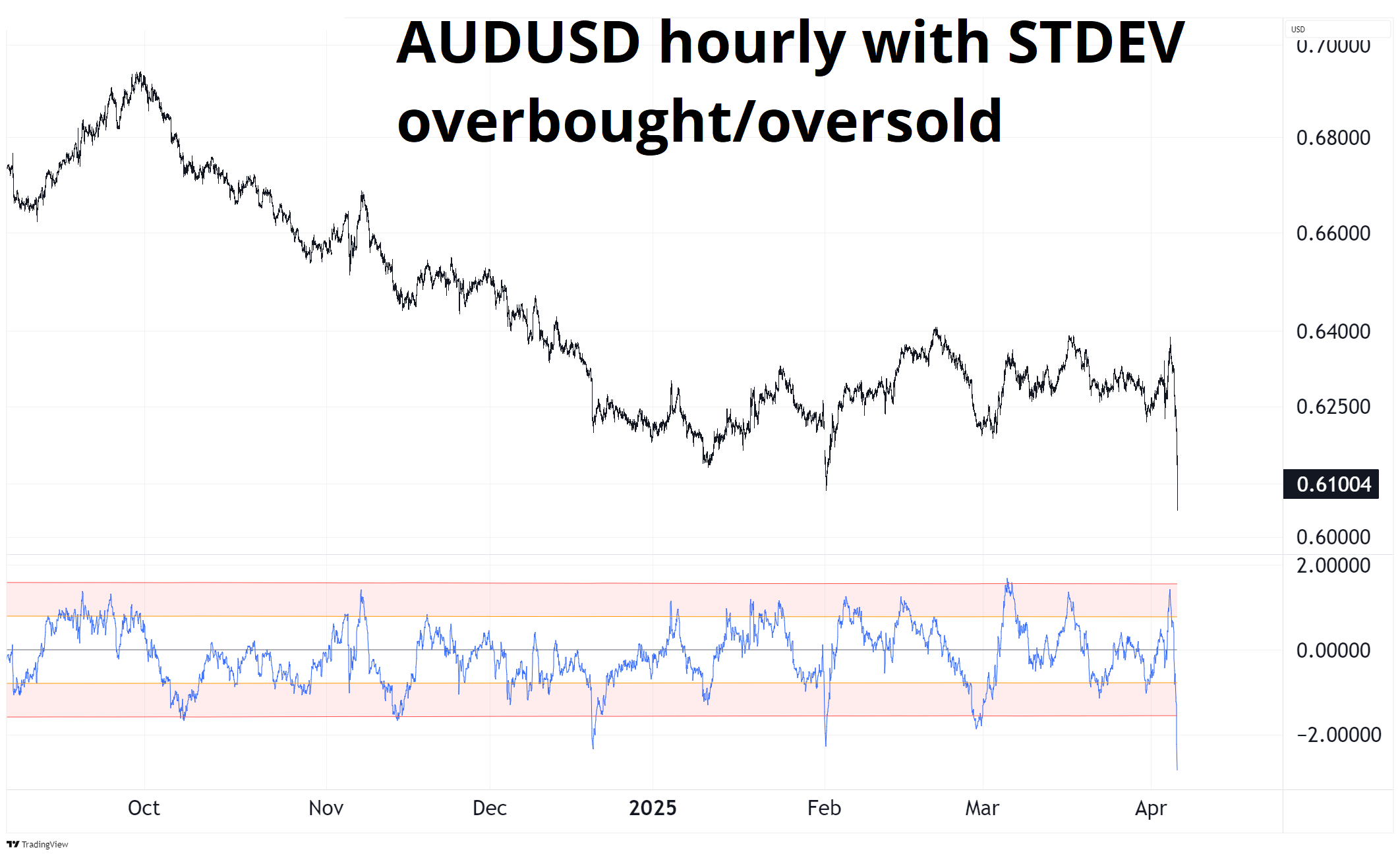

Another thing to remember in events like this is that oversold and overbought don’t mean anything. This chart should not make you want to buy AUD.

Bitcoin is holding incredibly well, so far, despite the complete demolition of most risky assets. Very impressive price action to date. I don’t have a strong view on whether this is bullish (it trades well!) or bearish (it’s lagging!). There’s probably some flow aspect to it with the lame copycats (GME, MARA) following the pied piper (MSTR).

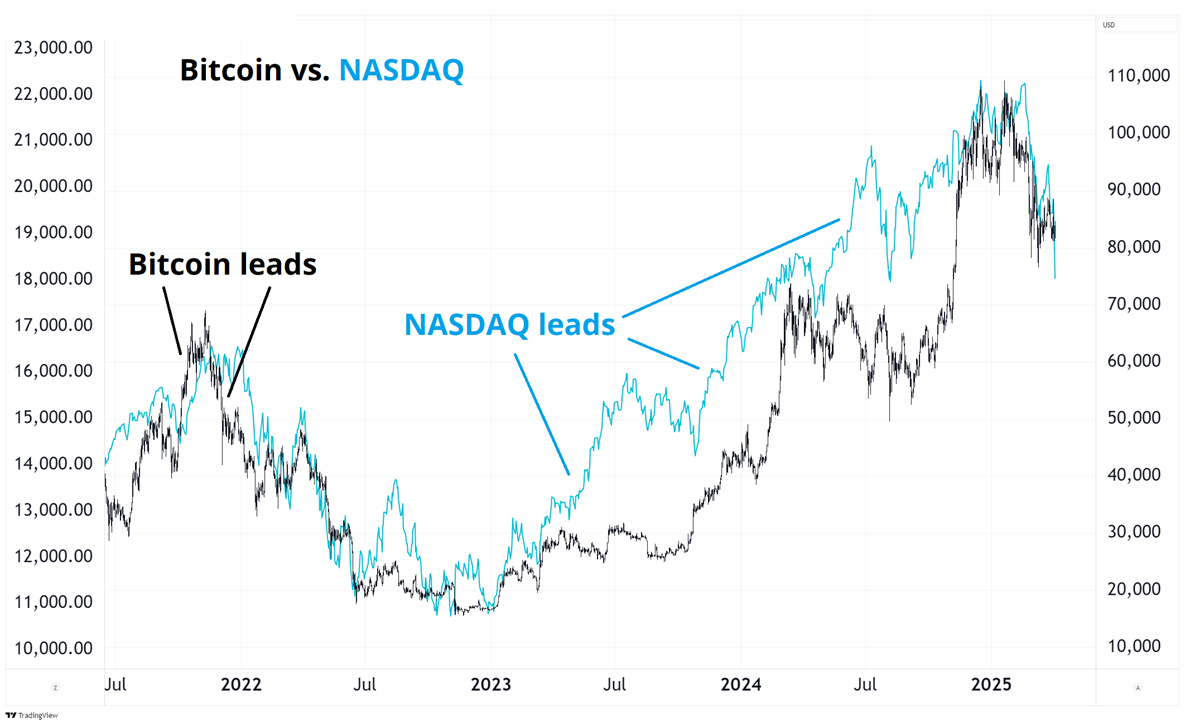

You can see that bitcoin was the leader in the 2022 cycle but NASDAQ has been the leader since the bottoms in early 2023. BTC stayed down longer due to SBF fear etc., and then caught up bigly after the bullish impulses from the spot ETF and Trump. If I was forced to make a bet, I would say the current demand is price insensitive flow from corporate treasuries and that will get filled and then we see 76k before 96k. My conviction is pretty low and I think there are better risky asset shorts than BTC.

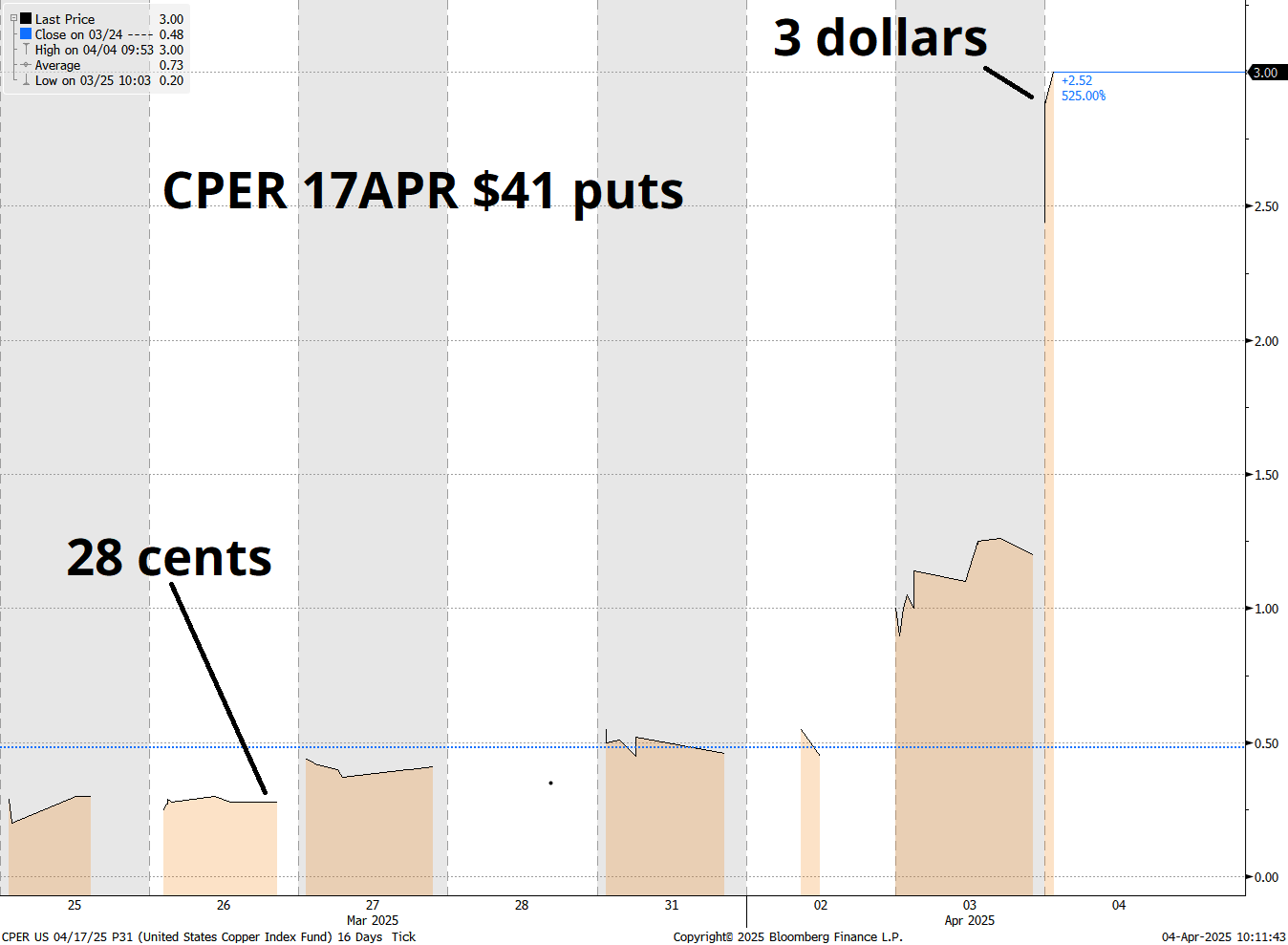

I am wrong a lot, but man was I right on copper. Last week I said:

The big story in commodities is a boom in US contracts fed by frontrunning ahead of tariffs. This is most notable in copper, which is raging to new highs despite tepid global growth and a balance sheet recession in China. There is huge convexity to the downside now in copper, imo, as the tariffs are priced in.

And then I showed this chart (get it, copper top?).

Here’s the updated chart:

Long CPER puts was my best trade so far this year. Again, I am wrong all the time, but when you can bet 1 to make 10, you don’t have to be right all that often.

I know it’s a bit gross when people brag, but sometimes when you’re excited, you just want to share it with the world.

That’s it for this week.

Get rich or have fun trying.

New Skrillex album!!!!

If you don’t like Skrillex, this is not the album for you. It’s very Skrillex-y.

F*ck you Skrillex You Think Ur Andy Warhol

*************

Crypto miner front running of tariffs and supply chain fears.

A summary of MSFT’s pullback from AI capex.

Walmart is trying to answer: Who will pay this massive new US import tax?

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.

NASDAQ sharply unchanged in quiet trading this month.

It goes against my core view, but I must admit The Economist is screaming BUY AMERICA

Time of day patterns in foreign exchange are surprisingly persistent and have never been more relevant.