Why I am bullish Brazil, and don’t’ want to wait for the second round of the election to engage. Plus much more

Current Views

3-month USDBRL 4.90 digital at 20%

Spot ref. 5.1850 on 10OCT22

Expires 11JAN23

Why I am bullish Brazil, and don’t’ want to wait for the second round of the election to engage. Plus much more

Spot ref. 5.1850 on 10OCT22

Expires 11JAN23

October 10, 2022

I am back from Brazil. It was the best business trip I have ever taken. We met with 20 funds and about 60 risk takers, mostly PMs and CIOs. The Brazilian hedge fund industry is ginormous. I thought it was medium-large, but it’s actually ginormous.

The structure of the business is different from the US or the UK, as much of the assets are retail, not pension or institutional money. There is a solid distribution system for retail money to go directly into hedge funds, so when rates started dropping in 2017, money flowed into hedge funds, big time.

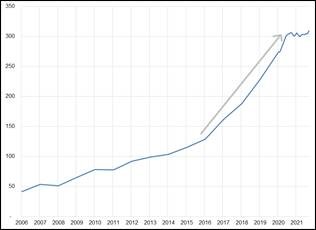

Retail was accustomed to and happy getting 8% to 14% risk free, but when Brazilian risk-free rates dropped first to 6.5%, then all the way down to 2.0% in the period from 2017 to 2020, retail investors in Brazil decided to take on more risk. The first chart is one a friendly Brazilian sent me via FinTwit (the chart goes to May 2022; SELIC is now 13.75%).

Next chart: growth of AUM in Brazil. Note the slope steepens after SELIC dropped from 2017 to 2020, then it flatlines as SELIC rebounds in 2021. When risk-free rates are 2%, you take more risk than when they are 14%! You can also earn a risk-free real rate of around 6% on fixed income products in Brazil. Apimentado!

It’s hard to find data using one consistent methodology for hedge fund AUM by country, but the global HF industry is estimated around $5T USD. Therefore, $300B is about 6% of global HF assets—a healthy size! I wouldn’t overstate the accuracy of this estimate because it’s hard to find apples to apples AUM comparisons by country. My data comes from the Brazilian Association of Financial and Capital Market Institutions (ANBIMA). I am adding AUM of balanced, mixed, and currency funds. I did not count fixed income or equity funds. If you add those, you get AUM above $1.4T USD.

I am not an expert on Brazil or emerging markets and generally don’t write about them all that much. But in this case, I landed a day after the first round of the Brazilian elections and therefore BRL and Brazilian assets were a big part of the conversation. Interestingly, I left with a strong view on BRL, despite going in with zero thoughts whatsoever. Here is why.

One of the best setups in trading is when everyone has a strong view about something, but nobody has much risk and is barely invested in the theme. Usually, the reason this happens is that there is an event or gap risk on the horizon, so it’s hard to manage the risk. For example, say everyone starts to get bullish USDJPY for some reason as there is news out on a Wednesday, but nonfarm payrolls is on Friday. People will not go all-in long USDJPY on Wednesday or Thursday. They will wait until nonfarm payrolls passes, then put on their full risk. As such, you will often see a weak NFP lead to higher USDJPY in a situation like this.

This is the setup in Brazil right now. The main scenarios are mostly bullish. You have Lula winning with Meirelles announced as finance minister. Bullish. Bolsonaro wins. Very bullish. Lula wins and announces another market-friendly finance minister. Bullish. Most PMs and CIOs we met in Brazil, believed that one of these three scenarios was most likely. But nobody is invested much in the trade yet because the event risk, gap risk, and high vol for the event make managing the trade too difficult. For your info, the most negative outcome is Lula wins and selects a finance minister like Nelson Barbosa, Guilherme Mello, or Márcio Pochmann. But this bearish path carried only a small weight in most conversations.

The large upside surprise for Team Bolsonaro in Congress was widely viewed as a bullish counter to Lula winning and means the setup is for gridlock in most scenarios. Because people were worried about Lula and leftist policies, gridlock is bullish. And Bolsonaro is still trading around 30% in Brazilian gambling markets, so there is some bigger upside possible in the event he pulls off the win.

Locals are bullish and flat. Foreigners are looking for carry but have stayed away from Brazil because of election risks. My bet is both locals and foreigners will buy BRL once the election risk passes, and maybe earlier if Lula signals Meirelles as finance minister in a bid to give himself a late boost among flexible first-round Bolsonaro voters.

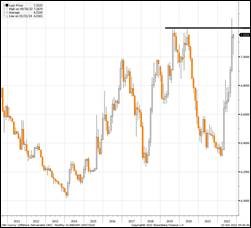

As you can see in the chart below, we are forming two huge triangles this year. A break of 5.00 would crack both and could lead to one of those trending moves like we saw January to March of this year. Several PMs and CIOs noted that the liquidity in Brazilian markets has not increased nearly as fast as AUM, so it’s getting harder and harder for Brazilian funds to put size on in domestic markets. That is, if everyone decides this is a good trade, there is a ton of firepower that could lead to a sustained, trending move.

Another good thing about long BRL is that it’s not as correlated to SPX or the DXY as the risky G10 currencies. It’s more idiosyncratic for the most part. USDBRL correlation with SPX and DXY since August has been around 41% vs. 67% for AUDUSD.

Short USDBRL outright is tricky because of the event risk (CPI and 2nd round of Brazil election). That said, when the big CPI came out in mid-July, that was the high for USDBRL. It’s not a pure USD or US rates trade. I think the best way to play it is pretty simple: Buy 3-month USDBRL 4.90 digital put for around 20% ish. This price is ballpark; please ask your salesperson for a market rate. EURBRL and GBPBRL help nullify the USD risk, if you like.

Everyone is in wait-and-see mode, so the ability or willingness to go early is an edge here.

If you’re a retail trader, EWZ is a good proxy. Perhaps a 34/38 call spread or 35 call[1]. There is a 90% correlation between EWZ and USDBRL so it’s basically the same trade.

The funny part of the conversations was that most people we met don’t seem to like either candidate. One PM said it’s: “Two bad guys, choose one.” A matter of the least bad option. This is similar to how many people feel around the world as global politics continues to make a series of new lows. One PM, made this comment about Congress:

There are 513 Federal Deputies in the National Congress. 350 are very stupid. 100 are stupid. 63 can walk and chew gum at the same time. – CC

This is how the populace feels about Congress here in the US; similarities between US and Brazilian politics are obvious and significant. The left/right schism vibes and the old “I don’t like Bolsonaro, but I like his policies” thing are right out of November 2020 USA. For the record, the funniest line of the trip was not market-related it was: “I’m 34 years old and I’m addicted to banana-flavored vape!” … Maybe you had to be there?

To summarize: I think locals and foreigners are both bullish Brazil and barely invested in the trade. Once the second round of the Brazil elections happens on October 30, BRL and Brazilian assets are much more likely to rally than sell off as underweights will pile in on most outcomes. The best outcomes for the trade are Bolsonaro winning, or Lula + Meirelles. This is a 1-or-2-month view, approximately. Max three months.

[1] Not investment advice. This is an indicative idea for educational purposes. Please trade your own view and do your own research.

I am bullish USD into year end, as I think positioning has lightened up significantly as specs are getting sticker shock. “It’s hard to be short euro on a .99 handle” kind of thing. To me, the conditions that have been in place for a stronger USD remain in place and are unlikely to change until at least 2023. While we have passed the energy crisis and gilt crisis phase of the story, we now enter the grinding pain phase for Europe and the UK.

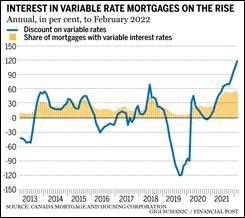

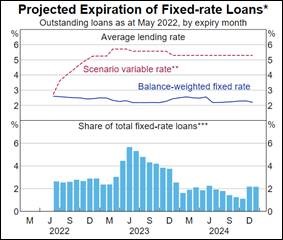

Of particular concern in the UK (and around the world, ex-US) is the mortgage reset story. Interest rates on mortgages in the UK, Australia, Canada, and elsewhere tend to only lock in short-term (2 to 5 years) and then the rate resets. If your rate goes from 2% to 6%, that’s a huge hit to your discretionary income. If you lose your job at the same time, it’s a disaster.

Each country has nuances. For example, there are some weird trigger issues in Canada, and pass-through from rate hikes to mortgage rates is different in each country. The main point is that most countries will take a big hit as mortgage rates reset, but the US will take a much smaller hit as variable rate mortgages are hardly a thing in America now.

Counterintuitively, Canadians took out a higher share of variable rate mortgages than usual during the 2020/2021 housing frenzy because the fixed/variable spread widened. Whoops.

Each country faces various cliffs and pressure points. Here’s a chart from the RBA:

The number one question on the trip (after BRL election) was: “What could turn the dollar?” Many PMs are sympathetic to the higher dollar, but light on risk because the levels are unattractive. And there remains a cohort of risk takers who would much rather be short dollars, but don’t see any reason to do the trade yet. They want reasons. While I don’t see any reasons here, I could imagine some in 2023.

Most meaningful USD selloffs come in an environment where there is growth somewhere outside the USA. Synchronized global growth is the ideal regime for short USD, and we don’t have a single large region outside the US offering strong growth. The credit impulse in China has picked up a smidge, so there is some hope there, perhaps. Then again, we were looking for a 54.4 PMI out of China last night and they delivered 48.8. An end to COVID-zero would be a major help.

Ironically, a rapid turn weaker in the US data and a dovish Fed does not necessarily mean a weaker USD. It could just mean we jump from one part of the USD smile to another, and global recession fears hammer AUDUSD (for example) down to 0.5500. Until we get some sign of growth from outside the USA, collapsing terms of trade and other concerns will keep EURUSD and GBPUSD in “sell rallies” mode.

Getting back to the original question: “What could turn the dollar in 2023?”

USDCNH is particularly interesting as we approach the 16OCT China Party Congress because the market has dramatically reduced USDCNH longs and has tons of ammunition to reload if the PBoC shows a willingness to allow upside momentum through the old all-time high and double top of 7.20. When we broke 7.20 last week, the PBoC slammed it, but was that simply to enforce some stability into the Party Congress? Intervention is always about the combination of speed plus level, and the move to 7.20 was a super-fast rally to a massive level. Now that the speed has been controlled, will they allow a piercing of 7.20? If so, expect a quick run to 7.40/7.50 and then the return of a more aggressive PBoC. The moves in USDCNH and the reactions by the authorities tend to be in 20 big fig increments, approx.

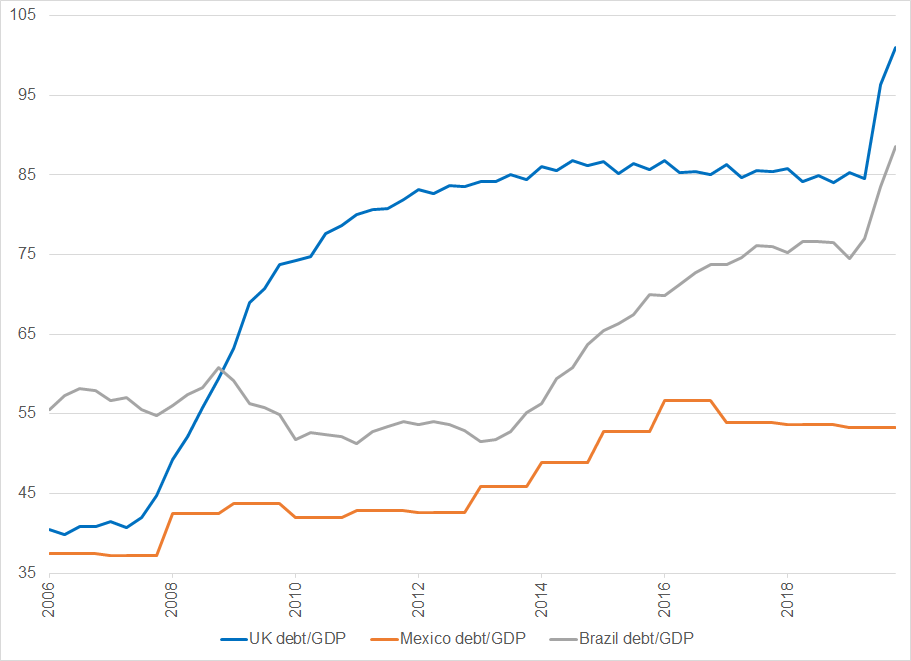

Mexico trades like a developed market. The UK trades like an emerging market. Mad unorthodox fiscal policy was accepted by markets back in the olden days (2017 to 2021) when yields were close to zero. Now, with real and nominal rates on a historic moonshot higher, the bond vigilantes are back. MMT-style policies were all the rage, starting with the 2017 Tax Cut and Jobs Act and continuing with the huge transfers of consumer liabilities to the sovereign. Governments like the UK are trying the same old tricks, but with borrowing costs now far, far above zero, the market is going to say no más. There are limits.

The UK found its limit. Other countries will find theirs. The US might even hit a limit one day (but don’t bet on it).

Here’s UK, Mexico, and Brazil debt-to-GDP.

The very first piece I wrote at Spectra was titled: am/FX: Unanchored and it detailed the accelerating trend towards a total disconnect between government revenue and spending. Snip! This was all fun and games when rates were zero because even Brent Donnelly can handle the cost of servicing billions in debt with interest rates at zero. Now, interest rates are high and cost of servicing matters. It matters for sovereigns; it matters for consumers (mortgage resets coming!) and it matters for unprofitable zombie corporations that gorged on free money. The wave of pain is currently visible on the horizon, and when the long and variable lags pass, it will slam down onto shore. Sovereigns are no longer immune and market cooperation is now a limiting factor on fiscal spending.

One PM mentioned that given the UK now trades the way emerging markets do, the playbook when things go awry in EM is to fire the finance minister. A Kwarteng departure followed by a Truss mea culpa is unlikely, but that is one bullish GBP headline risk to watch out for. On the MXN side, most agreed the Mexico story will not pivot until the US labor market breaks. Remittances hinge on the US labor market, which remains hot. Higher earnings and a shortage of low-end jobs in the United States is great for MXN. When claims skyrocket, buy USDMXN.

CPI is Thursday. The market is going to be ready for a strong one as we have done the runup trade from 1.00 to here. I am mixed with some long EM (BRL) and short GBP exposure but nothing strategic or multi-day enough to make the sidebar. My GBPUSD short from before I left was stopped out but I still think GBP goes lower. As long as Kwarteng is finmin, I think GBPUSD has a date with 1.05 again. The left tail is not as big as it was before, because the BoE can always stick a hand out to catch the gilts, but the story is still bad as the market has decided it will not tolerate this UK policy mix and the policy mix looks unlikely to change under current management.

Thank you to everyone in Brazil for the best, most fun business trip I have ever taken. The Brazilian HF community is incredibly laid back, cool, and humble. An absolutely excellent part of the world.

Source: My phone

I think soft data is showing the way, but many disagree.